Important information: As investment values can go down as well as up, you may not get back all the money you invest. Currency changes affect international investments, and this can decrease their value in sterling. If you’re unsure about investing, please speak to an authorised financial adviser.

Before investing in an overseas company, you need to convert your cash from GBP to the currency it’s traded in. That conversion has a fee attached, which means your costs can mount up - especially if you’re a regular international investor.

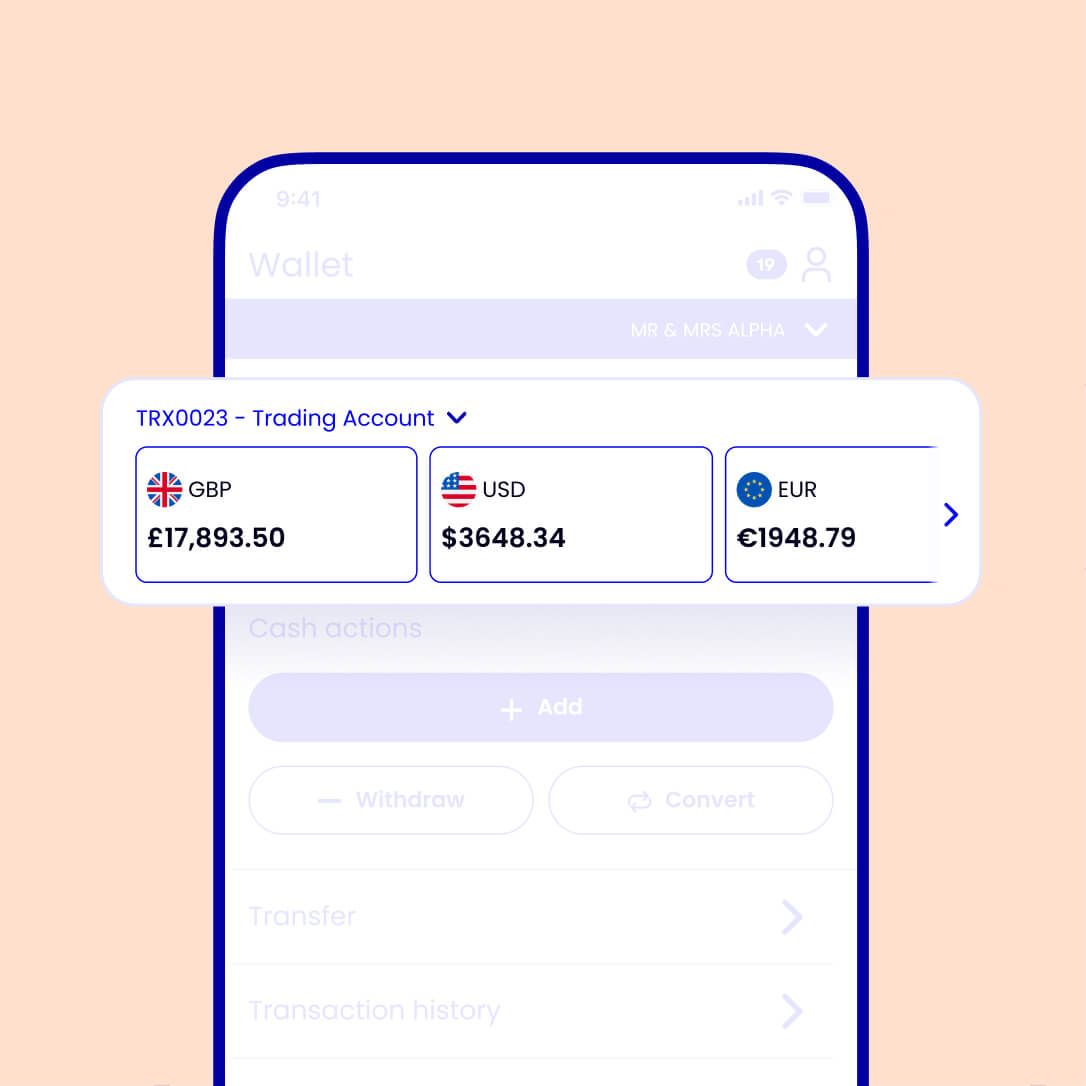

While other providers may charge you to convert before every trade, that isn’t the case with an ii Self-Invested Personal Pension (SIPP) or Trading Account. Hold multiple currencies in our accounts and trade directly in your investment’s currency, helping you avoid unnecessary FX costs.

FX fees are a frustrating reality of trading in international markets. But with ii, you can avoid unnecessary fees by buying and selling investments in their original currency.

Access 9 of the biggest global currencies to hold and invest within your ii account. Plus earn interest on your GBP, EUR and USD balances.

Be in control of your currency conversions. Enjoy the flexibility of choosing when to keep your international profits and income in the original currency.

Investors' Chronicle have named ii as a 4-star platform for international shares, adding to our wide range of investing awards.

Join over 500,000 others who trust us to deliver a truly global investing experience.

Tired of the same inflexible and expensive international investing experience? We would be.

Transfer to ii for a low-cost investment account and award-winning access to the world’s markets.

This is placeholder copy that is over 30 characters long, hidden from the user and screen readers in order to aid alignment in case the editor sets a short amount of content.

Because of HMRC rules, holding anything other than GBP in an ISA isn’t possible. But you can still open an ii SIPP or Trading Account to benefit from holding multiple currencies.

With 9 currencies and live pricing available, you can choose the currency and price you want when you need it. You can also link your currencies to particular trades - for example, linking USD to US share trades.

With your choice of currency at the ready, enjoy greater flexibility and control over how you invest in international markets.

The following currencies can be held in both an ii SIPP and Trading Account:

Please note that conversions of Swedish krona and Swiss francs are only available over the phone.

While you can hold foreign investments in an ISA, you can't hold foreign currencies. This is due to HMRC rules governing how ISAs can be used.

That means if the base currency of a share you want to buy and/or sell in your ISA is not GBP, a foreign exchange must be done at the time of trade. Any income from non-UK holdings will also be converted to sterling automatically.

Within your ii SIPP and Trading Account, you can hold multiple currencies. We pay you interest on the cash you hold in GBP, EUR and USD. The rates you get can be found on our cash interest rates page.

When we convert your currency, we use the current exchange rate (or “spot rate”). We'll then apply the relevant foreign exchange charge (see table).

It’s worth remembering, you can hold multiple currencies in your ii Personal Pension (SIPP) and Trading Account. This means you can convert when it works best for you - either as part of a trade or as a stand-alone transaction.

| Core | Plus | Premium |

|---|---|---|

| 0.75% |

0.75% (first £50,000) 0.25% (over £50,000) | 0.25% |

Important information: We may receive two parts of commission for international investing - trading commission and our foreign currency exchange charge. Please see our charges for full details of the costs. Exchange rates can create risk to international investment if a market’s currency rises against sterling. On the other hand, if a market’s currency falls against sterling, this can increase returns. Please be aware that we have a revenue sharing agreement for the foreign currency exchange charge with a third party. If you require further information, please contact us.