Why bonds are at a major turning point, according to veteran investors

28th June 2022 09:12

by Sam Benstead from interactive investor

Bond fund managers with more than 30 years of experience tell Sam Benstead what comes next as inflation and interest rates rise.

After a four-decade long bull run for bonds, where falling interest rates fuelled higher prices, investing in the sector could be about to get a lot more challenging.

Inflation in Britain is at levels not seen since the 1980s, and interest rates are forecast to continue rising sharply to cool the economy, even after the Bank of England has increased the cost of money from 0.1% to 1.25% in just six months.

Rising rates, against the backdrop of a slowing economy and high inflation, is negative for the bond outlook.

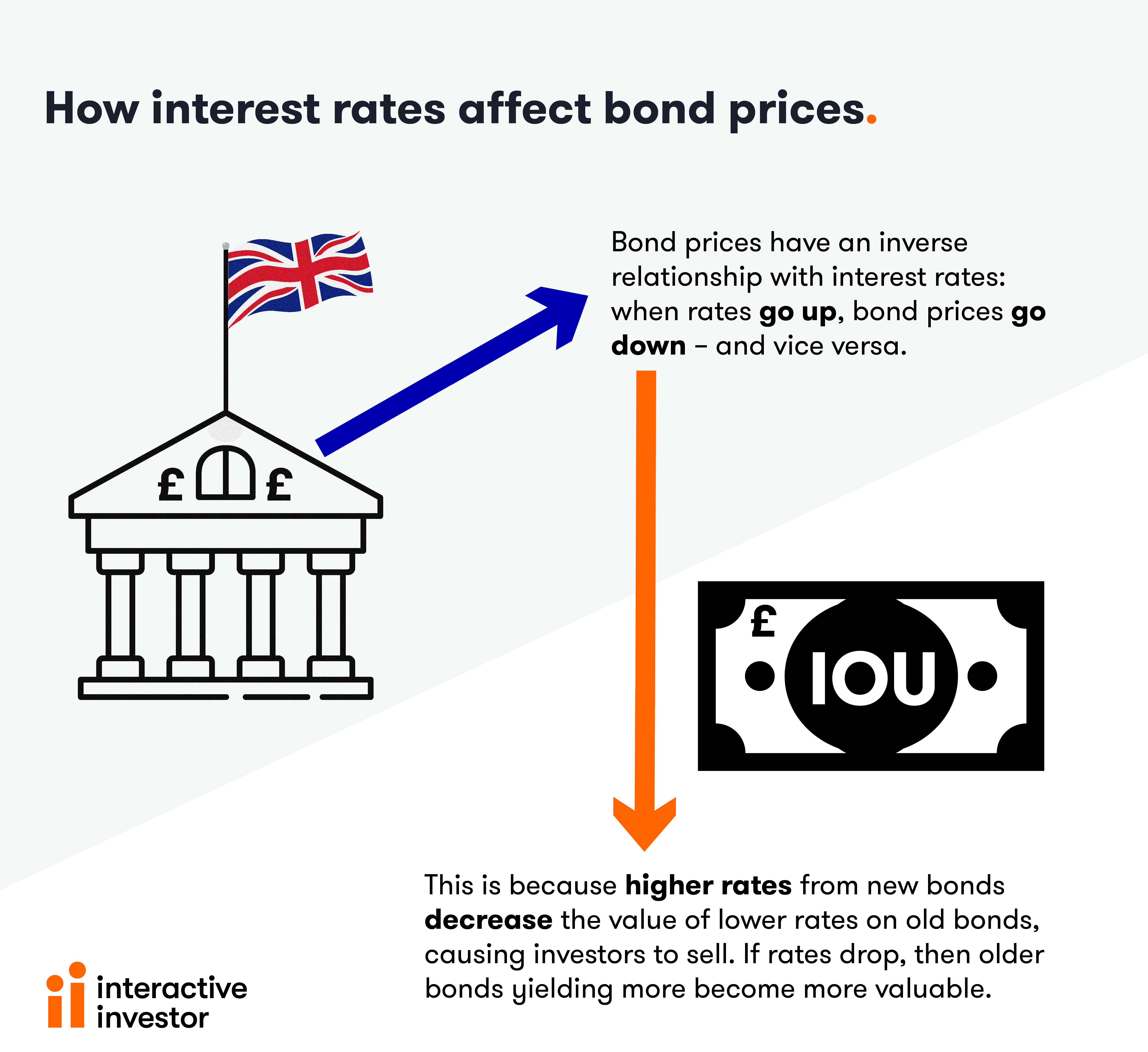

Investors sell bonds (also called fixed income) when interest rates go up because they can get a better deal by buying newly issued debt. Inflation erodes the value of a fixed coupon, making returns less appealing, while economic problems increase the risk that companies default on their debt.

- Why bonds are back after a record-breaking sell-off

- Recessions are becoming more likely – here’s how to invest

- How Terry Smith is investing as markets crash

The dire outlook has prompted investors to dump bonds. Investment manager Schroders calculated that the recent peak to trough sell-off in global bonds, a 17.6% fall from January 2021 to mid-May 2022, has been the biggest drop since data began in 1990. In contrast, bonds only fell 10.8% during the 2008 financial crisis.

