ii SIPP

ii SIPP Selected Growth Option

A low-cost investment chosen to match common goals when investing for retirement.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Not sure what investment to choose for your SIPP?

Introducing the ii SIPP Selected Growth Option

The ii SIPP Selected Growth Option is an optional low-cost investment that our team of experts has carefully selected to match common goals when investing for retirement. The Fund aims to balance a moderate growth level with a corresponding risk level to achieve long-term growth over 5 years or more and is considered a good middle ground investment.

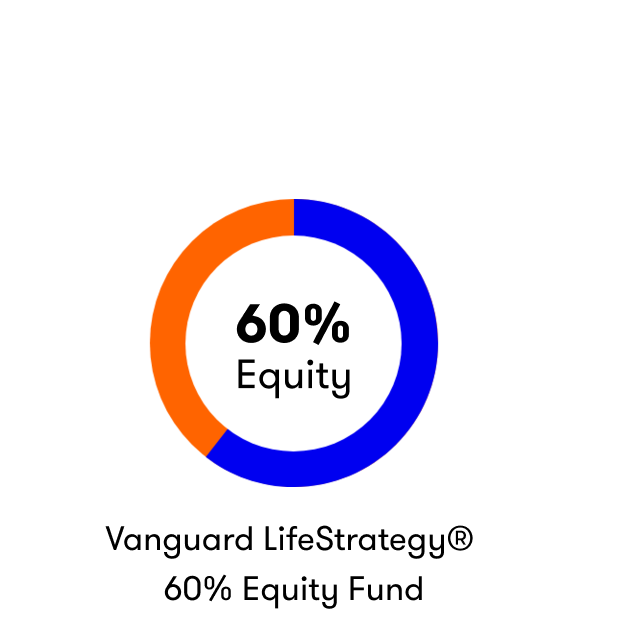

The ii SIPP Selected Growth Option is Vanguard LifeStrategy® 60% Equity Fund.

Investment Allocation

The fund is exposed to a diversified portfolio comprised of approximately: 60% shares and 40% bonds and other similar fixed income investments. The fund seeks to achieve its objective by investing more than 90% of its assets in passive funds that track an index.

Performance

Details of the past performance of this fund can be found on our factsheet. The factsheet includes details on how the fund is benchmarked, and charts showing the historical price and total return of the fund over time periods up to the last 5 years. Past performance is not an indicator of what may happen in future.

Things to consider - It important to understand that the ii SIPP Selected Growth Fund is not tailored to your specific needs and that it will not automatically invest in lower risk options as you approach your planned retirement age. Depending on your circumstances, including how long you plan to invest, you may be interested in taking more risk to potentially achieve higher returns or prefer a more cautious approach to help preserve your pension value and reduce the impact of a short-term fall in the value of stock markets. If you're unsure, we recommend seeking advice from a suitably qualified financial advisor before making any decisions.

How to invest

Once you've funded your account, an automatic secure message will be sent with a link to the ii SIPP Selected Growth Option - it's that easy.

1. Create an account

2. Fund the account

3. Follow the link in your secure message to the ii SIPP Selected Growth Option page

4. Invest in this fund; trading charges apply

If you plan to pay money into your SIPP monthly, consider using our free Regular Investing service.

What are the other options?

Quick-start Funds

If you are saving for retirement and would like to explore other options selected by our experts that offer different levels of risk, choose an actively managed investment or you are interested in sustainable investments you can read about our Quick-start Funds here.

Investment Pathways

If you have already or plan to move some or all of your pension into Drawdown and would like to explore investments selected to meet four common goals that people have in Drawdown you can read about our Investment Pathways here.

Disclaimer(s)

Our six Quick-start Funds, including our ii SIPP Selected Growth option, have been selected by investment experts as a simple starting point for investing. They are split into three broad risk categories: lower, moderate, and higher risk.

However, you should note that the selection of our Quick-start Funds is not investment advice or a ‘personal recommendation’. This means neither we, nor Morningstar, have assessed your investment knowledge, your financial situation (including your ability to bear losses), your investment objectives, your risk tolerance, or your sustainability preferences.

You should ensure that any investment decisions you make are suitable for your personal circumstances, and if you are unsure about the suitability of a particular investment or think you need a personal recommendation, you should speak to a suitably qualified financial adviser. Neither ii nor Morningstar are responsible for any trading decisions, damages or other losses related to the Quick-start Funds.

The past performance of an investment is not a reliable indicator of future results, and ii does not guarantee or predict the future performance of the Quick-start Funds investment list as a whole or the constituent investments.

Disclosure(s)

ii adheres to a strict code of conduct. Members of ii staff may have holdings in one or more Quick-start Funds, which could create a conflict of interest. Any member of staff involved in the development of research about any financial instrument in which they have an interest are required to disclose such interest to ii. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of the Quick-start Funds are subject to a personal account dealing restriction. This prevents them from placing a transaction in the specified instrument(s) for five working days before and after an investment is included or amended and made public within the Quick-start Funds. This is to avoid personal interests conflicting with the interests of investors in the Quick-start Funds.