As investment values can go down as well as up, you may not get back all the money you invest. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future.

‘Tax Year End’ simply means the end of the tax year. And thanks to a centuries-old UK accounting tradition, it falls on 5 April every year.

The last day of the current tax year (2025/26) is 5 April 2026. That’s the last day you can use up your annual allowances before they reset on 6 April.

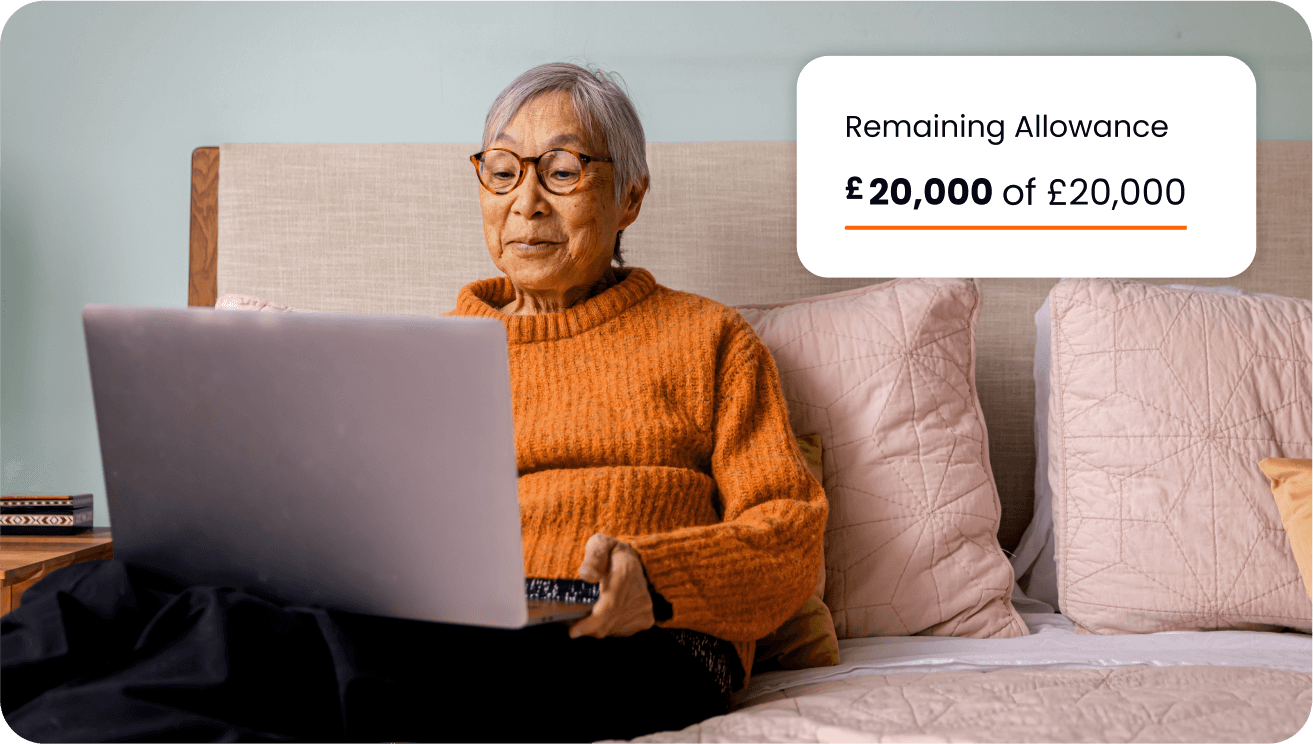

Tax Year End matters because it’s usually the last opportunity you have to use your annual ISA allowance, currently £20,000, and your annual pension allowance, currently £60,000. Not only that, but any newly announced financial rules usually take effect in the new tax year.

On 6 April 2024, the Capital Gains Tax (CGT) exemption was reduced from £6,000 to £3,000.

While 5 April might be the big date to look out for, many deadlines fall earlier that are good to be aware of.

If you want to make the most of your annual allowances this tax year, click the link below to find our key deadlines and our contact centre opening hours as the tax year draws to a close.

| Tax year | 2025/26 |

| ISA subscription limit | £20,000 |

| Junior ISA (JISA) subscription limit | £9,000 |

| Personal Pension Annual Allowance limit | up to £60,000 |

| Personal Pension Money Purchase Annual Allowance (MPAA) | £10,000 |

Read more: ISA allowances | SIPP contributions

Our latest report reveals that over half (51%) of UK adults were particularly stressed when thinking about investing for their future.

Furthermore, 70% were hesitant to start or continue to invest due to the stress related to managing investments – but this doesn’t have to be the case. Below, we have our five-step checklist to get you on top of your investments before Tax Year End.

Make sure you’ve topped up your ISA and added cash before the tax year ends – even if you’ve not decided how to invest it. The key is to maximise your £20,000 allowance before it refreshes.

If you’ve got children, you can also open a Junior ISA and begin saving for when they turn 18. This can help with those big future expenses like university, or their first car.

Tax Year End is a good time to reassess your pension and make any last minute contributions. Pension rules let you roll over unused allowance from the past three years and claim tax relief. Check if you have unused years before you lose them.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). If you’re unsure if a SIPP is right for you, please speak to an authorised financial adviser.

Put your best financial foot forward in 2026.

Join ii today and kick off the year with our special offers:

Offers end 28 February 2026. Terms apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

Join over 500,000 investors and see why we’re Boring Money’s Best For Share Traders and Best For Investment Enthusiasts.