Why Metro Bank just plummeted another 18%

After losing 94% of its value in 18 months, is this the end for the Metro Bank experiment?

24th September 2019 12:45

by Graeme Evans from interactive investor

After losing 94% of its value in 18 months, is this the end for the Metro Bank experiment?

There was no respite for bombed-out Metro Bank (LSE:MTRO) shares today after a fresh blow to investor confidence extended the stock's losses in a tumultuous 2019 to a whopping 90%.

The latest bloodbath was triggered by the lender's failure yesterday to raise £200 million in a a bond sale, even though it offered investors a chunky yield of 7.5%. Metro blamed market conditions and said its strong capital position meant it still had the flexibility to raise the funds when the time was right.

But with Metro only attracting £175 million of orders on the bond sale, the failure was another blow to confidence after the revelation of an accounting error in January triggered a shares tailspin from 2,202p. At their peak in March 2018, Metro was trading as high as 4,000p.

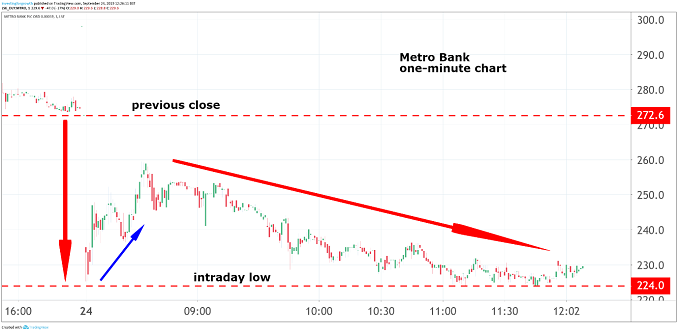

The heavily-shorted stock, which was relegated from the FTSE 250 index on Monday, went as low as 224p after losing almost 20% of its value in the opening minutes of trading today. A brief rally followed, only for the stock to reverse back to the record low seen earlier in the session.

Source: TradingView Past performance is not a guide to future performance

The slide comes at a time when shares in other listed UK lenders, including Lloyds Banking Group (LSE:LLOY) and Barclays (LSE:BARC), have been showing tentative signs of revival. The yield on Metro's bond sale was already higher than that seen on riskier classes of UK bank debt.

Goodbody banking analyst John Cronin was quoted by Reuters as saying it looked less likely the bank would be able to retain its independence, predicting that it could be sold by the end of 2020.

Metro had originally been looking to raise £250 million of debt to meet a regulatory deadline of January 1 to cover MREL - the minimum requirement for own funds and eligible liabilities.

MREL ensures that investors and shareholders – and not the taxpayer – absorb losses when a firm fails. MREL is the minimum amount of equity and subordinated debt a firm must maintain to support an effective resolution and is separate to Bank of England capital requirements.

Attention will now turn to the company's third-quarter results, which are due to be published on October 23. Interim results in July laid bare the fall-out from Metro's difficulties following January’s discovery of a major accounting error where some commercial loans on its balance sheet were wrongly classified in risk terms.

Statutory profits slid to £3.4 million from £20.8 million a year ago, with costs relating to the need for new processes and controls one factor. It said at the time that £2 billion of deposits were withdrawn over the first six months of the year, but that the tide had turned in the subsequent eight weeks after net deposit inflows of over £700 million.

Metro's customer account growth remained robust at 190,000 in the half year, with a 23% rise in personal accounts and 19% for business. However, there's concern about the impact of an ultra-competitive mortgage market on Metro's net interest margin, which declined to 1.62% from 1.85% a year earlier and had further weakened on a quarter-on-quarter basis.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.