Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). If you’re unsure if a SIPP is right for you, please speak to an authorised financial adviser. Please note, partners of ii are paid a referral fee that does not affect the cost of your service plan. Tax treatment depends on your individual circumstances and may be subject to change in the future.

It’s important to understand that the use of Salary Sacrifice or the ii SIPP is not a recommendation and that the ii SIPP is not an Employer, Workplace or Auto Enrolment Pension. You can arrange with your employer to have contributions paid into your ii SIPP via Bank Transfer. The ii SIPP is a Personal arrangement between you and interactive investor, and you are solely responsible for agreeing & monitoring contributions made by your employer.

Put your best financial foot forward in 2026.

Join ii today and kick off the year with our special offers:

Offers end 28 February 2026. Terms apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

When signing up to an employer pension contribution arrangement with Parasol you are agreeing to reduce your salary in return for pension contributions. Therefore, your contributions will be deducted from your gross pay and you will pay less PAYE tax & less employee NI. Parasol will also pass on a portion of the employer NI savings to you as well.

It is important to understand that the use of employer pension contributions or the ii SIPP is not a recommendation and that the ii SIPP is not an Employer, Workplace or Auto Enrolment Pension.

You can also use the ii SIPP to bring together other pensions so you can manage everything in one place via our website or our user-friendly app. Before transferring a pension, please check you won't lose any valuable benefits or whether exit fees apply.

interactive investor is the #1 flat-fee SIPP provider in the UK and the second largest investment platform in the UK by assets under administration.

A Self-Invested Personal Pension (SIPP) is a type of tax-efficient pension account. It gives you greater flexibility over how you save for your retirement and a wide range of investment options.

Whatever your investing experience looks like, a SIPP can help you reach your goals. Choose from ready-made funds selected by our experts, or hand-pick your own investments from the UK and global markets.

Investing with a low-cost SIPP, like the ii SIPP, puts you in control of how you want to grow your savings for the retirement you want.

Setting up salary sacrifice with Parasol can help you reduce the amount of Income Tax and National Insurance (NI) you pay.

Arranging salary sacrifice involves making pension contributions from your gross pay. This will help you pay less PAYE tax and save on both employer and employee NI contributions. Plus, Parasol will pass on any employer NI savings to you, too.

As an example, let's say you earn £125,000 a year and are looking to do salary sacrifice of £40,000.

Your expected take-home pay for 2025/26 could be up to £78,057. And you could owe up to £46,942.60 in Income Tax and NI.

If you decide to make a salary sacrifice of £40,000, then your gross pay will be £85,000. Your expected take-home pay for 2025/26 could be up to £59,857.40, but your Income Tax and NI bill could be reduced to £25,142.60. That’s a saving of £21,800.

Please note, this is an illustrative example. For a personalised illustration, please get in touch with Parasol.

Assumptions:

It’s important to understand that the use of Salary Sacrifice or the ii SIPP is not a recommendation and that the ii SIPP is not an Employer, Workplace or Auto Enrolment Pension. You can arrange with your employer to have contributions paid into your ii SIPP via Bank Transfer. The ii SIPP is a Personal arrangement between you and interactive investor, and you are solely responsible for agreeing & monitoring contributions made by your employer.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). If you’re unsure if a SIPP is right for you, please speak to an authorised financial adviser.

For the fourth year in a row, independent analysts at Which? have recognised the ii Personal Pension (SIPP) for its industry-leading choice, support and value.

We’ve also been named Best Contractor Pension Provider at the Contracting Awards 2025.

Join over 500,000 ii investors and start prioritising your pension, with our award-winning, low-cost SIPP.

