Why Google shares are such a strong buy

Google parent company Alphabet has taken a pasting, and our columnist thinks he's spotted a bargain.

8th May 2019 11:10

by Rodney Hobson from interactive investor

Google parent company Alphabet has taken a pasting recently, and our columnist thinks he's spotted a bargain.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

You don't normally need a microscope to conduct a search using Google, but investors needed to scan carefully through first quarter results from parent company Alphabet (NASDAQ:GOOGL)). It was a bit of a mixed bag.

Apart from the Internet search operation, Alphabet has diversified into Youtube video sharing, the Gmail email service, the Android mobile operating system, a voice activated service Google Assistant and a range of computers. It also has a venture capital division and provides broadband and Internet connections in some parts of the US. It even has a subsidiary developing driverless cars.

Advertising revenue, including the Youtube video site, rose by 15.4% from $26.6 billion in the previous first quarter to $30.7 billion and other revenue increased 25.6% from $4.3 billion to $5.4 billion.

The overall gain of 16.8% looks pretty good. Unfortunately, analysts were expecting 20%, so the shares immediately fell 7.5% back below $1,200. It was a timely warning that tech shares in particular can run ahead of themselves and then suffer a subsequent sharp correction, especially when there is no dividend underpinning them.

For the record, the fall wiped $68.2 billion off Alphabet's market capitalisation, the biggest drop ever recorded in one day.

Analysts were also concerned about a fall in paid-for clicks on advertising links compared with the final quarter of 2018, overlooking the 39% growth over the past 12 months and the 5% extra per click that advertisers were charged.

The share price fall seems unfair, since profit is more important than revenue, and the group's operating profit rose by 11.4% to $9.3 billion, which was better than expected.

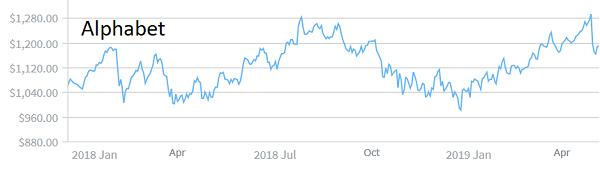

Source: interactive investor Past performance is not guide to future performance

Certainly, shareholders who got in at the float in 2004 and held on have done well. The shares were initially priced at $85 and one free share was subsequently issued for each share already held. They have baulked at $1,290 twice in the past 12 months and now stand at just under $1,200, so $85 invested at the float is currently worth about 28 times as much.

There is no reason why the rise should not resume. Google is far away the search engine of choice for most people despite the stranglehold that Microsoft has over basic computer programmes for ordinary users. The fact that most people refer to "Googling" for information on the Internet whatever search engine they are actually using is far more valuable than any amount of paid-for advertising.

Although Alphabet is a global giant, it will be helped by the continued good economic news coming from its home base. US economic growth picked up in the first quarter and the country is the best performer among developed nations, with unemployment at a 49 year low of 3.6%.

World economic uncertainties, not least US President Trump's determination to antagonise trading friends and foes alike, are a potential worry but Alphabet is riding the waves in style.

Like Trump, though, Google seems determined to upset people in power. It is under pressure from regulators to exercise greater control over the content it gives access to and the placing of offensive advertisements. Google and other Internet operations can no longer wash their hands of what others post online.

It has been fined €1.5 billion for anti-competitive practices by the European Commission and gives the impression that it regards such fines as part of the cost of doing business. Google has nothing to fear from addressing this issue – its market dominance is assured.

Hobson's choice: This is strictly a share for those looking for steady capital gains, as Alphabet does not pay a dividend and there is no sign that is will do so any time soon. If that doesn't bother you, the shares are a 'strong buy' while they remain under $1,200. Time to snap them up at this comparatively cheap level may be short.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.