After such a long bond market bull run, fixed-income veterans are best placed to evaluate what the future holds and how to navigate what could become the most pivotal moment for bonds since the 1980s. We asked them what the future holds for a market that could be about to be turned upside down.

‘A unique moment in my career’

Stephen Snowden, head of fixed income at investment manager Artemis, who has been investing in bonds for more than 30 years, said he had never seen market conditions like this.

“This is a unique point in my career, where we are going from low to high inflation. Most investors will not have experience in such a market.”

On top of that, Snowden said that a lot of investors had never worked during periods when there was not quantitative easing (QE), where governments began buying financial assets to support markets in the aftermath of the 2008 financial crisis.

He believes there is a lot more volatility to come as QE ends and interest rates rise. He said: “Market volatility since QE has been lower, so it is logical to expect volatility to be higher in the future. Markets will overreact to good and bad news. Now central banks are unlikely to step in to calm them, which will cause more volatility.”

Therefore, Snowden argues that active fund managers have never been more important. “The era of QE floated all boats. You could have bought anything and it would have gone up, which helped passive bond funds perform very well. This period is now over and bond picking will be key as prices will lurch more. So there are more opportunities for active managers,” he said.

Graeme Anderson, one of the founding partners of bond specialist TwentyFour, said that markets are now unlike any other period.

The investor, who has more than 35 years’ experience, says that three decades of benign inflation and falling interest rates means that central banks have to play catch up and have lost control of inflation.

“This period started in mid-1980s. From the 1990s, there were continual reductions in interest rates which led to many decades of untypical market conditions.

“The next period will see the return of the economic cycle coming back, where interest rates rise and fall to balance out the economy. This environment will be good for bond managers.”

Paul Brain, investment leader of Newton Investment Management's fixed income team, also argues that things are different now.

“Long-term trends of globalisation and low inflation are fading. We are at a turning point where the future will be about disagreement, deglobalisation and division – the three Ds. There will also be more government intervention, such as through subsidies and handouts, which will create a higher base for inflation.”

Brain, who has more than 30 years of investment experience, is telling his team to look at historical patterns but not to assume things will repeat.

“Recognise you don’t know everything and it is impossible to forecast exact central bank moves. It is better to sit on the fence and wait, adding money steadily to bonds you like without trying to call the top or bottom of the market,” he said.

Jim Leaviss, fixed income chief investment officer at M&G Investments, also said experience was not everything, as it is rare that the future plays out the same way as in the past.

The fund manager, who started his career in the early 1990s and is manager of M&G Global Macro Bond, a member of interactive investor’s Super 60, said: “Having experience can hold you back. Experienced bond managers were caught out by falling bond yields over the past 15 years.

“We need to approach things with a fresh perspective, as the future is never like the past exactly. We only have 100 years of market data – not a long period for human history, so we can’t make accurate predictions.”

Value finally restored

After the steep bond sell-off this year, Leaviss said bonds were now delivering value again in terms of the income they produce. He remarked that this was a shift in direction after falling yields for most of his career.

“Corporate investment grade credit yields around 5% now. More than double what investors were paid a year ago. Negative yields are a thing of the past now,” he said.

Leaviss is predicting a drop off in inflation next year, so with yields up he said it was a good time to buy bonds.

He says that the long-term driver of the inflation decline is lack of trade union membership. If wages do not track inflation, then discretionary spending will fall and the economy will slow, bringing prices down with it.

“Markets are forecasting inflation to be on average 3% over the next five years. It is about the future, not today’s headlines,” said Leaviss.

Brain also said that it was a good time to be buying bonds. “US treasuries yielding almost 4% are good to buy and hold. There will come a time when markets realise that central banks have raised rates too quickly and bonds will increase in price again. Investors can now look at the bond market and say that yields are attractive, so we should see inflows into bond funds later this year,” he said.

- The US funds beating the S&P 500 over the short and long term

- US stocks enter bear market, but there’s a silver lining for funds

Anderson adds that higher bond yields now make it a better time to own the asset class.

“I was more concerned for the future of bonds when central banks had crushed yields. Now, with yields higher, it is a better place to be in bonds. Higher yields mean predictable returns are back,” he said.

Bill Gross, who ran the world’s largest bond investor PIMCO for 40 years and was once dubbed the “bond king”, argues that 4% or 5% inflation awaits markets in 2023.

He said: “If so, the Federal Reserve and other central banks may take a little pedal off the metal, stopping rates at 3% or so in America.”

In that scenario, he said higher-risk growth stocks may bounce back as investors stop pricing in higher interest rates, which devalue future profits. “This may pause the inflationary discounting of future profits that have created an avalanche in Cathie Wood’s and millions of others’ portfolios,” he said.

However, he notes that this is not a call to reinvest cash balances, but rather an observation that at some point in the next few months the carnage may stop for tech stocks.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.