Why Vodafone dividend cut is a positive

A significant dividend cut was inevitable, but Vodafone is being rewarded for doing the right thing.

14th May 2019 10:10

by Richard Hunter from interactive investor

A significant dividend cut was inevitable, but Vodafone is being rewarded for doing the right thing.

The kitchen sink is clearly on display as Vodafone (LSE:VOD) continues its transformation.

There is a long list of reasons to be uncheerful from these full-year numbers. Slightly light of expectations on earnings, and accompanied by a large miss on revenues, the group swung to an overall loss.

In terms of key metrics, adjusted earnings per share (EPS) fell 55%, and the previously trailed dividend cut is an unwelcome development. Vodafone has been battling several headwinds over the year, ranging from impairments, adverse foreign exchange movements and a loss on the sale of Vodafone India through to stuttering markets in the likes of Spain, Italy and South Africa.

Yet there are also grounds for optimism in terms of Vodafone's ambitions. The 40% reduction in the annual dividend from 15 euro cents to 9 (the final dividend drops to 4.16 euro cents from 10.23 euro cents in 2018) is prudent, given the enormous constraints on cash flow, not to mention that dividend cover had slipped to unsustainable levels.

Even after the cut, the yield will remain punchy at around 5.7% at current prices, and the group has committed to returning to a progressive policy.

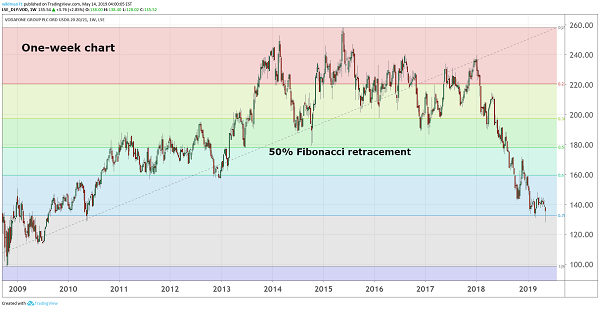

Source: TradingView Past performance is not a guide to future performance

Meanwhile, the Liberty Global deal should prove positive in terms of coverage, presence and cross-selling opportunities, the group is exploring ideas to monetise its array of towers and there are high hopes for its 5G network, which is to be launched imminently in the UK.

In regions such as Africa and the Middle East, data and smartphone usage remains relatively low, which could provide further growth potential. The streamlining of the business also provides the focus required to keep a sharp and beady eye on costs.

In addition, and despite the challenges of the last year, net debt has been reduced, there are signs of margin expansion and the level of revenues remains prodigious, even if they missed expectations.

Whether today proves to be an inflection point remains to be seen, but Vodafone is setting its sights high. Much of the negative news over the last year seems to have been absorbed into a share price which has declined 37%, as compared to a dip of 7% for the wider FTSE 100 index.

Now that the challenges are in plain sight, perhaps investors will give consideration to some of the potential for the company, and with the market consensus remaining stubbornly at a ‘buy’, there is clearly already an optimistic following.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.