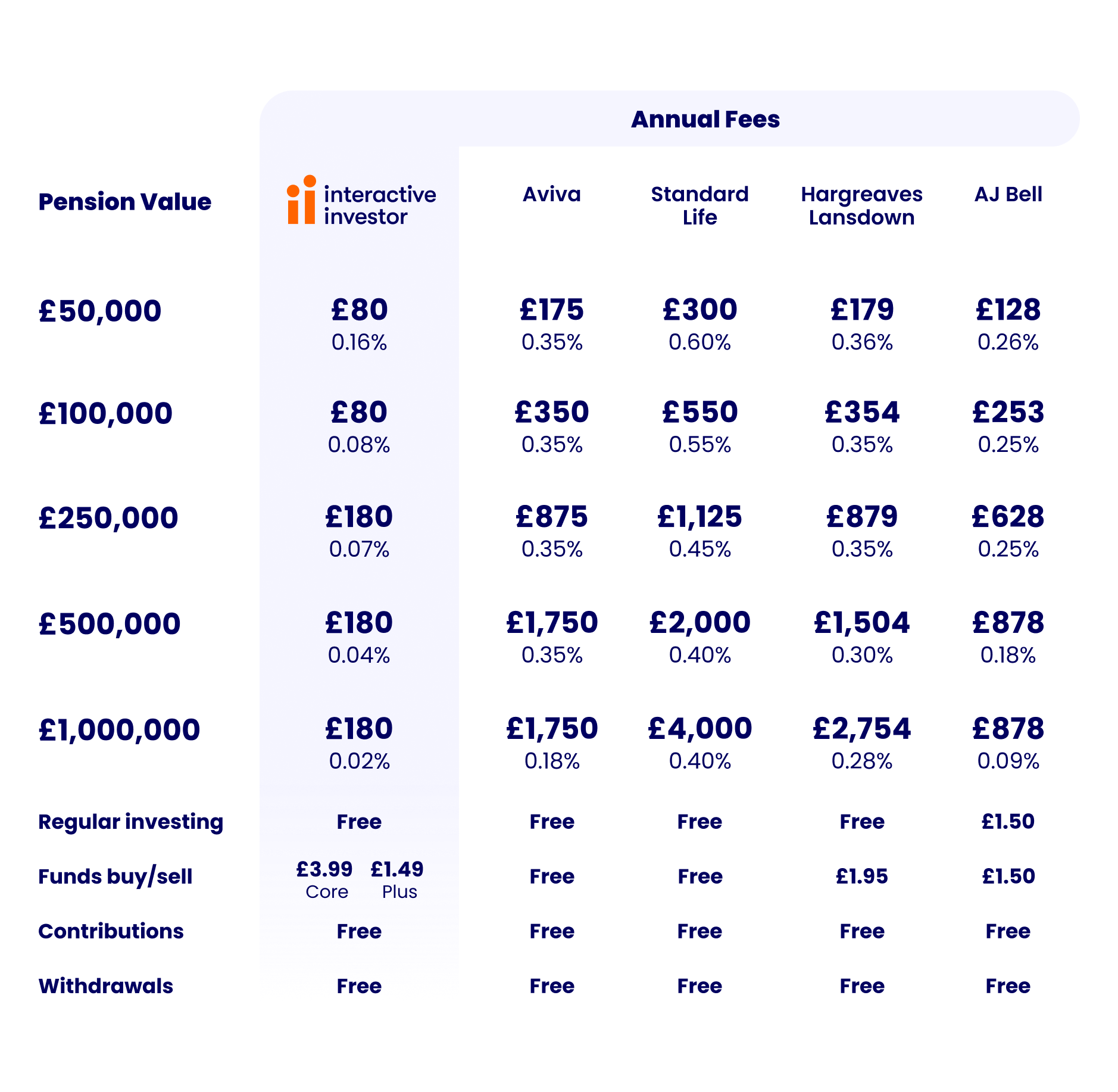

See how much you could save with our low, flat monthly fee Personal Pension compared to other SIPP providers that charge percentage-based fees.

Here's a look at our flat monthly fees:

With ii, you will always pay a low flat fee - helping you keep more of your money invested for the future.

