Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

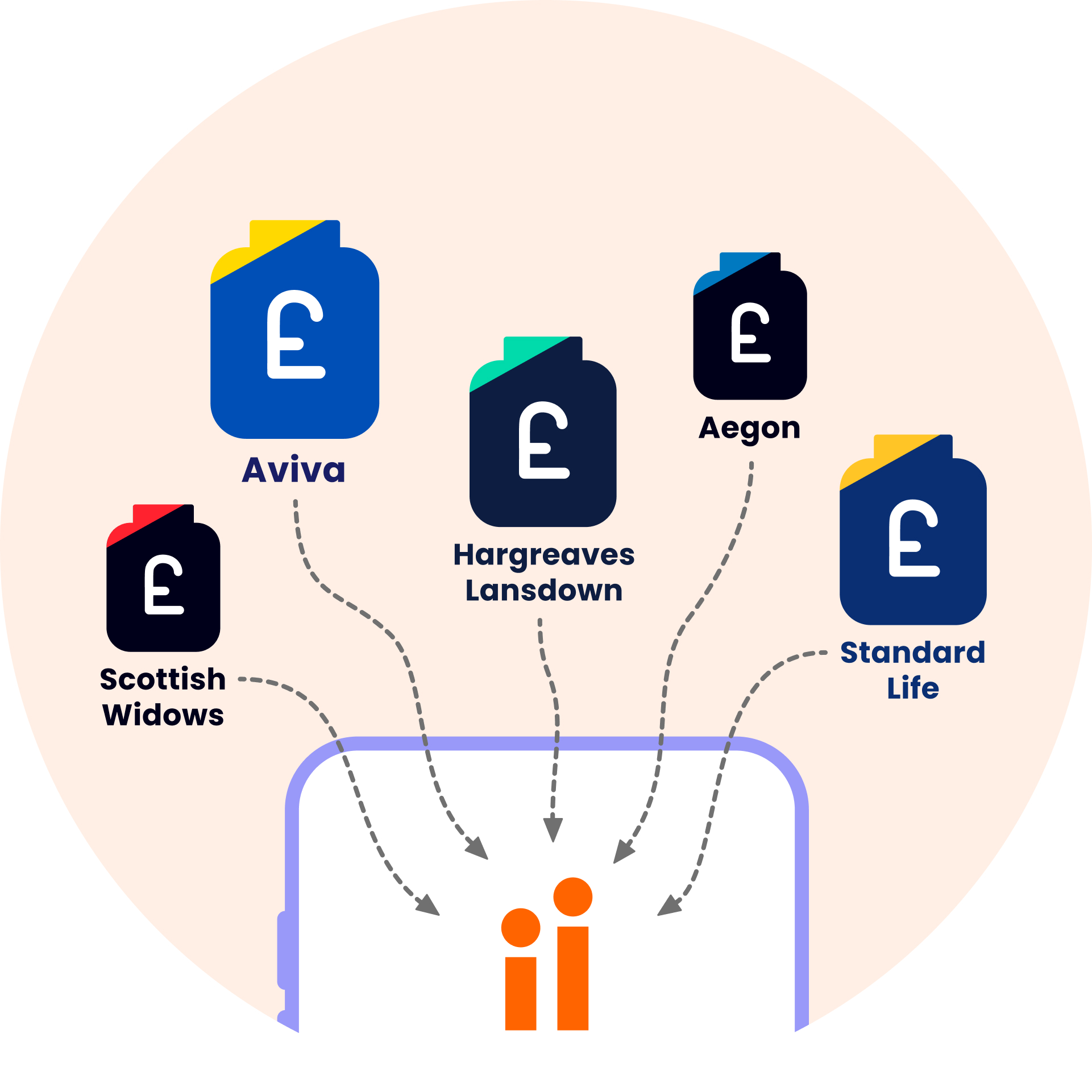

Pension consolidation may sound complicated, but it simply means transferring multiple pension pots into a single account. Over the course of your career, it’s easy to contribute to numerous pensions with different providers. Controlling them can become a challenge.

