Why India could be the next superstar in your portfolio

28th July 2023 09:00

by Theodora Lee Joseph from Finimize

Emerging market stocks have been quietly lighting up all year, and there’s one market that’s been shining the brightest: India. The way I see it, there are eight reasons why India could be the decade’s next superstar – one you’ll need in your portfolio.

India is rising: it’s now the world’s most populous nation and its economy is expected to be the third-biggest by the end of this decade.

Supply chain diversification trends and key reforms are two of many reasons why India could be the next superstar.

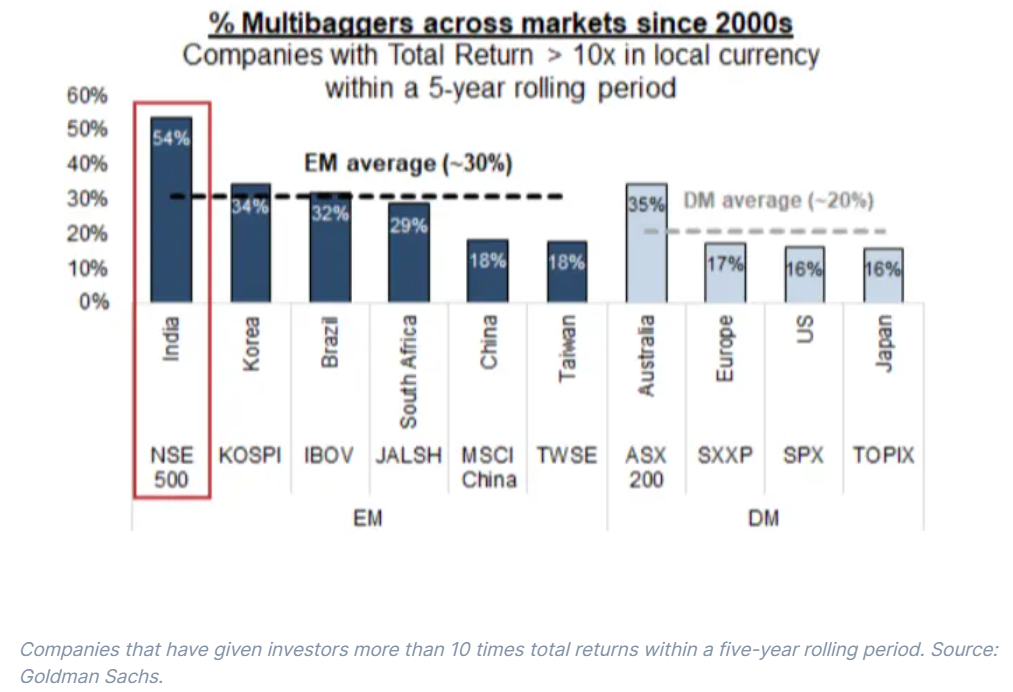

More than half of the Indian stock market consists of small- and mid-cap stocks, making it an excellent place to fish for potential multibaggers.

Emerging market stocks have been quietly lighting up all year, and there’s one market that’s been shining the brightest: India. Its stock market has been positively beaming, with key indexes hitting new all-time highs this year and showing little signs of burning out. And the way I see it, there are eight reasons why India could be the decade’s next superstar – one you’ll need in your portfolio.

1. It’s the world’s most populous nation.

If you thought China was big, well, this is bigger. India is home to over 1.4 billion people, nearly a fifth of the world’s population, living on only 2.4% of the world’s land mass. That sheer number of people offers home-grown local Indian businesses – and foreign ones – a vast consumer opportunity. What’s more, the population has a younger demographic, compared to China, and is still growing, and it boasts a significant English-speaking segment. That makes it a very attractive place for foreign companies that are seeking to build and hire in South Asia.

