Which general election winner will be best for UK stocks?

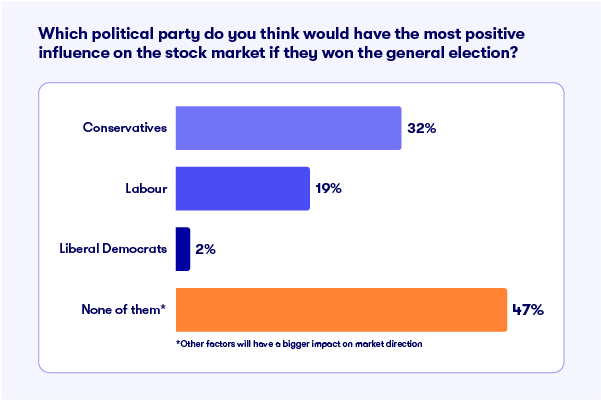

We asked you which political party you think will have the most positive influence on the stock market if they won the general election on 4 July. Here’s what you said.

3rd July 2024 11:33

by Lee Wild from interactive investor

We write a lot about the things that influence stock market behaviour - company results, corporate announcements, takeovers, the economy, data and global events. Whichever political party is in charge can have an impact too – we saw that with Liz Truss’s disastrous mini-budget in 2022 – but ahead of the general election on Thursday, we wanted to know what you think about politics and its ability to move markets.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Labour is often accused by the Right of fiscal mismanagement during administrations over the decades. Conservatives are blamed by the Left for economic errors – again, Truss gets a mention, but opponents also point to high levels of borrowing, inflation and the cost-of-living crisis.

This is not the place for political debate; what we want to understand is how you think political parties can affect financial markets. So, we asked which one you thought would have the most positive influence on the stock market if they won the general election.

- Do British prime ministers influence economic growth?

- Election countdown: what’s the deal with personal taxes, really?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Almost a third (32%) of the 1,479 people who responded to our poll thought that of the three main parties, markets would react best to a Conservative win. Labour was second at 19% and the Liberal Democrats third with just 2%.

Perhaps its Chancellor Jeremy Hunt’s promise of more tax cuts and plans for the economy that might give the market confidence in five more years of Tory rule. And maybe Labour’s “safe” manifesto lacks a spark to trigger a stock market rally. But neither manifesto contained any radical policy shifts, and both leaders promised not to raise income tax and VAT. Each also plans to help people on to the property ladder.

- Election manifestos 2024: the impact on your personal finances

- How to invest ahead of the general election

While the fiscal outlook might not change much whoever wins on Thursday, it’s argued that Labour’s wish for better relations with the EU could boost Britain’s growth prospects. Analysts at M&G think it could “help to unwind some of the Brexit discount and could be of particular interest to global investors”. It might take a while, but EU realignment and any subsequent benefits could come quicker if Labour does secure the significant majority currently being predicted.

However, almost half of you (47%) think it doesn’t matter who gets the keys to Number 10 - other factors will have a bigger impact on market direction. Individual leaders and parties decide policy that impacts the economy, true, but so many other events push and pull stock prices, that this influence is often short term in nature.

Often politicians find themselves passengers during periods of market volatility rather than a pilot able to control direction.

We’ll find out what the big institutions and other influential market participants, both here and abroad, think when the result is likely confirmed on Friday morning.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.