Each year, thousands of people choose to consolidate and transfer billions of pounds from other pension providers to our Which? recommended SIPP. Our flat fees mean that the more you keep with us, the more you save.

Throughout your working life, you can build up quite the collection of pension pots with multiple providers. Keeping track of these pots, and how your retirement savings are progressing, can become a full-time job on its own. That's where combining – or ‘consolidating’ – your pensions can make life that little bit easier. Bringing your pensions together under one roof simplifies your savings and is a powerful move in taking control of your retirement.

Streamlining your pensions means streamlining your charges, too. Combining your pensions with a single provider that brings you the best value can help you make significant savings.

Most providers charge you for a percentage of your pension. This means you could be paying hundreds or thousands of pounds in charges – without realising.

The ii Personal Pension is different. Our low, flat fee from £5.99 a month means you can keep more of your retirement wealth. It’s one simple and transparent cost that can help you reach your goals sooner. Even when you know the benefits of consolidating, moving your pensions can feel like an uphill struggle. But it doesn’t have to be - at ii, we take the hard work off your hands.

Our straightforward online process allows you to set up your ii Personal Pension and begin transferring old pensions to us in minutes. Throughout the transfer process, our award-winning UK-based support team will keep you updated every step of the way. You’d be joining the many thousands of people every year combining their pensions with ii. Our Which? Recommended Personal Pension supports transfers from well-known life insurance providers and investment platforms, among many others. Find out lots more about combining your pensions with ii right here on our website.

Secure the retirement you deserve with the ii Personal Pension.

The ii Personal Pension (SIPP) offers a wide range of investments to suit most people's needs. More choice doesn’t have to mean more complexity. Let our expert picks and SIPP investment ideas do the legwork for you.

Some pension schemes can feel restrictive when it comes to taking your retirement income. With the ii Personal Pension, you can choose from tax-free cash, income drawdown, lump sums, or a combination - all within your control.

By consolidating your pensions into one pot, it’s simpler to manage your savings and plan for your retirement. With ii, it's easier than ever to monitor and manage your pension - either via the website or using our handy mobile app.

For the fourth year in a row, independent analysts at Which? have recognised the ii Self-Invested Personal Pension for its industry-leading choice, support and value.

Join over 500,000 ii investors and start prioritising your pension with our award-winning, low-cost SIPP.

Many pension providers charge a fee based on a percentage of your pension pot. This means the more you make from your investments, the more they take.

At ii, we believe in flat monthly fees that can help you reach your retirement goals sooner.

Other charges, such as trading fees, apply. These are charged separately to your monthly fee. More about our plans and charges.

| Account value | Monthly fee | Plan |

|---|---|---|

| Up to £100,000 | £5.99 | Core |

| Any value | £14.99 | Plus |

While consolidating your pensions can be a positive step towards planning your retirement, there are some important checks to make before you make any moves.

It’s always free from our side to consolidate your pensions with ii. Be sure to check if your current provider charges any exit fees or penalties.

Some pensions have special guarantees and benefits. Before consolidating, make sure you won't lose any of the following:

If you’re unsure about consolidating your pension(s), please speak to an authorised financial adviser who specialises in pensions.

It takes less than 15 minutes to open a Personal Pension with ii.

Once you’ve decided consolidating is right for you, you can apply online for your ii Personal Pension and get set up in less than 15 minutes. If you need any support with your application, our team is here to help.

When completing your transfer request, you’ll need to tell us a few important details, including:

You may need to send us forms after you’ve submitted your request.

If so, the forms will be available on the confirmation page for you to print, complete, sign and return to us.

Once you’ve reached the confirmation page, leave the rest to us.

Once your transfer details are in, it’s time for you to sit back and relax. We’ll work with your current provider to move your pension to ii.

If we need any more information from you, we’ll be in touch. And your case handler will bring you regular updates as the transfer progresses.