2. Its economy is expected to be the third biggest by 2030.

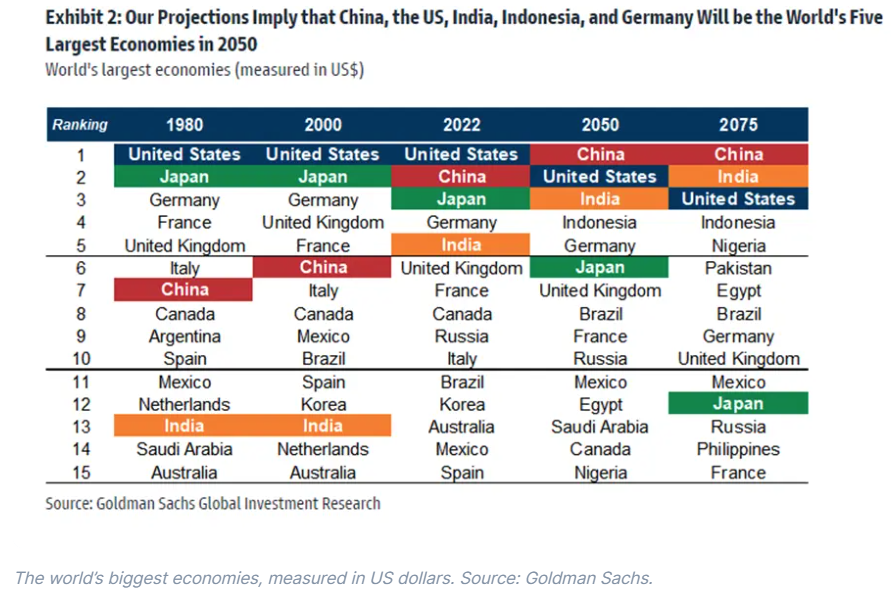

Sure, a huge population isn’t helpful if it doesn’t translate into economic growth. But analysts at Goldman Sachs project that at its current run rate, India will overtake Germany and Japan to become the third-biggest economy by the end of this decade, and overtake the US to be the second-biggest by 2075. The investment bank also sees scope for India to achieve the world’s biggest global market cap share increase, rising to about 8% by 2050 – essentially triple its current levels of about 2.5%. To place this in context, China’s market share was 10% in 2022 and is expected to grow to just 15% by 2050.

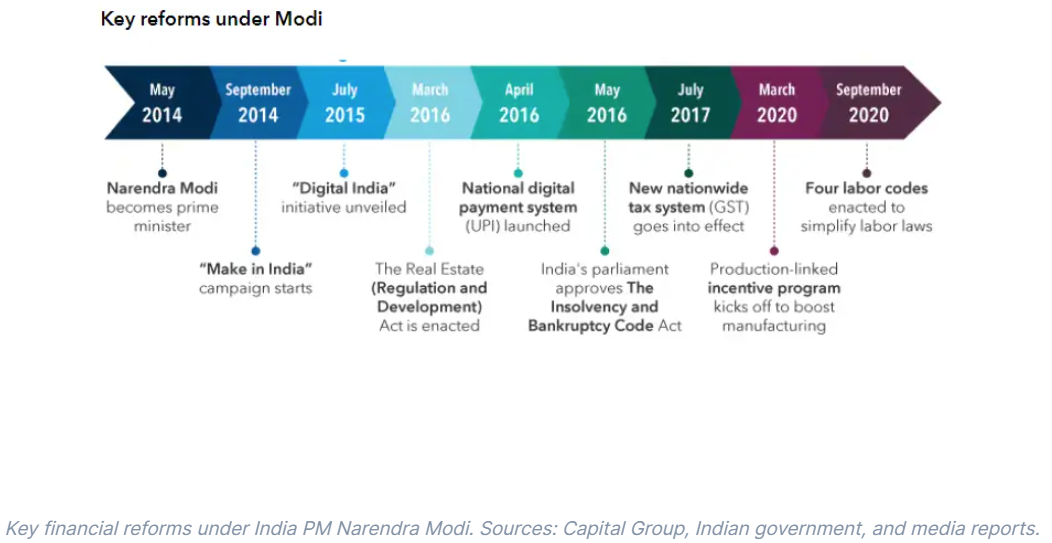

3. It’s made a lot of pro-growth reforms.

India’s been full-on competing to attract business investment. Here are some of the changes its government has introduced:

- a unified payments interface: a system for instantly moving money that has revolutionized how people pay for things,

- a goods and services tax (GST) that unifies India’s 36 states and union territories into one common market, enabling regional businesses to flourish into national players, and

- the Aadhaar, a biometric identification system (similar to the social security number in the US), that has helped make it easier for people to access subsidies and pension payments.

4. Its growth is everywhere.

India’s economic growth is being driven by three main engines: population expansion, the per-capita wealth increase of its middle class, and foreign investment. And it’s impacting a wide range of industries – like real estate, building materials, commodities, banking, industrials, and technology. When growth is plentiful, it’s much harder to go wrong when picking stocks. After all, a rising tide lifts all boats.