Important information - Annual charge comparisons based on published SIPP charges on 01/02/2026 for Aviva SIPP, Standard Life SIPP (Level 2 Investment Options) & AJ Bell SIPP. Hargreaves Lansdown SIPP charges based on new pricing plan effective 01/03/2026. Assumptions: 100% holding in funds - choosing other assets such as shares and ETFs, may result in lower charges. Two fund purchases/sales. Pension charges only, excludes fund manager charges. Read more about our analysis. Verified as accurate by The Lang Cat.

“With a lot of providers’ charges, it’s this plus that plus that. Whereas with ii, it’s straightforward. What I pay is what I pay – ii’s fees are just so much cheaper. That’s why I’m with ii.” Mark, 47, was frustrated with the fees he was paying with his old provider. With ii’s low flat fee, he believes he may be able to retire earlier.

You can also use the ii SIPP to bring together other pensions so you can manage everything in one place using our website or handy mobile app.

It’s free to transfer your pensions to the ii SIPP, with our simple online process and the support of our top-rated team.

Before transferring, please check with your current provider that you won't lose any valuable benefits or whether exit fees apply.

It takes less than 10 minutes to open an ii SIPP. You can do this here on the website or by downloading our mobile app.

Once your account’s set up, you can choose to transfer any existing pensions to your SIPP using our simple online process.

The first thing you need to do is contact Parasol by phone on 01925 644860 or by email pensions@parasolgroup.co.uk to let them know when you want to begin contributing to your ii SIPP. Once instructed, your contributions will begin from the agreed date.

You’ll also need to download and complete our SIPP contribution form and return this to us. You can find instructions on how to complete this form in our FAQs.

Choose from our extensive range of shares, funds, bonds and more. Need help deciding? Get some inspiration from the experts, including our SIPP investment ideas.

You can pay up to 100% of your salary (capped at £60,000) per year into a SIPP. This is your pension annual allowance and can be spread across all the pensions you pay into.

Your annual allowance also includes tax relief, so the maximum you can pay yourself is usually £48,000; the remaining £12,000 would be added by the government.

Your annual allowance may be lower if you’ve already taken money out of your pension or are a higher earner. Remember, pension and tax rules apply and depend on your personal circumstances.

For every personal payment you make into your SIPP from your net income, we’ll automatically claim basic rate (20%) tax relief for you. So, if you contribute £80, this will be topped up to £100.

Once your tax relief has been sent to us by HMRC, we’ll pay it as cash into your SIPP account, so you can choose how to invest it.

If you’re a higher rate (40%) or additional rate (45%) taxpayer, you can claim back the rest of your tax relief through your annual Self Assessment.

The earliest you can access your SIPP is age 55, rising to 57 in 2028.

You can withdraw from your SIPP in various ways, including tax-free cash, income drawdown, lump sums, or a combination that best suits your needs.

You can take up to 25% of your pension tax-free - subject to a maximum of £268,275 - while any remaining withdrawals will be added to your income and could be taxed.

Yes, you can have a SIPP and a workplace pension and can pay into both at the same time. Just make sure your total contributions don’t exceed your annual allowance.

Once you’ve maximised your employer pension contributions, paying into a SIPP can be a great way to complement your workplace savings.

Yes – there's no limit on how many SIPPs you can have. However, bringing your pension pots together into one SIPP can make your retirement planning much simpler.

We make it easy to transfer other pensions into the ii SIPP. You can transfer when opening your account, or you can come back and do it later.

At ii, we make it really easy for employers to make contributions to a SIPP through one-off and/or regular payments. If you want to pay into your SIPP this way, you'll first need to ask your employer if they're able to arrange this.

Call our award-winning UK-based support team on 0345 646 2390 between 8am-4.30pm, Monday to Friday.

If you’re thinking about retiring soon and want to understand your options, make sure you speak to someone at Pension Wise.

Pension Wise is part of the government’s Money Helper service, offering free and impartial pension guidance to the over-50s. They can also help you decide if transferring your pension is the right choice for you.