Which taxes pose the greatest threat to your wealth?

As the UK tax burden hurtles past its highest level in eight decades, Craig Rickman examines six taxes that can thwart your ability to grow and preserve your money.

16th October 2023 10:47

by Craig Rickman from interactive investor

Tax is one the biggest obstacles between you and your financial goals. The more tax you pay on your income, savings, and investments, the harder your money must work.

In case you hadn’t noticed it on your payslip or when filing your tax return, we’re all paying a bit more tax than we used to.

According to the Institute for Fiscal Studies, the UK government is currently raising more in tax revenue, as a percentage of national income, than at any time since the 1940s. And this theme is set to continue over the next few years.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The UK tax system can impact your finances in various ways. Sometimes the effects are mild, other times more pernicious. HMRC can grab a slice of what you earn, what you buy, what you sell, and what you leave to others when you pass away.

When it comes to growing and preserving your wealth, there are six taxes that can stand in your way: income tax, capital gains tax (CGT), inheritance tax (IHT), National Insurance (NI), corporation tax, and stamp duty.

But which of these poses the greatest threat to your financial future?

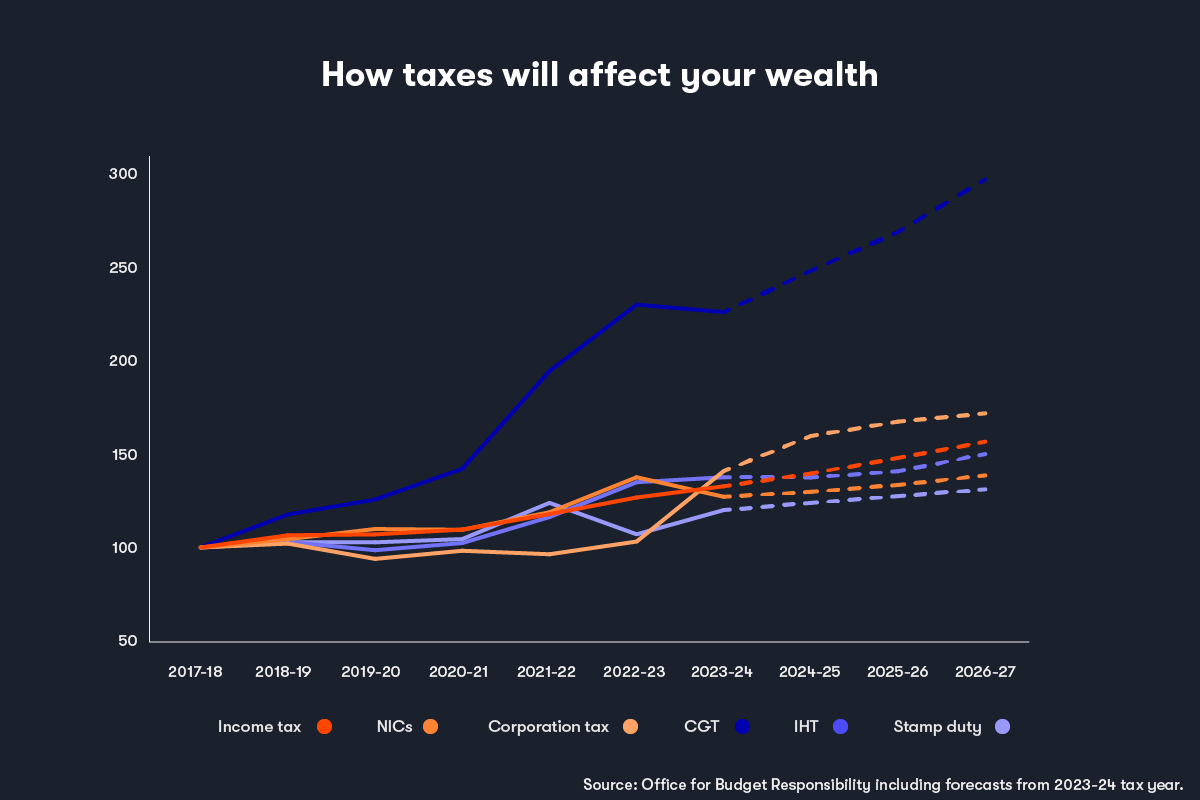

Let’s examine the trajectory of UK tax payments since 2017 and forecast their expected path until 2027, to learn a bit more about what’s going on.

Tax payments on the march

To work out which taxes might cause you the biggest problems, first we must create a fair comparison. Rather than analysing the total annual receipts for each tax, I’ve rebased all six at 100, and calculated their previous and expected future payments from 2017 to 2027.

The first thing to say is that receipts of all six taxes are predicted to rise between now and 2026-27, but that’s not necessarily a bad thing. Tax payments should nudge up every year in-line with price rises. However, as the graph shows, some are outpacing inflation, and by a wide margin.

The one that sticks out like a sore thumb is capital gains tax, or CGT, with annual payments predicted to triple in the 10 years to 2026-27.

This is despite CGT rates being more favourable than most other taxes. The top rate of CGT when you sell investments is 20%, around half the top rates of income tax (45%), dividend tax (39.35%), and IHT (40%).

