Will there be festive cheer for UK investors in December 2023?

This time last year it was all doom and gloom. Now, investors are in a festive mood and people are talking up the chance of a Santa rally. Here’s what happened last month and some lessons from the history books.

1st December 2023 11:33

by Lee Wild from interactive investor

Last month, at the end of a miserable October for global stock markets, I suggested investors could do with a period of calm. Well, my wish came true, and many markets and regions head into the Christmas period boasting double-digit returns for 2023.

Much of the optimism revolves around data coming out of the US indicating central bank monetary policy is working. A rapid rise in interest rates is dampening inflation and cooling the economy just enough to avoid a recession. This Goldilocks scenario makes it more likely we’ll see a first cut in borrowing costs some time next year.

As you can see in the chart below, the VIX volatility index halved last month. And America’s Nasdaq tech index and stock markets in Japan, Germany, Brazil, France and India are now up 12% or more so far this year.

Source: TradingView

US tech stocks were the story of November, with the Nasdaq Composite up 10.7%, troubling recent highs set in July and levels last seen in April 2022. Intel Corp (NASDAQ:INTC), Tesla Inc (NASDAQ:TSLA), Netflix Inc (NASDAQ:NFLX) and NVIDIA Corp (NASDAQ:NVDA) gained 22.5%, 19.5%, 15.1% and 14.7% respectively.

Elsewhere, German Dax added 9.5% in November, the S&P 500 rose 8.9%, Dow Jones 8.8% and Japan’s Nikkei 8.5%.

FTSE 250 was best of the UK markets, registering an impressive 6.7% gain for the month. However, while it’s a creditable performance, the index is only reclaiming ground lost during October and is now back where it was at the end of September.

The FTSE All-Share featured among the laggards, up a more modest 2.5% and still a long way short of peaks seen in any month this year. It’s the same for the FTSE 100, which added 1.8% last month and is little changed in 2023.

- UK company profit warnings keep on coming

- FTSE 100 giants have £6bn dividend gift for investors this Christmas

High-profile profit warnings from the likes of Diageo (LSE:DGE), Burberry Group (LSE:BRBY) and Kingfisher (LSE:KGF) have kept a lid on things here. But it’s not all gloomy. In the FTSE 100, 31 companies racked up double-digit percentage gains last month, including Ocado Group (LSE:OCDO) up 27.6%, JD Sports Fashion (LSE:JD.) up 23.4%, Barratt Developments (LSE:BDEV) up 22.8% and Rolls-Royce Holdings (LSE:RR.) 22.3%. There are still opportunities to make money here.

Will stocks deliver gains this December?

As explained last month, we’re now into the historically strong winter period for stock markets, and November kicked things off in style. Now, thoughts typically turn to the likelihood of a Santa rally in the run up to Christmas and calendar year-end.

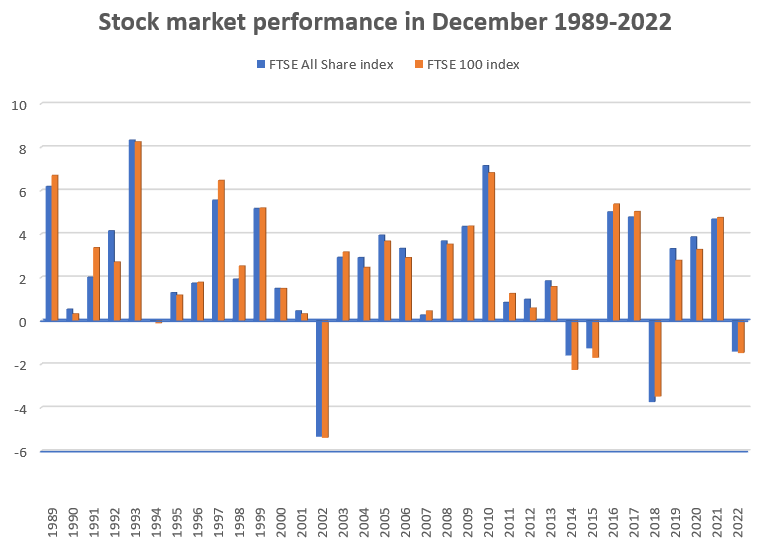

Indices don’t normally fall in December. A year ago, I wrote about the “impressive” performance of both the FTSE 100 and FTSE All-Share in December since 1986. The pair had fallen just four times so far this century and only six times since the mid-80s.

Source: Morningstar. Total returns in GBP. Past performance is no guide to future performance.

However, three of the December declines have occurred since 2014, and a run of three positive Decembers ended in 2022 when both the UK indices fell 1.6%, or a fraction less on a total return basis.

Others did much worse. The Nasdaq slumped by 9%, the Nikkei by 7% and European markets by 3% or more. Investors took fright as they considered a perfect storm of rising inflation, higher interest rates, the Ukraine war and recession fears.

As central banks in the US, UK and Europe had all just raised interest rates by 50 basis points, weak data and further hawkish rhetoric from policymakers raise the prospect of dire economic consequences.

The mood seems considerably better this festive period. While the threat of economic trouble remains, the data is telling us that a deep recession is unlikely, and interest rates could begin to decline at some point in 2024. Those positives are currently being factored into equity markets.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.