Why stock investors should get exposed to high-end luxury

Rich folk love their brands, even in recession, so our overseas investing expert names his stock to buy.

31st July 2019 10:35

by Rodney Hobson from interactive investor

Rich folk love their brands, even in recession, so our overseas investing expert names his stock to buy.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Wherever you live in the world, and however poverty stricken the general population, you will always find some rich people flaunting their wealth.

There will always be people who enjoy the luxury products of brands such as Gucci and Yves Saint Laurent, so it is worth considering investing in parent company Kering (EURONEXT:KER), which also owns Alexander McQueen and Balenciaga.

It's not surprising that despite all the talk of a slowdown in economic growth, particularly in Kering's European heartland, sales have been on the rise. The worry now is whether the rising trend is losing momentum.

That may sound a strange statement when you consider that Kering has just reported a 15.3% rise in sales in the six months to 30 June. Sales at YSL rose 16.6% and at Balenciaga and McQueen they soared by 20.3%. Chairman and chief executive Francois-Henri Pinault was able to boast:

"We created an additional €1.2 billion in revenue in the six months."

The big concern was that Gucci sales, which had been roaring away, were only 16.3% ahead over the period, with sales in the US and Japan falling short of analysts' expectations. The Italian label's second quarter growth of 12.7% represented a slowdown from 20% in the first quarter, which was itself half the 40% level recorded in the same quarter of the previous year.

Gucci's clothes, shoes and accessories account for more than half of Kering's revenues and have been the main driver of growth over the past three years. The effect of the loss of momentum is that Kering is no longer outperforming rival luxury products group LVMH (EURONEXT:MC), owner of the Louis Vuitton, Christian Dior and Moet Hennessy brands, whose key fashion and leather products surged 20% in the second quarter. Critics claim that LVMH has been more successful in revamping its leading brands.

- Overseas shares that investors should learn to love

- Looking to diversify your portfolio? ii's Super 60 recommended funds is full of great ideas

- It's not just UK stocks that pay big dividends. Check out these ii Super 60 recommended income funds

Kering's stance is that sales growth is merely normalizing and that creations by designer Alessandro Michele are still in demand among fashionistas. Gucci continues to increase its profitability, with operating margins rising to an extremely impressive 41% over the latest six months.

The brand continues to perform well in China as the ballooning of consumerism among the newly created middle class and a weakening of resistance among the authorities to imports of luxury goods is creating demand for more expensive items.

Other encouraging signs are an improvement for the Bottega Veneta fragrances, bags and shoes. This subsidiary has been struggling with falling sales but it returned to growth in the latest quarter, thanks to well received collections from new creative director Daniel Lee.

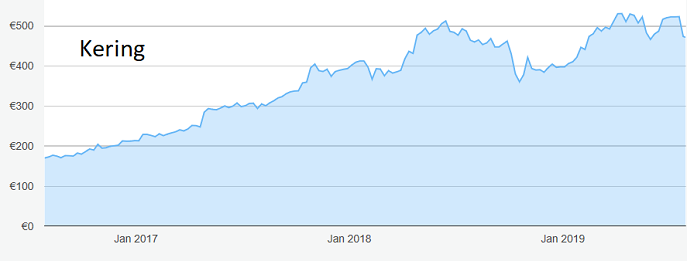

After a period of tracking sideways, Kering shares have been on the rise over the past three years from €147 to a peak of €537 in April. They slumped, a little unfairly, from €511 to €467 on the results but have started to pick up again.

Source: TradingView Past performance is not a guide to future performance

Based on last year's dividend, the yield is a perfectly acceptable 2.2% at the current price of €466 with the prospect of a further boost in the payout this year. The dividend has started to take off: after remaining static at €4 in calendar year 2015 it edged up to €4.60 in 2016 and then €6 in 2017 before leaping to €10.50 last year.

The price earnings ratio is a little high at 31, but a company selling goods of this quality justifies the rating. The overwhelming majority of companies across the globe would be delighted with double digit sales growth.

Hobson's Choice: Buy Kering at up to €475. More cautious investors might like to see if the shares sink back a little, but you risk missing the opportunity: there is likely to be little downside, while the immediate upside potential is €516.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.