Why these real estate funds look attractive

Saltydog Investor looks at the property sector, which is being boosted by falling interest rates.

23rd September 2024 14:40

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

With interest rates beginning to fall, we would expect returns from money market funds to start to reduce.

For a long time, our portfolios did not hold these funds. When bank rates were barely above zero, there were times when these funds could not even generate enough income to cover the management charges. However, for the past couple of years interest rates have been higher, and we have held Royal London Short Term Money Market and L&G Cash Trust funds. They have both gone up by more than 5% in the past 12 months.

- Invest with ii: Buy Global Funds | Top Investment Funds | What is a Managed ISA?

If their performance starts to deteriorate, then we will be on the lookout for funds offering better returns, but without increasing the overall volatility of our portfolios too much.

We already hold funds from the £ High Yield, £ Strategic Bond, and £ Corporate Bond sectors. However, the Property sector has also been looking good in our recent analysis, and it is a sector that can perform well when interest rates are falling.

Lower interest rates mean that it is cheaper for people to borrow money to buy property or refinance existing loans. This leads to increased demand, which in theory will push up prices.

- Will interest rate cuts help tide turn for property investing?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

At the same time, the yield on bonds and other fixed-income investments often becomes less attractive. This can drive more investors towards real estate, which may offer higher yields compared to traditional fixed-income securities. All this is good for the property funds.

Unfortunately, that is not the only scenario and it is dependant on a relatively healthy economy. If there are fears of a recession, then lower interest rates may just encourage people to reduce their debts without stimulating the economy. We will just have to watch carefully and see how markets perform over the next few weeks.

There are two Investment Association (IA) sectors for funds that invest in Property:

UK Direct Property, which is for funds that invest an average of at least 70% of their assets directly in UK property over five-year rolling periods.

Property Other, which is for funds that predominantly invest in property and do not meet the requirements of the UK Direct Property sector. Funds that:

- invest an average of at least 70% of their assets directly in property over five-year rolling periods but do not meet the requirements of the UK Direct Property sector; or

- invest at least 80% of their assets in property securities; or

- invest at least 80% in a mix of direct property and property securities.

The key difference is that UK Direct Property funds must predominantly invest in “bricks and mortar”, but the Property Other funds can invest in property securities, or a mix of property securities and bricks and mortar.

Property securities are equity or equity-related securities issued by real estate investment trusts or companies that own, develop or manage real property located worldwide.

The funds from these two groups behave quite differently due to the nature of the underlying assets.

The funds investing in bricks and mortar assets tend to move relatively slowly. They can earn a steady income stream from their properties and hopefully benefit from a gradual increase in housing prices.

However, that is not always the case. If property prices suddenly increase or decrease then this will be reflected in the pricing of the funds, which can become much more volatile.

- Funds and trusts tipped to prosper from falling interest rates

- DIY Investor Diary: my long-term strategy allowed me to retire early

This can then highlight another potential problem – liquidity. Although the funds invest directly in property, they do hold a cash buffer to account for day-to-day trading. However, if the number of people wanting to sell exceeds the cash available, then the funds have got a problem. They have to sell their properties, and it is usually at the worst possible time!

This raises a couple of issues for investors. Because the fund is being forced to sell, market conditions are probably not ideal and so the assets may end up getting sold for less than their book value. There is also the problem that it takes time for the sales to go through and so investors may have to wait before they can withdraw from the fund.

In the second half of 2022, when interest rates were rising, there were fears of a recession. The economic uncertainty was exacerbated by the Liz Truss mini-budget and we saw UK Direct Property funds fall by over 15%. However, since then some have started to make a steady recovery.