If you’re thinking about retiring soon and want to understand your options, make sure you speak to someone at Pension Wise.

Pension Wise is part of the government’s Money Helper service, offering free and impartial pension guidance to the over-50s. They can also help you decide if transferring your pension is the right choice for you.

Call our award-winning UK-based support team on 0345 646 2390.

You can reach one of our friendly SIPP specialists between 8am-4:30pm, Monday to Friday.

The ii SIPP accepts transfers from current Workplace Pensions, and you may have the option to transfer all or part of your existing fund value. However, your employer or their pension provider may not allow this without first closing the Workplace Pension or opting out of Auto Enrolment, which would stop ongoing Employer and Employee contributions to your Workplace Pension. You may also lose other pension or employment benefits, guarantees, or protections.

Before transferring funds from a current Workplace Pension to the ii SIPP, we recommend speaking to an authorised financial adviser.

At ii we make it really easy for employers to make contributions into a SIPP through one-off and/or regular payments. If you want to pay into your SIPP this way, you'll first need to ask your employer if they're able to arrange this.

Pensions with valuable benefits and guarantees, such as defined benefit or final salary schemes, are usually best left where they are. Transferring these can mean losing those guarantees, which might result in missing out on important benefits.

If you're unsure about the type of pension you have, take a look at your paperwork or talk to your current pension providers. If you do have a pension with guarantees, you’ll likely need to consult with a regulated financial adviser before considering a transfer.

Defined benefit pension schemes offer a guaranteed annual income in retirement. It is rarely beneficial to transfer out of a defined benefit pension as you will lose a guaranteed income for life.

Consolidating small pension pots could reduce your overall costs. It could also make managing your pension easier. However, it may not be worthwhile if your current provider charges large exit fee. Even with a small pension, there may also be benefits – such as the age you can access it and how much can be taken tax free – which may be worth keeping. Some providers also require a minimum transfer value to accept a transfer. There is no minimum transfer value requirement if you are transferring to the ii Personal Pension.

Deciding whether to merge your pension pots depends on several factors. If you only have two pensions both with the same or similar benefits, but one has higher fees, then it may well be worth combining them into the lower fee option.

Start by gathering all the details, using a tracing service if needed, to compare the benefits and costs of each pot. Doing this will help you determine if merging would benefit your retirement savings, or if a pot you currently manage has its own valuable perks. If you’re still unsure, seeking financial advice’s a good idea. If you only have two pensions both with the same or similar benefits, but one has higher fees, then it may well be worth combining them into the lower fee option. But if consolidating means you'll lose a key benefit or access to a particular investment, it may be worth sticking with what you've got.

Combining your two pensions could simplify your retirement savings, especially if one has higher fees or less favourable investment options. However, if any pension has valuable benefits or guarantees, it’s important to seek advice before transferring to avoid losing those benefits.

There’s no limit to how many pensions you can have. You can have multiple pensions from different employers, personal pensions, or other retirement plans. However, managing multiple pensions may become complicated, so consolidating them into one pension could make it easier to track and manage your savings.

With ii, if you transfer your pension as a cash payment, it usually takes between 2 – 6 weeks to complete. For cash transfers, you must sell your existing investments before transferring.

If you’d like to keep your existing investments, the transfer will take longer. It usually takes 8 – 12 weeks but it depends on the type of investments you hold.

The length of time the transfer takes will also be reliant on how quickly your current provider works with us to complete it. If you are transferring defined benefit pension or a Small Self-Administered Scheme (SSAS), the time frames shown are not representative. For these schemes, given the increased level of due diligence that providers are required to carry out, transfers may take considerably longer.

You can't combine your pension pots with your partner's pension directly, as each pension is linked to the individual who owns it.

Consolidating your pensions won't automatically make them grow more, but it could give you more control over your investments. By combining your pensions, you may have access to better investment options, lower fees, or more efficient management, which could potentially help your savings grow faster over time.

Luckily, finding lost pension pots are not as difficult as you may think.