Analysis of monthly pension provider charges

We partnered with independent experts at The Lang Cat to develop a simple one-month pension provider charge comparison. We used the following criteria to find out how ii pension provider charges compare.

How we worked it out

Our analysis is a simple comparison of the pension provider charge made for administering a SIPP pension for one month based on published charges as at 18 July 2025.

Investment Charges such as Fund Charges are excluded from the comparison to ensure only pension provider charges are compared.

Trading charges to buy or sell funds are excluded from the monthly figures. All comparison content makes it clear when there is an additional charge for trades and when no additional charge applies. In this analysis the ii Online trade costs are detailed, together with no additional trade cost for Standard Life and Aviva.

As the comparison is for a single month only, which does not project values or the effect of charges over time, no investment growth or effect of inflation is assumed in the comparison.

To ensure a meaningful comparison the analysis compares currently available products that are all Self Invested Personal Pensions, having access to some of the same Investment Funds,

Standard Life has different SIPP options available, the level 2 variant that offers access to both similar features and similar investments, including both the same fund and platform classes of fund, was chosen.

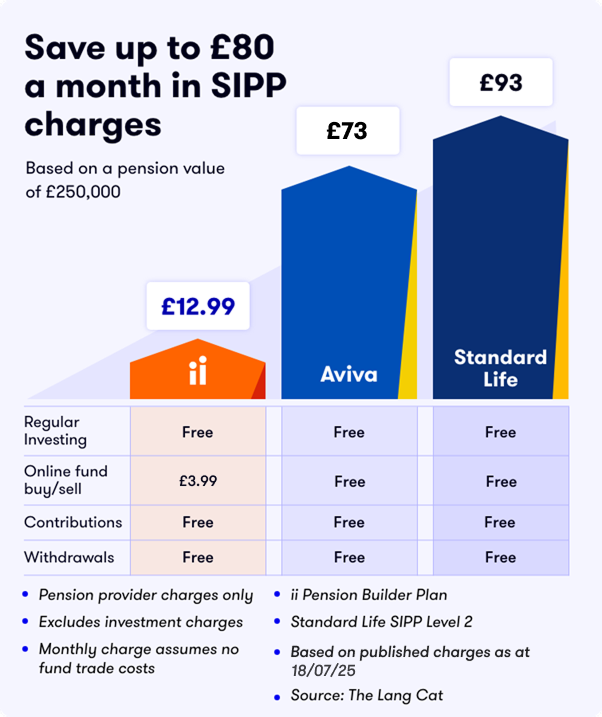

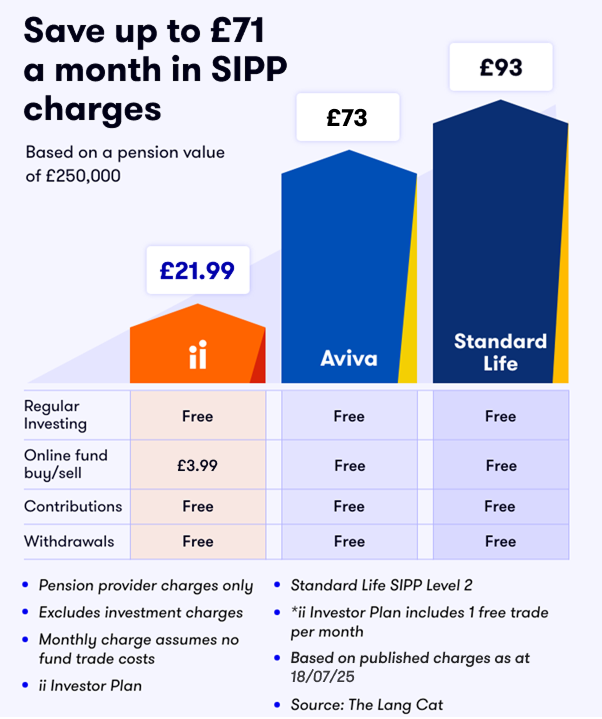

In our content we made two comparisons using both the ii Pension Builder Plan (Pension Only Customers) and Investor Plan (Pension & ISA/Trading Account Customers)

Pension Builder comparison

ii SIPP vs Traditional pension providers - Monthly charge comparison

| Pension pot value | ii SIPP | Aviva SIPP | Standard Life SIPP |

|---|---|---|---|

| £50,000 | £12.99 | £14.58 | £25 |

| £100,000 | £12.99 | £29.17 | £45 |

| £250,000 | £12.99 | £72.92 | £93 |

| £500,000 | £12.99 | £145.83 | £166 |

| Online fund Buy/Sell | £3.99 per trade | Free | Free |

| Regular investing | Free | Free | Free |

| Contributions | Free | Free | Free |

| Withdrawals | Free | Free | Free |

Investor comparison

ii SIPP vs Traditional pension providers - Monthly charge comparison

| Pension pot value | ii SIPP | Aviva SIPP | Standard Life SIPP |

|---|---|---|---|

| £50,000 | £21.99 | £14.58 | £25 |

| £100,000 | £21.99 | £29.17 | £45 |

| £250,000 | £21.99 | £72.92 | £93 |

| £500,000 | £21.99 | £145.83 | £166 |

| Online fund Buy/Sell | £3.99 per trade | Free | Free |

| Regular investing | Free | Free | Free |

| Contributions | Free | Free | Free |

| Withdrawals | Free | Free | Free |

Applying for an ii SIPP

When applying for an ii SIPP we ask how you intend to use your pension, including how you plan to invest and how often you plan to buy or sell investments. This information is used to provide you with a personalised illustration, which will include an estimate of all the charges you could pay and what the effect of those charges could be on your investment performance over time.