Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Unlike percentage-based fees charged by many providers, with ii you will always pay a low, flat fee. This could dramatically increase your retirement wealth over time.

Start on our Core plan at £5.99 a month and upgrade when you want access to a wider range of benefits - or when your portfolio grows above £100,000.

It’s a transparent, cost-effective way to invest in your pension, with everything you need in one place.

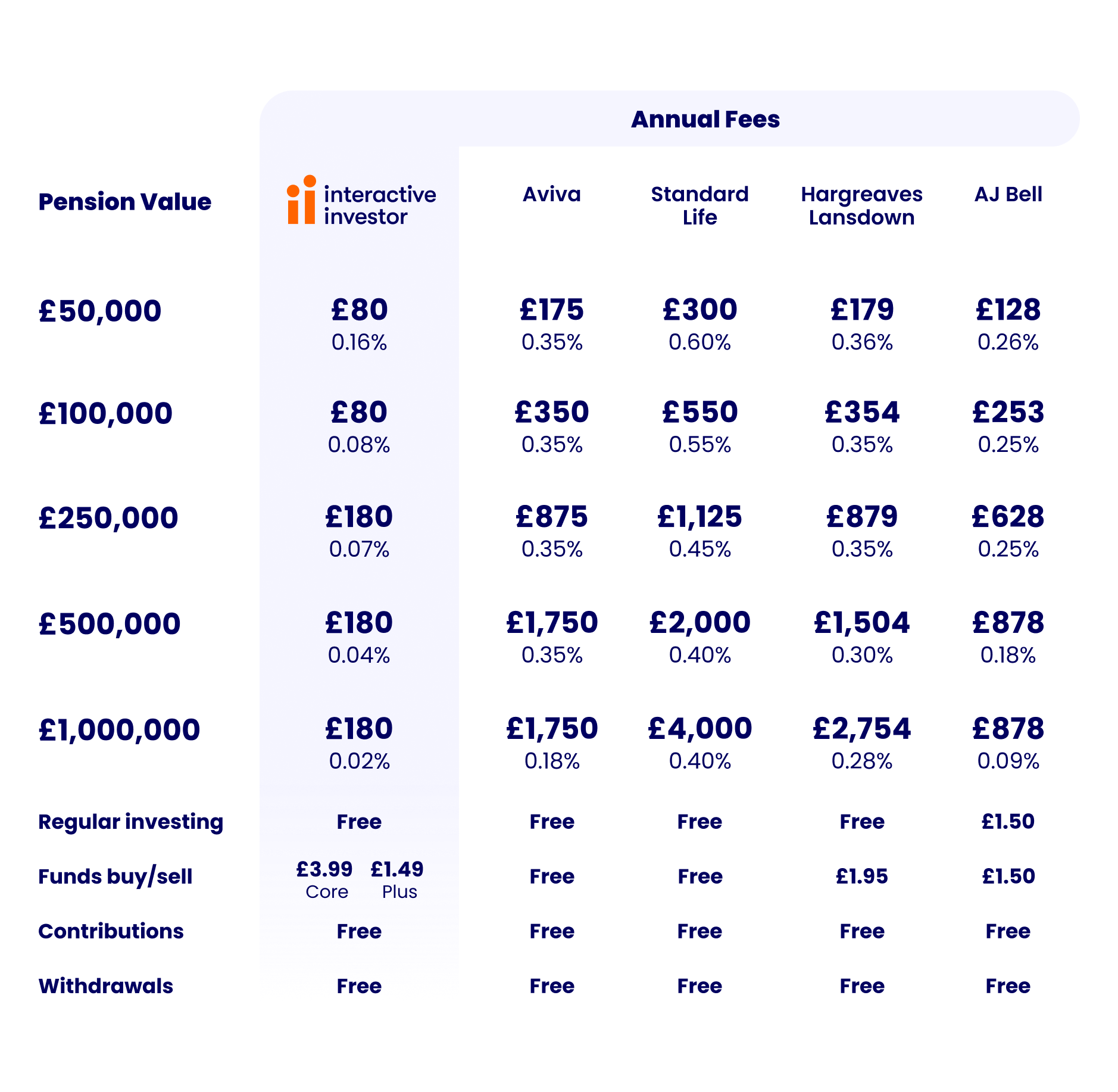

See how much you could save with our low, flat monthly fee Personal Pension compared to other SIPP providers that charge percentage-based fees.

Here's a look at our flat monthly fees:

With ii, you will always pay a low flat fee - helping you keep more of your money invested for the future.