5. It’s on the cusp of an urbanization-led infrastructure boom.

Sure, India is still relatively rural (with 33% of it urbanized, compared to 65% in China), but its cities are growing quickly. So the government is embarking on a $1.4 trillion infrastructure investment project to shore up its roads, railways, airports, and shipping and seaport facilities. That kind of development has a multiplier effect on growth: studies estimate that for every rupee spent on infrastructure, there’s a 2.5 to 3.5 rupee gain for the economy.

6. Supply chains are slowly migrating from China to India.

The gradual decoupling of the US and Europe from China means that companies are having to find new manufacturing hubs. Only India has a labor force and an internal market that’s comparable in size to China’s (and it certainly helps that the majority of India’s population speaks English). Case in point: Apple is shifting production facilities from China into India, and JPMorgan estimates that a quarter of all Apple iPhones will be made in India by 2025.

7. It’s the best place to find multibagger investments.

Stock-picking has never been more interesting than it is in India right now. According to Goldman Sachs, the country’s stocks delivered the best compound annual returns in Asia over the past two decades, and significantly more than the broader emerging market or world indexes. So if you’re looking to pick stocks that can appreciate by 10x or more, Indian stocks are worth a look. Goldman’s study showed that within a five-year rolling period since 2000, more than half of the stocks trading on the Nifty 500 Indian index generated over 10x returns – way better than in China, the US, or Europe.

8. Innovation is high.

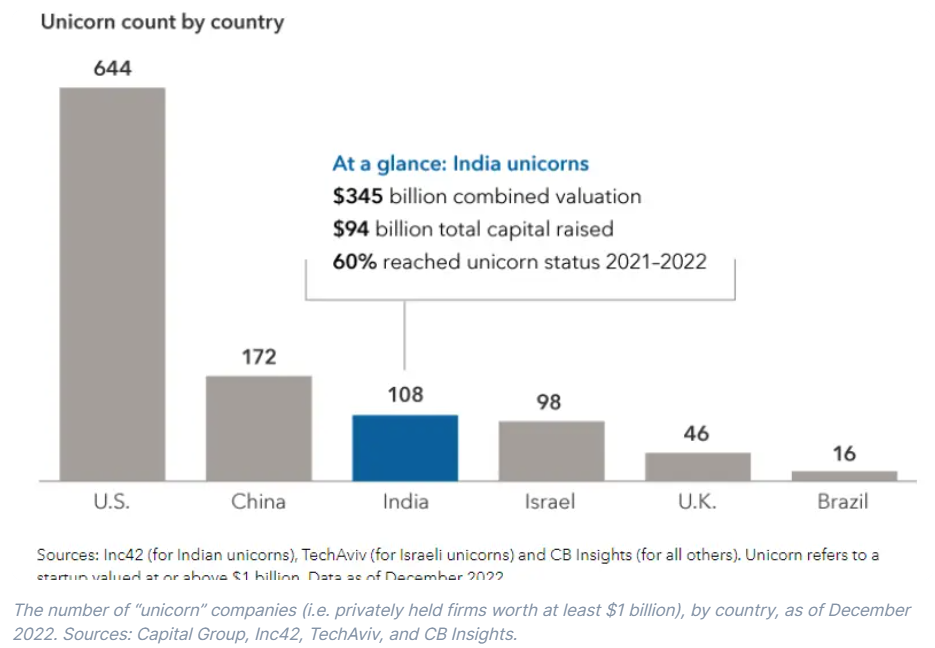

India now has the third-biggest startup ecosystem in the world, after the US and China, and had 108 “unicorns” (privately held tech companies worth at least $1 billion) as of December 2022.