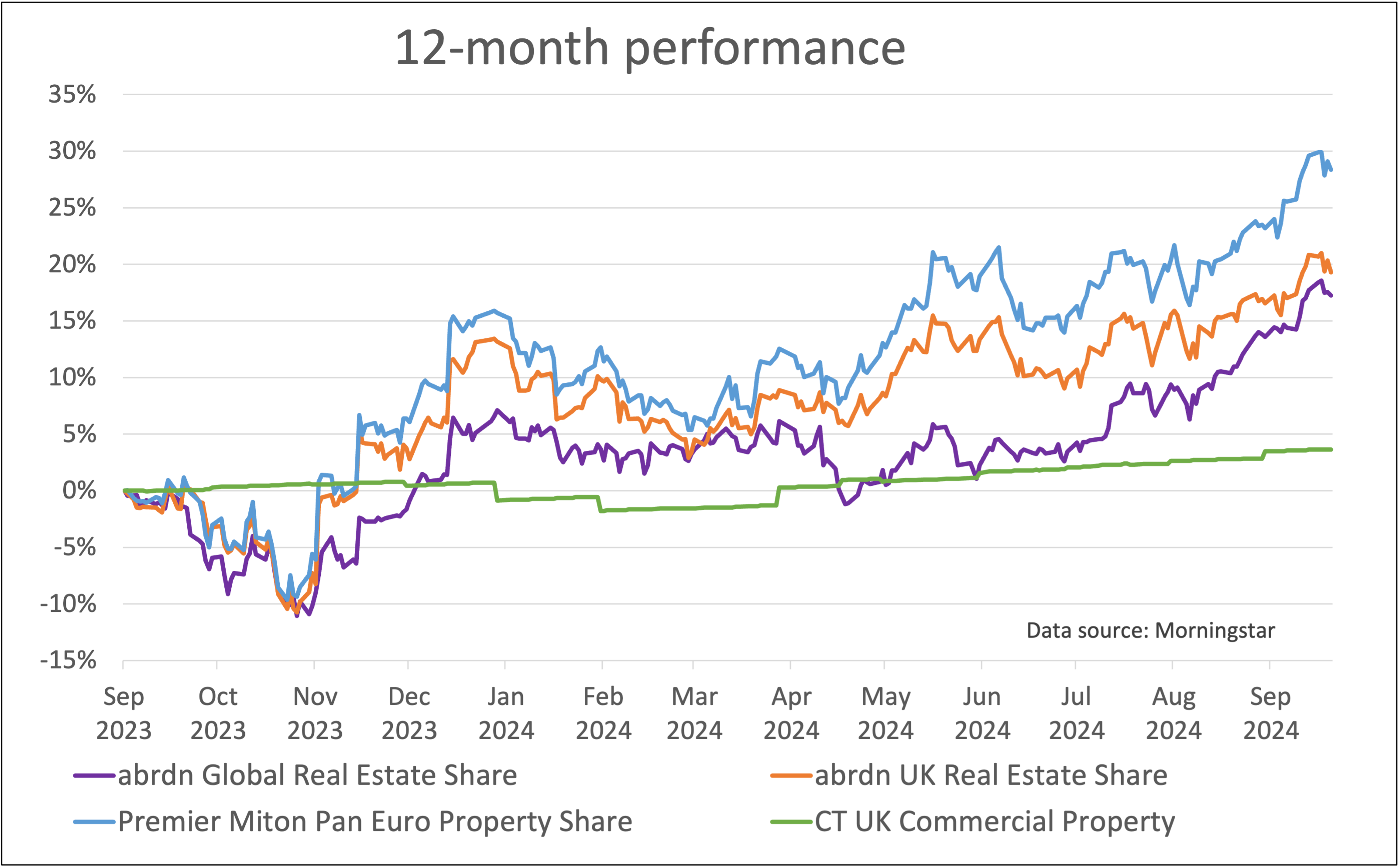

The CT UK Commercial Property fund is the leading fund in our analysis of the UK Direct Property sector, based on its performance over the past six months.

- Is this the catalyst for a bounce back in UK shares?

- High returns and low volatility from this little-known fund

The funds from the Property Other sector behave quite differently, especially the ones investing solely in property securities. Although the underlying trend, property price movement, is the same, funds investing in shares in companies associated with the property sector do not have the liquidity issues associated with actually buying and selling property. This means that it is much easier to sell the funds when things are going wrong, but it does not mean that it will protect you from the fall. It also tends to make the funds much more volatile, because the share prices are more vulnerable to changes in market sentiment.

The leading funds from the Property Other sector have gone up by over 15% in the past year.

Here is a graph showing the CT UK Commercial Property fund, from the UK Direct Property sector, along with three funds from the Property Other sector.

Past performance is not a guide to future performance.

Since the beginning of August, the three funds from the Property Other sector have had a particularly good run. If this trend continues, then it might be worth considering one of these funds for our portfolios.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.