How to get started with US share trading

From Amazon to Zoom... our guide to investing in US markets.

Please remember: The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The value of international investments may be affected by currency fluctuations which might reduce their value in sterling. We may receive two elements of commission in relation to international dealing - Trading Commission and our FX Charge. Please see our rates and charges for full details of the relevant costs. Foreign markets will involve different risks from the UK markets. In some cases the risks will be greater.

How to buy US shares

New to ii? Open an account

You can buy and sell US shares with any of our investment accounts. It only takes a few minutes to get started.

Set up your account for US trading

Before trading US incorporated stocks you will need to:

— Sign the online Exchange Agreements

These are agreements with international exchanges which allow us to provide live international share prices to you. When you attempt to trade a non-UK listed stock you will automatically be prompted to sign the exchange agreement.

— Complete a W-8BEN form

A W-8BEN form confirms you're not a U.S. resident and may reduce the tax withheld on U.S. dividends and interest payments depending on your country’s tax treaty with the U.S. You can do this online by logging in and visiting our Useful Forms page. You don't need to do this if you are only investing in the ii SIPP.

More information and guidance on completing a W-8BEN can be found here.

Do your research

You can find ideas by visiting our International investing page, or head over to our international shares news.

— Jump to: What shares can I buy?

You’re ready to go

A few useful things to remember about trading US shares:

— US markets are usually open from 2.30pm to 9pm UK time (that's 9.30am to 4pm Eastern time) - so you can trade later than UK shares.

— You will see prices in dollars and cents – not pounds and pence.

— When you trade US shares, you will not see the 15-second countdown with a fixed price as you do with UK shares. Your order will be sent directly to the US exchange, and the actual traded price will be confirmed when the trade completes.

— With our Trading Account and SIPP, you can convert pounds into dollars and hold it in your account until you’re ready to trade. This saves you having to pay currency conversion fees on every trade.

Trading Account fees and charges

When you open a Trading Account you will start on our £4.99 a month Investor Essentials plan. Should your investments grow above £50,000, you will move onto our £11.99 a month Investor plan.

- Investor Essentials plan: £4.99 a month. Our low-cost plan for those investing up to £50,000. UK and US trades are £3.99.

- Investor plan: £11.99 a month. Our most popular plan. It includes a free trade every month and you can add as many Junior ISAs as you need for your children. You can also add 2 friends or family members for free. UK and US trades are just £3.99.

- Super Investor plan: £19.99 a month. For super-charged investors. You get 4 free trades every month and you can add as many Junior ISAs as you need for your children. You can also add up to 5 friends or family members for free. UK and US trades are just £3.99.

All our plans allow you to invest as little as £25 a month using our free regular investing service.

Other fees such as stamp duty and foreign exchange charges may apply.

On Investor Essentials, you must be set up to pay your fees by direct debit, and receive your communications electronically. Full terms for our Investor Essentials plan can be found here.

Read more: Our charges

Why we’re the right choice for international trading

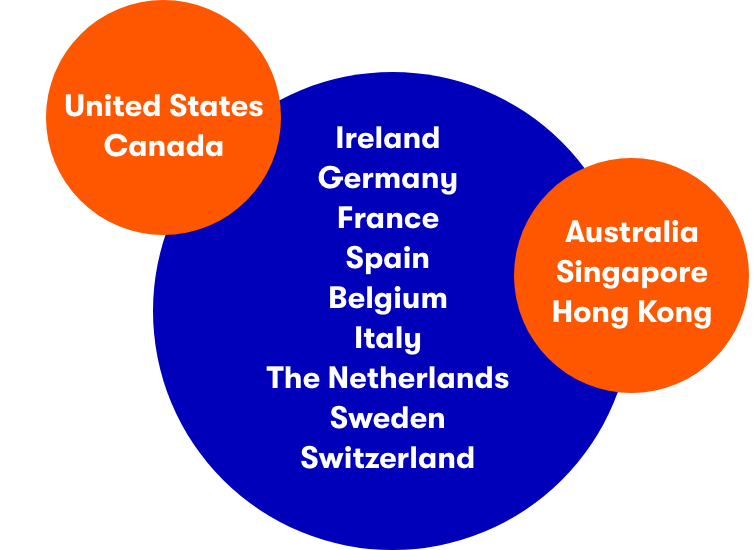

- Choice - access one of the widest ranges of investments on the market.

- Value - fair, flat fees.

- Award-winning - we won "Best Stockbroker for International Dealing" at the 2023 ADVFN International Financial Awards.