Important information: As investment values can go down as well as up, you may not get back all the money you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future. We cannot provide tax or legal advice. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser.

A dividend is a type of income some companies provide to shareholders as a way of distributing their profits. With dividend reinvestment, that income is automatically used to buy more of the same shares, rather than taking the cash.

Each time this happens, you own a little more of that investment — which means your future dividends can grow too. This snowball effect, known as compounding, can help you grow your portfolio steadily over time.

With dividend reinvestment, you can put the money back into the investment at a reduced cost from our usual trading fees. A minimum amount of £10 per dividend reinvestment applies.

You can set up dividend reinvestment for UK shares, investment trusts and ETFs in minutes. And once you're paid a dividend, we'll automatically buy more of the same investment for you.

Dividend reinvestment can help your wealth to grow over time, and make your dividends work harder. It's the power of compounding in action.

Log in to your existing ii account or open an account with us using our website or mobile app.

Dividend reinvestment is available in the ii ISA, Personal Pension (SIPP), Trading Account or Junior ISA.

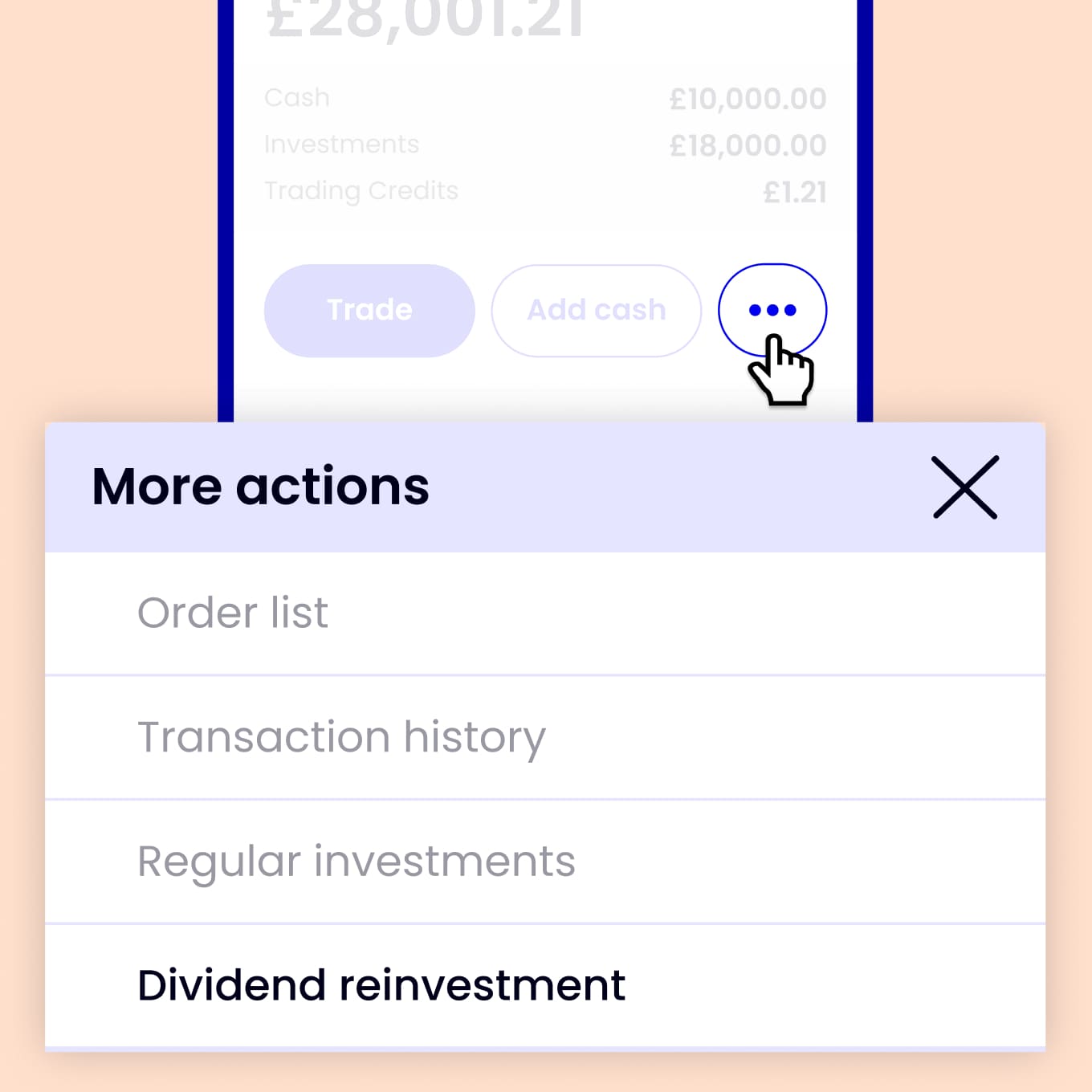

From your account, go to the ‘Portfolio’ option on the top menu bar. Then tap on ‘Manage’ and then select ‘Dividend reinvestment’.

If you’re using the app, simply select the account you want to reinvest your dividends, press the three dots and then select ‘Dividend reinvestment’.