Comparison information - Annual charge comparisons based on published SIPP charges on 01/02/2026 for Aviva SIPP & Standard Life SIPP (Level 2 Investment Options). Hargreaves Lansdown SIPP charges based on new pricing plan effective 01/03/2026. The calculator compares SIPP charges only – other types of pensions may have lower or higher charges. For ii charges you'll start on our Core plan for £5.99 a month and move to our Plus plan for £14.99 a month if your account goes above £100,000. Verified as accurate by The Lang Cat.

Assumptions: 100% holding in funds - choosing other assets such as shares and ETFs, may result in lower charges. Two fund purchases/sales. Pension charges only, excludes fund manager charges. Read more about our analysis.

Choosing the right SIPP provider could mean thousands more pounds for your retirement. Dig deeper into how the ii SIPP compares to some of the other SIPPs on the market.

Ella has a SIPP valued at £205,000 and holds no other ii accounts. Her pension portfolio is split between funds, shares and cash.

Ella contributes £500 per month to her pension using ii’s Free Regular Investing service, but she does make the occasional trade.

In the table, find an example of Ella’s monthly charge when she makes one trade in a month.

| Plus plan | £14.99 |

| £500 monthly investment | Free Regular Investing |

| 1 fund trade | £1.49 |

| Total charge for the month | £16.48 |

The investments you choose may have their own charges, such as charges from a fund manager. These are in addition to our account charges. Other charges, including foreign exchange (FX) fees, may apply.

Our trading fee is a low £3.99 per trade, or £2.99 if you’re on our Premium plan.

If you invest often, our regular investing service is free when you invest more than £25 a month.

International shares start at £9.99 per trade, but are lower when you upgrade to our Plus or Premium plans.

Additional charges, like FX fees, may apply - check our full trading fees for large trades.

Our dividend reinvestment service with the ii Personal Pension costs just 99p per trade, with a £10 minimum per reinvestment.

Access a huge variety of investments. Choose from a range of shares, funds, ETFs, bonds, investment trusts and more.

With the ii SIPP there are no fees for taking an income from your pension. It's all included in our low-cost SIPP service plan – there are no hidden administration or withdrawal fees.

Don’t pay FX on every trade. Hold cash in the same currency as the asset you are buying with ii’s currency wallet.

“With a lot of providers’ charges, it’s this plus that plus that. Whereas with ii, it’s straightforward. What I pay is what I pay – ii’s fees are just so much cheaper. That’s why I’m with ii.”

Mark, 47, was frustrated with the fees he was paying with his old provider. With ii’s low flat fee, he now gets to retire earlier.

We collect your monthly subscription via Direct Debit. If you have a stand alone SIPP and have no Direct Debit set up, we will try to collect fees from the cash you hold in your SIPP.

If you have a Trading Account alongside your SIPP, we will try to collect fees from cash you hold in your Trading Account. If there is no cash in your Trading Account, and you also have an ISA account, we will attempt to collect fees from your ISA. We may regularly sweep across your accounts, if cash becomes available to settle part or all of a fee debt.

If these methods aren't successful and we have your Debit Card details, we will attempt to charge that card the outstanding amount. If there is no other means of payment, we reserve the right to sell your holdings to cover any outstanding fees.

With the ii SIPP there are no fees for taking an income from your pension. It's all included in our low-cost SIPP service plan – there are no hidden administration or withdrawal fees.

You can withdraw money from your pension once you reach 55 (57 from 2028).

We offer a range of flexible online options:

Take a tax-free lump sum - you can usually take up to 25% of your pension tax-free, even if you don't plan to take the rest until later.

Income drawdown - take a tax-free lump sum of up to 25%, and set up regular or one-off payments for the rest.

Lump sums (UFPLS) - take your pension in lump sums, as and when you need them. The first 25% of each lump sum is tax-free, and the rest is taxed as income.

A combination of the above.

Read more about retirement options.

It’s completely free to transfer to us. Your current provider may charge exit fees, so please check first.

This includes ‘in specie’ transfers, in which you keep the same investments as your old pension.

If you have any questions about transferring to ii, please contact our highly rated UK-based customer support team.

If you can’t find the information on this page, contact us with your questions and we’ll be happy to help.

There are no hidden SIPP charges. Any trading fees that are not listed on this page can be found on our charges page.

If you are not trading, you will only pay the monthly account fee. It is worth noting that you can set up free regular investing so your pot continues to grow. We also have attractive cash interest rates if you hold cash in a sipp.

With ii, it’s completely free to transfer your pension. Before transferring your pension, check if you’ll be charged any exit fees and make sure you won’t lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

If you’re thinking about retiring soon and want to understand your options, make sure you speak to someone at Pension Wise.

Pension Wise is part of the government’s Money Helper service, offering free and impartial pension guidance to the over-50s. They can also help you decide if transferring your pension is the right choice for you.