But perhaps the most painful aspect is that you only trigger CGT once you sell something; it’s not deducted every year. You could see a fifth wiped off your total investment gains in one hit.

Why are CGT bills rising so sharply?

One reason for the sharp rise in CGT payments is unrelated to investments. A combination of higher taxes and spiralling mortgage costs is forcing many buy-to-let landlords to consider selling up. What’s more, you pay an 8% premium on residential property sales, vaulting the top rate of CGT to 28%.

Another reason is that tax-free allowances are becoming stingier, which is hurting investors. The annual CGT exemption – the total profit you can realise every year without paying CGT – was chopped from £12,300 to £6,000 this year and will halve again to £3,000 in April 2024.

The CGT allowance has long been a useful tool for tax-saving strategies such as Bed & ISA - where you sell shares within your allowance and repurchase them in a tax wrapper. But the shrinking allowance is narrowing the scope for this approach, hitting investments held outside tax wrappers.

What about other taxes?

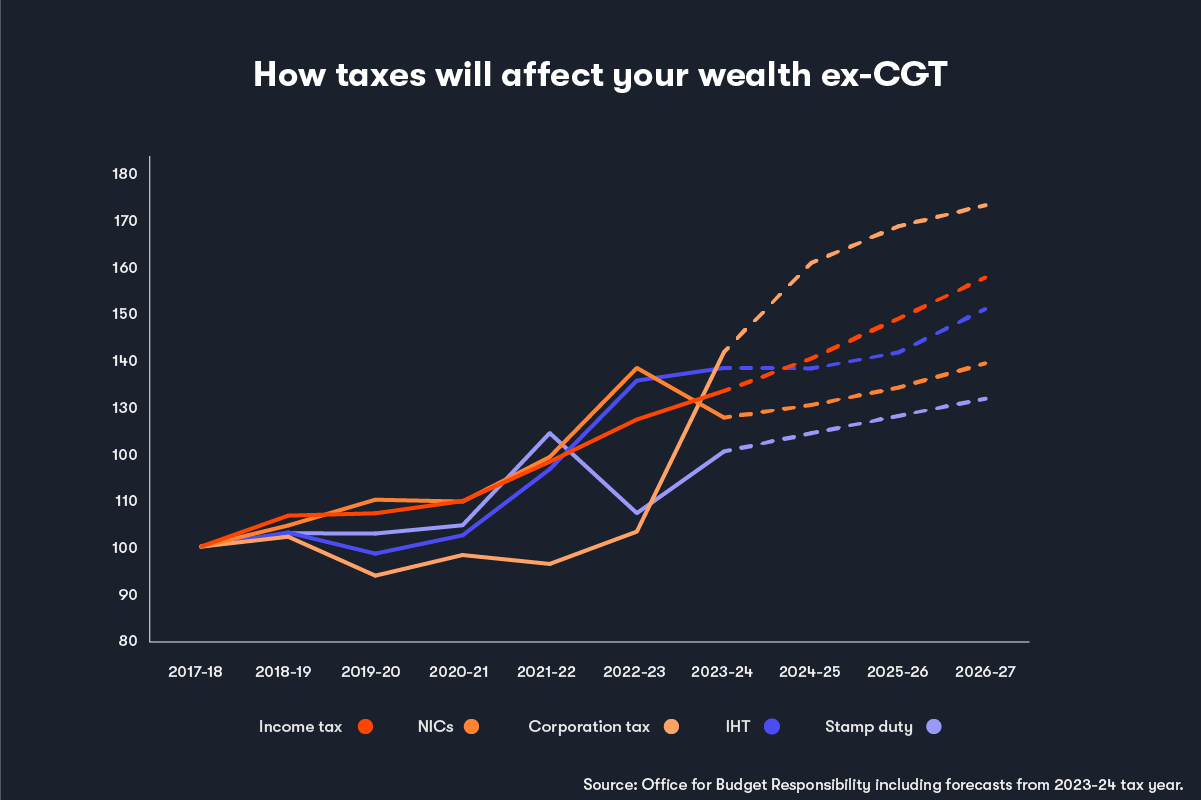

To give you a clearer idea of the potential threat of other taxes, let’s remove CGT from the equation.

I appreciate the inclusion of corporation tax when analysing personal wealth may seem rather odd. The tax affects businesses rather than individuals, right?

Well, not quite. Of the roughly two million corporate businesses, some 46% are single-employee limited companies.

- Self-employed? Here’s the best way to save for your retirement

- How SIPPs can beat the corporation tax raid

Owners of these firms are effectively freelancers using the limited company structure, mainly for the tax advantages. But with the top rate of corporation tax being jacked up from 19% to 25% in April, annual receipts are expected to jump an eye-watering 67% between now and 2026-27.

The table below shows how much government tax receipts are expected to rise over the next four years.