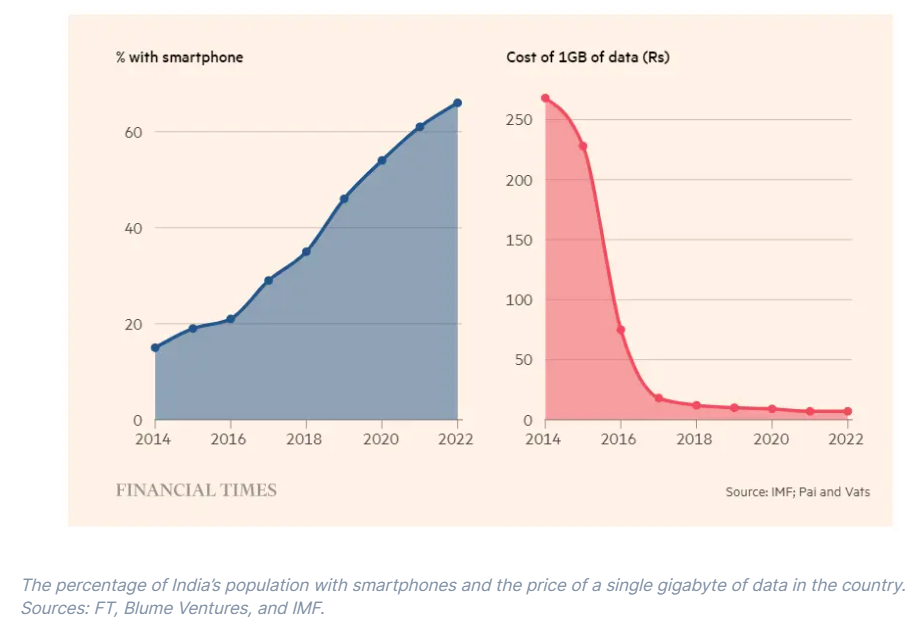

E-commerce and fintech companies make up the bulk of India’s newly minted unicorns, and that’s no surprise: India is well on its way to digitizing its economy with aims to bring the majority of its population across its rural towns “online”.

But isn’t India too pricey now?

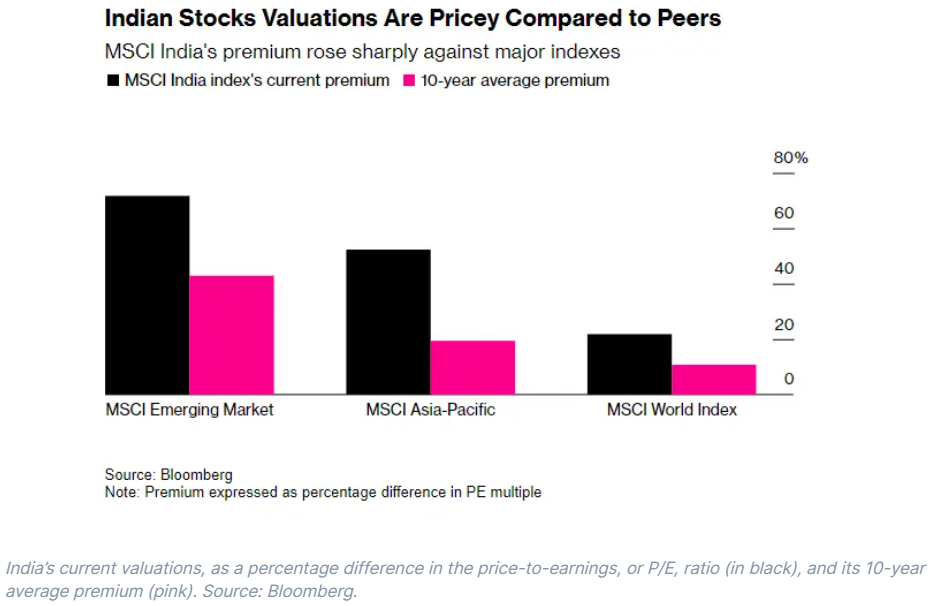

Valuations are important, but they also reflect a company or a market’s earnings potential.

The chart below shows the MSCI India’s price-to-earnings (P/E) current and 10-year average premium relative to a few benchmarks. In all three cases, the MSCI India index’s current premium has expanded a lot more compared to its peers. That said, it’s worth noting that the historical premium has always existed, reflecting India’s growth potential and relatively better economic performance. This premium expansion can continue if India continues charging ahead with its reforms. In fact, you could even argue that this premium expansion is justified and that Indian companies can grow into these valuations. After all, compared to a decade ago, India’s fundamental outlook is a lot better: inflation is under control, economic growth is strong, the government has been fiscally responsible, and corruption is lower.

So, how do you invest in India?

That can be tricky: for foreigners, there isn’t an easy way to directly invest in India-listed stocks. But ETFs or funds that have exposure to the Indian market do offer a way in. You could consider investing in a broad market index ETF like the iShares MSCI India ETF USD Acc GBP (LSE:IIND), which tracks more than 100 small- and mid-cap stocks, which is what most of the index consists of. You might also consider the Xtrackers Nifty 50 Swap ETF 1C GBP (LSE:XNIF), which tracks the country’s 50 biggest stocks.

For more sector or theme-related exposure, have a look at the Columbia India Consumer ETF (INCO; 0.75%), the VanEck Digital India ETF (DGIN; 0.71%), the VanEck India Growth Leaders ETF (GLIN; 0.77%) or the PineBridge Global Funds – India Equity Fund Y3.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.