Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser. Please note images displayed are for illustrative purposes only.

Put your best financial foot forward in 2026.

Join ii today and kick off the year with our special offers:

Offers end 28 February 2026. Terms apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

Transferring your investments to ii is free, and we make it as straightforward and seamless for you as possible. Get started in three simple steps – just make sure you have your existing account details to hand.

If you don’t already have an account with ii, open one that suits your investing needs. Opening an account should only take 10 minutes.

You can start your transfer while opening an account. Or, you can log in and transfer at any time. You can complete the process easily online.

Rest easy while we work with your current provider to complete your transfer. Your dedicated ii case handler will keep you updated along the way.

Our low, flat fees means the more your investments grow, the more you can save. Count on a simple, transparent and convenient cost every month.

You’ll have access to one of the widest choice of investments on the market. Experienced and beginner investors alike will be able to find something to suit their investing style.

You can reach out to our award-winning customer service team with any questions. You can also stay informed with a wealth of insights from our experts.

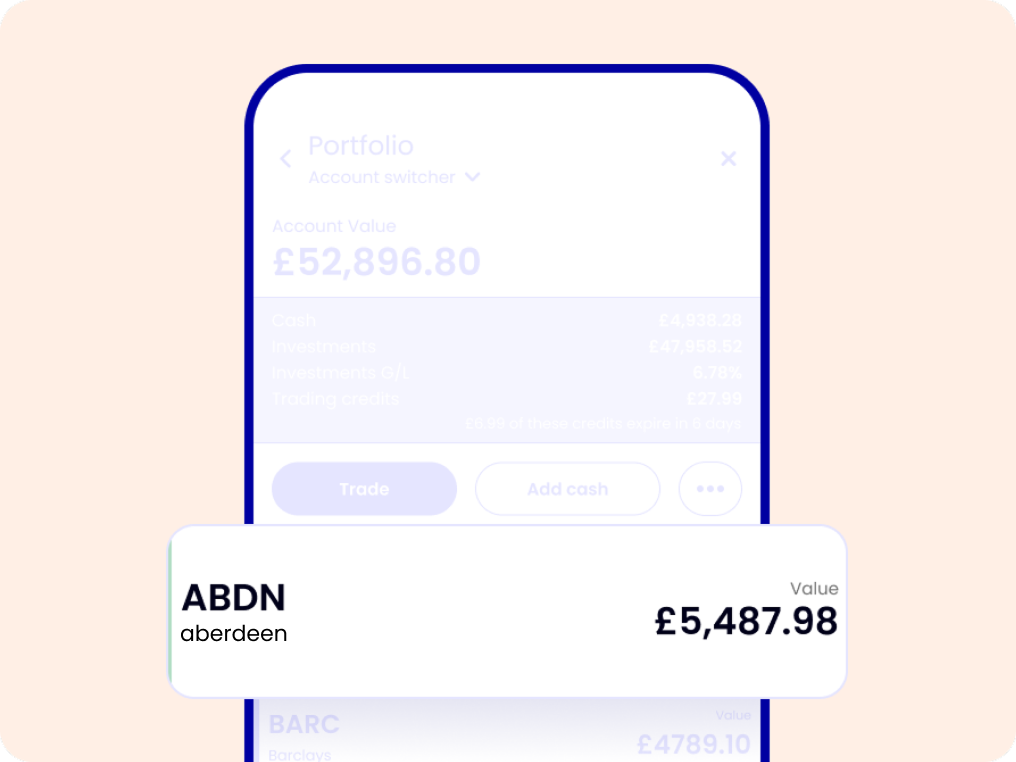

Experience our easy-to-use platform for yourself. Get a clear idea of what your ii account will look like. And see our simple money management tools in action.

This is placeholder copy that is over 30 characters long, hidden from the user and screen readers in order to aid alignment in case the editor sets a short amount of content.

See why over 50% of our customers have been with us for more than 10 years. We’ve been supporting investors just like you since 1995.

A SIPP is for those wanting to make their own investment decisions when saving for retirement.

As investment values can go down as well as up, the amount you retire with could be worth less than you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028).

Check if you’ll be charged any exit fees and make sure you won't lose any valuable benefits, such as:

This communication isn’t a personal recommendation. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Before you start your transfer, there are a few things to think about first. We’ve made this checklist for you to make sure you’ve considered everything you need to before you switch:

If you want to trade while your transfer is in progress, contact your current provider to find out if they can do that for you. Don’t forget to keep both them and us updated on any changes to your investments.

If you’re ever unsure about the transfer process, we recommend seeking advice from an independent financial adviser.

ISA transfers typically take up to 4 weeks for cash transfers, and up to 6 weeks when moving across investments.

Transferring your pension as a cash payment to the ii SIPP usually takes 2 to 6 weeks to complete. Transferring in existing investments can take longer - typically 8 to 12 weeks.

Please note these timescales are a guide. Your transfer time can depend on your portfolio and how quickly your current provider works with us. During busier periods, your transfer may take longer.

If you’re transferring a defined benefit pension, a Small Self-Administered Scheme (SSAS) pension or an overseas pension scheme, the process can take even longer.

Regardless of what you transfer to ii, you’ll always have a case handler to keep you up to date with any progress.

You can transfer a number of accounts and investment types to ii, including:

Yes. If you have various investment accounts, ISAs or pensions, it’s possible to move them all across to us. If you’re transferring multiple accounts at the same time, our team will help you manage the process.

Yes – transferring accounts without selling your investments is known as an ‘in specie’ transfer. For example, you could transfer an ISA to us and the investments in your ISA would simply move across to the ii platform.

This type of transfer avoids having to sell any investments and repurchase them after your transfer.

Please note there is an exception: you won’t be able to transfer any investments that we don’t offer at ii. They will have to be sold first and transferred as cash. To check whether we offer a particular investment, you can search our shares, funds, investment trusts and ETFs pages for more information.

To transfer shares from a ‘Save As You Earn’ (SAYE) or a 'Share Incentive Plan’ (SIP) scheme, you'll need to open an ii ISA.

Transfers of employer share plans directly into an ISA must be made within 90 days of the exercise of the SAYE option or release from the SIP.

Your employee scheme, broker, or registrar must initiate the transfer request via the online portal.

Please request a Letter of Appropriation (LOA) from the scheme provider confirming your details and information relating to your holding and its release date from the scheme.

If you want more information about this transfer process, you can find a more detailed explanation in our Save As You Earn hub.