Increase 2022-23 to 2026-27 (%) | £bn | |

Corporation tax | 67.4 | 36.3 |

CGT | 29.4 | 5.3 |

Income tax | 23.8 | 54.7 |

Stamp duty | 22.8 | 0.9 |

IHT | 11.3 | 0.8 |

NICs | 0.8 | 1.4 |

Source: Office for Budget Responsibility

The result is that freelancers and contractors could see HMRC grab more of their profits over the next few years, leaving less scope to extract these profits and build personal wealth.

The scourge of fiscal drag

The threat of income tax on wealth creation is hard to ignore. We are taxed on our wages, some business profits, property income, pensions, dividends, and savings interest.

And income tax is the government’s biggest source of tax revenue. The Office for Budget Responsibility (OBR) estimates the tax will raise £268 billion in 2023-24; 25.3% of all receipts, equivalent to around £9,400 per household. And by 2026-27 annual payments are predicted to surge past the £300 billion mark.

The main culprit here is something called fiscal drag, also known as the stealth tax.

With income tax bands frozen until 2028, more people will unknowingly tip into higher tax brackets over the coming years. Estimates suggest 7.8 million people will pay income tax at 40% or above by 2027-28, a four-fold increase since the early 1990s, underlining the effectiveness of fiscal drag as a tax grabbing measure.

The decision to reduce the 45% income tax threshold from £150,000 to £125,140 will also boost the government’s coffers.

Elsewhere,given IHT gets such a bad rap, you might expect it to rank higher both in terms of expected increases and volume. But the government only pockets around £7 billion a year in IHT - a measly 0.2% of GDP - and payments are only expected to uptick 11% between 2023-24 and 2026-27.

Still, you shouldn’t overlook the threat of IHT, especially with a top rate of 40%. As with income tax, fiscal drag presents a problem.

The tax-free threshold has been frozen at £325,000 since 2009 and will remain at this level until 2028 (although we might see some reform at this year’s Autumn Statement) resulting in more estates being hit with bigger tax bills.

While only one in 20 estates pay IHT, those that do can be hit hard. And even though IHT is arguably not a problem for you – it’s your heirs who pay it – given the average payment is more than £200,000 it can take a sizeable chunk from your legacy.

Don’t forget about NI

National Insurance isn’t labelled as a tax, but it most certainly is one. However, it’s not a concern for everyone.

You pay NI on income you earn or self-employed profits but stop paying it when you hit state pension age, even if you continue in paid work.

You may notice a kink in the chart during the 2022-23 tax year when receipts spiked. That’s because NI upticked 1.25 percentage points in April 2022, although the hike was reversed in November the same year.

The quiet threat of stamp duty

Most people are aware that you pay stamp duty when you buy a home, but it also applies to many share purchases. The graph solely focuses on receipts for the latter.

Of the six taxes I’ve examined, stamp duty has the smallest impact on your wealth, both in terms of volume and trajectory. Annual stamp taxes on shares are set to rise from £3.5 billion to £4.6 billion between 2017 and 2027.

That said, if share trading is your thing, it’s something you must be aware of.

In most cases when you buy UK shares you pay 0.5% on the value of the trade. You don’t pay the tax on international shares, funds, or exchange-traded funds (ETFs). You do, however, pay stamp duty when you buy shares in investment trusts.

How to protect your wealth from the taxman

As everyone’s financial situation is unique, some taxes will be a bigger problem for you than others. The key is to recognise what these are and take steps to reduce their impact.

Here’s a quick round-up of a few things that you can do to protect your wealth.

Income tax

Simply put, tax wrappers such as pensions and ISAs are your friend here. When you pay into a pension you get tax relief at your marginal rate, which could save you up to 45%. And both ISAs and pensions shelter any interest and dividends from HMRC.

Your annual ISA allowance is £20,000 and you can pay up to £60,000 into your pension every year and get tax relief. Consider using these tax wrappers if you can.

Capital gains tax

As above – you pay no CGT on gains made within an ISA and or a pension. Other tips include using your annual CGT allowance every year, offsetting losses against gains, and switching investments (after you’ve used your annual CGT allowance) to the spouse in lowest tax bracket before selling shares.

National Insurance

National Insurance contributions, or NICs, can be tricky to avoid but one way is to use salary sacrifice. This is where you exchange a portion of your salary for a pension payment. As your salary is lower, you pay less NICs, and so does your employer.

If you’re a limited company owner/director, paying profits straight into a pension rather than taking it as salary can save you both employer and employee NICs.

Inheritance tax

IHT is arguably the easiest tax to avoid, but it won’t happen by accident. Making tax-free gifts (in some cases you may have to survive seven years), using trusts, and leaving money to charities are all effective ways to swerve the tax. Investing in qualifying AIM shares is another option, provided you can stomach the sharp ups and downs.

Corporation tax

Pensions are a great way to thin your limited company’s corporation tax bill and supercharge your retirement savings at the same time. Pension payments made by the company are deemed an allowable business expense, and so reduce your company’s taxable profits.

Stamp duty

As noted above, buying international shares is one way to avoid stamp duty, as is investing in funds and ETFs. But avoiding stamp duty shouldn’t be your chief aim when choosing investments and is unlikely to act as a deterrent when it comes to picking stocks.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.