ii research & reports

Our experts regularly research and survey the financial landscape to provide you with the latest in-depth reports. Explore our findings below.

Fair charging and value for money

- Research lays bare just how subjective the issue of ‘value for money’ is, with investors considering £25 per month on average a fair price for non-pension investing

- Meanwhile 13% of people with money invested outside their pension believe they are paying nothing in investment charges to use investment platform technology

- There is clear interest amongst investors (67%) for investment firms to switch to a fixed subscription fee - or at the very least they are receptive to the idea

- Around a quarter believe fixed subscriptions are a fairer way to charge, or think it’s a simpler method, or find it more appealing, while 16% also think this is a more transparent way to charge.

The Future Growth report

- Why your expectations might be too high

- How growth forecasts on pension statements have come down over time

- What some of the world’s biggest asset managers think stock market growth will look like over the decades to come

- What the impact of this will be for people with defined contribution pensions

- What you can do personally to reduce the impact of lower growth rates on your pension

- What we think providers and the government could do

The ii Show Me My Money report

The ii Show Me My Money research paper reveals that pension blind spots are hampering the nation’s financial resilience. The positive impact of auto-enrolment masks a serious national issue, with a comfortable or even moderately comfortable retirement off the cards for many.

Our research finds that over 55s know less about their pension than younger pension investors and those who have their main pension pot with traditional life pension companies have less knowledge than those with DIY platforms.

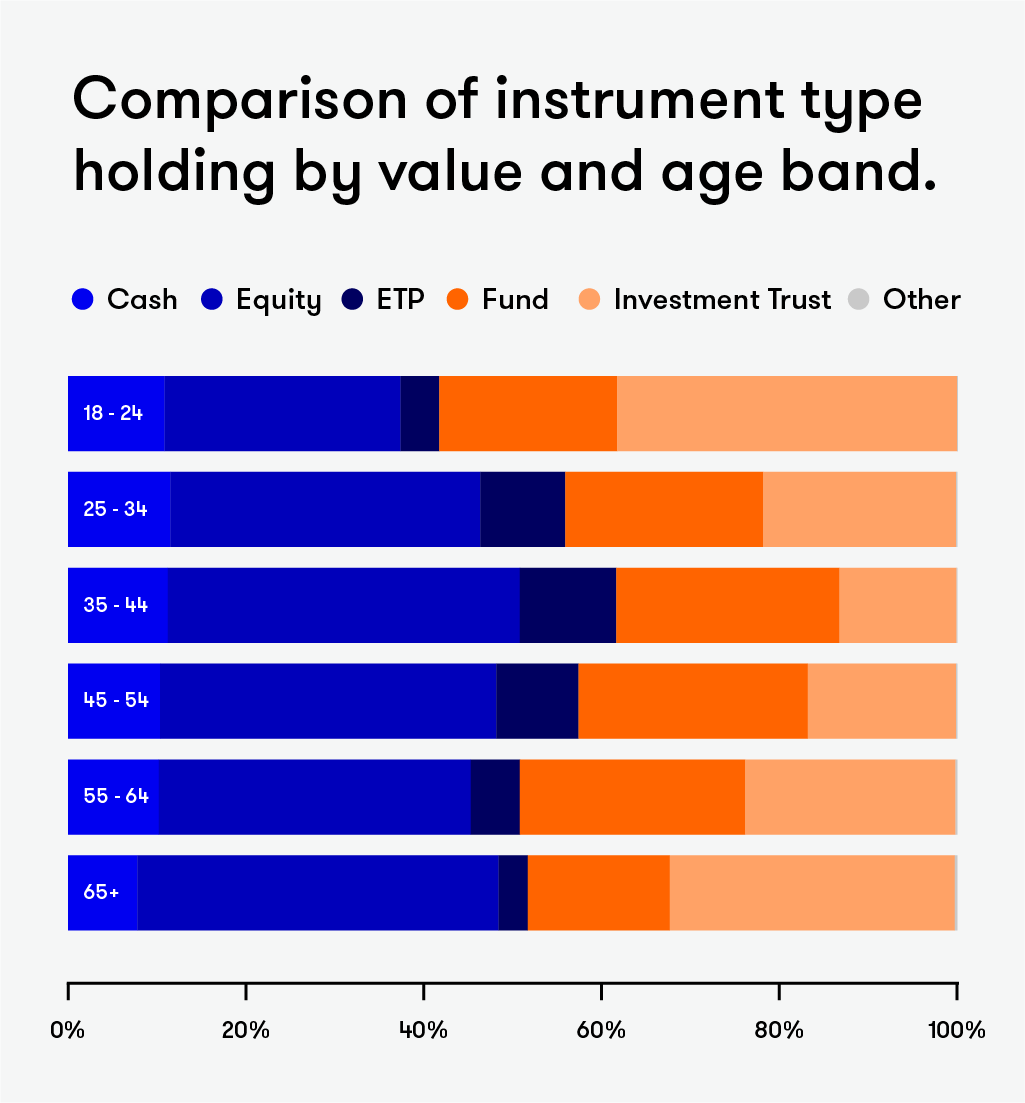

The ii Index

The interactive investor (ii) Index gives a unique insight into customers’ investment performance since January 2020 and over more recent periods.

This index won’t always make for comfortable reading, but we want it to be a useful barometer of how retail investors are faring, through all market conditions.

These articles are provided for information purposes only. The content is not intended to be a personal recommendation. The value of your investments, and the income derived from them, may go down as well as up. If in doubt, please seek advice from a qualified investment adviser.