Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future.

An ISA transfer should be simple, smooth and straightforward. With ii, it is.

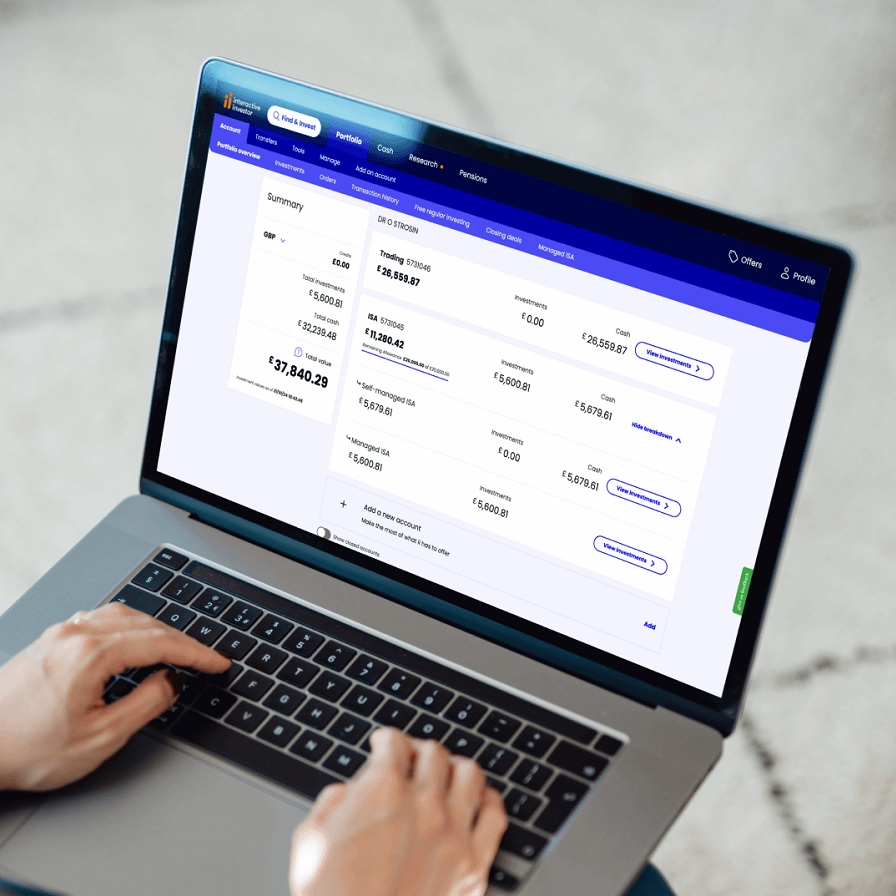

Let us know what you want to transfer, and we’ll take care of everything. Make your investments go further with our award-winning platform and a low, flat monthly fee. No hassle and no juggling multiple platforms.

With all your investments under one roof, you can save time by managing your money on a single platform.

Transferring your ISA lets you cut down on admin. It centralises your investments and gives you more time to focus on your future.

You might benefit from transferring your ISA if you’re looking to save on costs.

By transferring, you can consolidate your costs into a simple, flat fee. It means the more your money grows, the further it could go.

With a Stocks & Shares ISA, you have the freedom to choose how to invest your money.

You can access a range of opportunities. You can invest in everything from shares to funds, ETFs, bonds, investment trusts and more.

Enjoy £100 towards your trading fees when you open an ii ISA. That’s up to 25 free trades to kick-start your year.

Offer ends 28 February 2026. Terms and fees apply.

Transferring an existing ISA doesn’t affect your annual ISA allowance.

Whether you’re moving a Cash ISA or a Stocks & Shares ISA, you won’t use up any of your £20,000 annual limit. And to make it even better, transferring to ii is free. Existing provider fees may apply.

Our low, flat fee means the more your investments grow, the more you can save. Count on a simple, transparent and convenient cost every month.

You’ll have access to one of the widest ranges of investments on the market. And with our selection of Quick-start Funds, getting started is easy.

Get in touch with our award-winning customer service team with any questions. You can also stay informed with a wealth of insights from our experts.

“Transferring to ii was very easy. Their Customer Support team was always in contact and gave me a clear visual timeline of the switch. That’s why I’m with ii.”

Chris appreciated the human touch of our transfer process. Hear why he’s joined over 500,000 investors taking greater control of their money with ii.

If you don't already have an account with ii, you'll need to open an ISA to start your transfer. Don’t worry, it only takes 10 minutes.

You can kick-off your transfer while opening your account. If you want to transfer later, that works too – just log in and start the transfer process at any time.

Sit back and relax. We’ll work with your current provider(s) to move your money to ii. You’ll get regular updates as the transfer progresses.

Transfer your ISA and jump into one of the widest choices of investments in the market.

Transferring a Stocks & Shares ISA to ii is simple. Just let us know that you want to transfer an existing ISA and we’ll handle the rest. We’ll work with your old provider to transfer your funds and will keep you updated throughout the process.

It’s important that you keep your current ISA open. If you close your account, you lose the tax-efficient status, and it will count against your annual ISA allowance.

In most cases, you can transfer all your investments to ii as we offer a wide range of options. However, it’s possible that your investments are not available on our platform. If so, you may have to sell the investments and transfer as cash.

Yes. It's easy to transfer a Cash ISA to a Stocks & Shares ISA.

If you've made contributions to your Cash ISA within the current tax year (6 April to 5 April the following year), you can choose to move some or all of it.

It’s free to transfer an ISA to ii. However, your existing provider may charge an exit fee when you leave, so check this before you start.

Transfers typically take up to 4 weeks for cash transfers and 6 weeks when transferring investments. Though this can take longer if there are delays from your current provider.

To make it as smooth as possible, we take care of the whole process and keep you up to date with any progress.

There is no limit to how many ISAs you can transfer in a year.

If you have multiple ISAs with different providers, you can consolidate them all into one ii Stocks & Shares ISA. This could allow you to better manage your investments and give you greater control of your finances.

Transferring shares into a Stocks & Shares ISA is known as “Bed and ISA”.

We’ll take care of transferring over any shares to your ISA. It means selling and rebuying your shares, but we handle that and you only pay trading fees on the repurchase – not the sale. Read our Bed and ISA guide to find out more.

We can transfer most investments into your ii ISA. In the event that your investments are not available on our platform, you can:

You can search for available investments on the following pages:

Yes, you can do a partial ISA transfer as long as both ISA providers support this option.

There are some golden rules when transferring your ISA:

For a more thorough breakdown, be sure to check out this guide about ISA transfer rules.