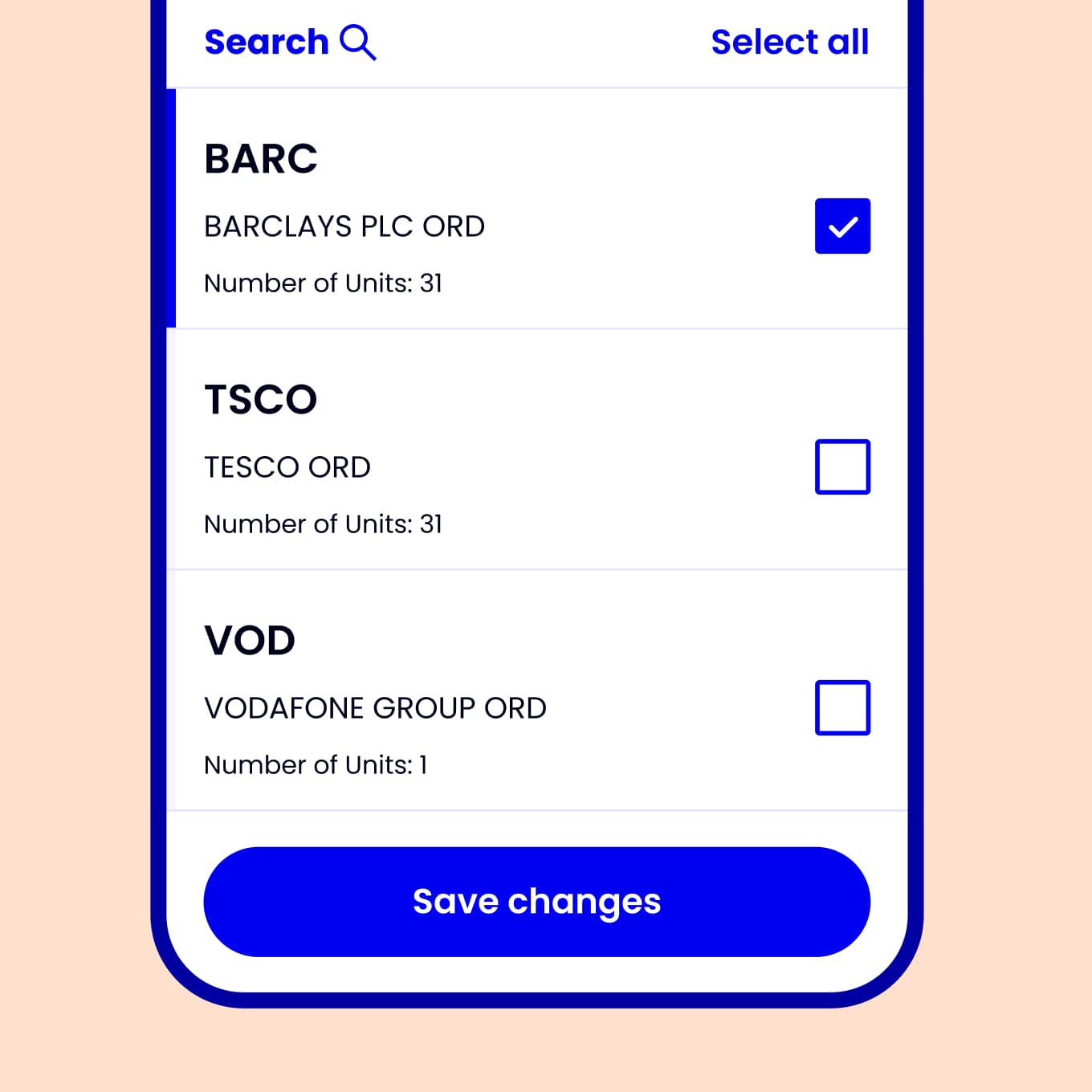

You can set up dividend reinvestment with UK shares, investment trusts and ETFs - including high dividend ETFs.

When deciding where you’d like dividend reinvestment to apply, you can choose to select all eligible dividend payments, or only for specific investments.

Once you’re happy with your selection, select ‘Save your changes’. Just keep in mind, you’ll need to set your preferences separately for each account.

If you need some investment inspiration, our experts have put together a range of ideas to help you choose.

See why our customers trust us with their investments - and their future. Whether you’re saving for your dream retirement or planning your next big life event, you always have our support.

You can set up automatic dividend reinvestment for a wide range of popular UK shares (including the FTSE 350), investment trusts and ETFs.

The minimum amount per dividend reinvestment is £10.

You can only automatically reinvest dividends that are received in pounds sterling.

You can set up dividend reinvestment in a number of ii accounts, including:

In a tax-efficient account, such as a Stocks and Shares ISA or a SIPP, you won’t pay tax on dividends. One of the main benefits of dividends in an ISA is that they don’t count towards as ISA contribution. Likewise, there’s no tax on dividends in a SIPP, as the income stays within your pension until you start drawing it.

In a Trading Account, dividend income may be taxable. You can receive up to £500 in dividends (2025/26 tax year) before any dividend tax applies.

Dividend reinvestment costs 99p a trade for each investment you’ve selected. This will be taken from any cash balance you have in your portfolio. If you don’t have any cash in your account, the trading fee will be deducted from your stored Direct Debit details. Dividend reinvestment is free with our Premium plan.

This depends on when your selected investment pays out a dividend. Most companies pay dividends twice a year - but it can vary depending on how well the company is doing and other factors.

It is possible to find out when the companies you're investing in are next paying dividends - and therefore when to next expected a dividend reinvestment.

If you don’t need the money, using your dividend payments to buy more shares can make a big difference to your returns over time.

Just keep in mind that share prices and dividend pay-outs fluctuate over time, and pay-outs and share price rises are not guaranteed. We recommend thinking about this strategy over the long term and we would also encourage investing in a portfolio of shares.

And also, the value of your investments and the income derived from them may go down as well as up. You may not get back all the money that you invest.

Dividend reinvestment usually happens two business days after the dividend has been paid into your account.