Wild’s Winter Portfolios 2021: not immune from growth exodus

8th February 2022 09:12

by Lee Wild from interactive investor

Growth has been the strategy to own in recent years, but the inevitability of higher borrowing costs has implications for these two portfolios.

January was a month to forget for growth investors. Concerns about higher interest rates in the US and elsewhere did the damage, triggering a rotation out of quality growth, or expensive stocks.

Higher interest rates typically affect growth companies more than others – higher rates mean higher borrowing costs both for companies themselves and their customers who see disposable income shrink. Central banks raise rates when they want to cool the economy, and that’s a worry.

Corporate results have been mixed, too, with underwhelming outlook and guidance statements, while supply chain issues and shortages remain a concern. Valuations are also a problem, with many stocks priced for perfection. Geopolitical issues such as Ukraine, Russia, China relations rumble on, and the pandemic hasn’t gone away.

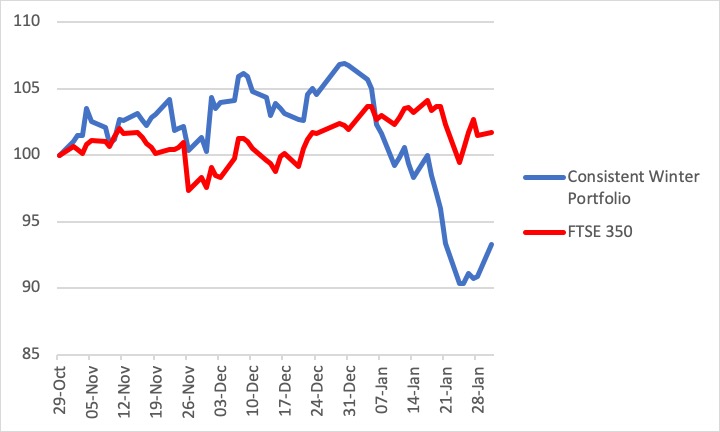

The Consistent Winter Portfolio had made a very respectable start to this year’s seasonal strategy, with a 6.7% profit easily outperforming the FTSE 350 benchmark index. But it’s been a terrible start to 2022 for the usually reliable basket of five shares, and that gain is now a 6.7% loss after January’s 12.6% dive.

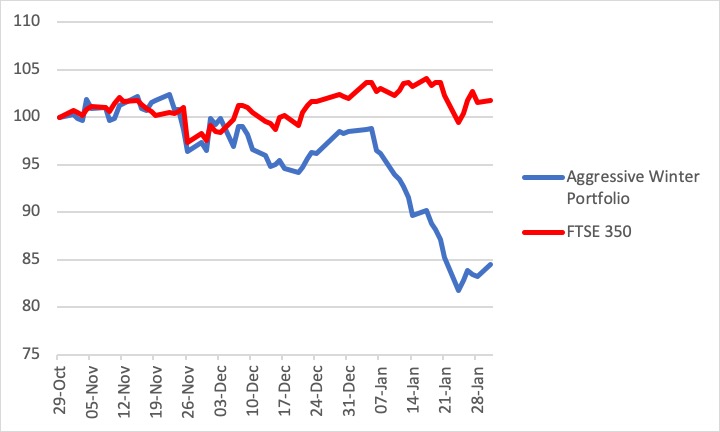

It was worse for the Aggressive Winter Portfolio, which takes on extra risk for potentially bigger gains. Already nursing a 1.6% deficit at the end of December, January was a sea of red, and the basket of five shares fell over 14% for the month. That takes declines for the first three months of this six-month strategy to 15.5%. The FTSE 350, barely changed in January, is up 1.7%.

Consistent Winter Portfolio 2021-22

Source: interactive investor. Past performance is not a guide to future performance.

Liontrust Asset Management (LSE:LIO) was up almost 7% at one point in December, but January was not kind to the fund manager. The high-flying shares were marked down as growth fell out of favour. By the time the dust had settled, Liontrust shares were down 26%.

Even a decent third-quarter update – assets under management of £37.2 billion as at 31 December 2021, up 20% over the financial year - couldn’t reverse the trend. The sell-off wiped out all the share price gains made since June last year.

Technology conglomerate Halma (LSE:HLMA) is another great growth company on a high valuation. It’s exposure to defensive sectors has, historically, protected it from the worst ravages of recession, but the recent valuation was frothy. The shares had risen 30% in a year but fell 22% in just three weeks.

- 10 shares to give you a £10,000 annual income in 2022

- Subscribe for free to the ii YouTube channel for our latest share tips and fund manager interviews

There was a double-digit loss for self-storage firm Safestore (LSE:SAFE), too, despite good numbers for the year to 31 October. Management referred to “a record-breaking year of self-funded growth and occupancy with [earnings per share] up 34.1% and final dividend up 38.6%.” A big gain for the first three months of this portfolio has been whittled down to 5.3%.

XP Power (LSE:XPP), maker of power adapters, reported a better-than-expected 65% surge in orders in its fourth quarter. Revenue growth of 4% was a little lighter than predicted, but supply constraints had already been well flagged. It does mean, however, that profits will be just below the bottom end of expectations.

I’ve left the best till last, but even insurer Admiral (LSE:ADM) ended the month in the red, down 0.4%. It’s still the best consistent stock in the portfolio this winter, up 9.5%.

Aggressive Winter Portfolio 2021-22

Source: interactive investor. Past performance is not a guide to future performance.

As always this winter, what happens to Liontrust and Safestore will affect both portfolios, the pair being consistently big winners over the past decade.

Not one of the five aggressive stocks managed a profit last month. Infrastructure products company Hill & Smith (LSE:HILS) was another of those shares that had significantly outperformed since the Covid crash. Trading near a record high before the selling began, it lost almost 17% by the time calm had been restored.

Synthomer (LSE:SYNT), supplier of chemicals used to make paint and latex gloves, had already struggled this winter following its $1 billion acquisition of the adhesive resins business of Eastman Chemical Company. No news was not good news for the company, though, and a near-9% drop in value for the month took the seasonal decline to 28%.

It was quiet on the news front at precision instrumentation expert Spectris (LSE:SXS), too, but it didn’t prevent a further 8% decline in share price.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.