What you need to know about investing in commodities

8th June 2022 12:44

by Alice Guy from interactive investor

Alice Guy takes a look at how to invest in commodities. She explains why commodity prices are rising and examines if investing in commodities is a low-risk option for investors.

Commodities, often seen as a safe-haven investment, are enjoying their moment in the sun this year. Many have enjoyed eye-watering price increases and, in some cases, that strong growth looks set to continue.

Those recent healthy returns are in sharp contrast to stock market performance. It’s not surprising that many investors are considering commodities as a potentially attractive alternative investment.

Here we take a detailed look at commodity investment, explain what you need to know and examine why extreme volatility suggests they may not be a safe option.

What are commodities?

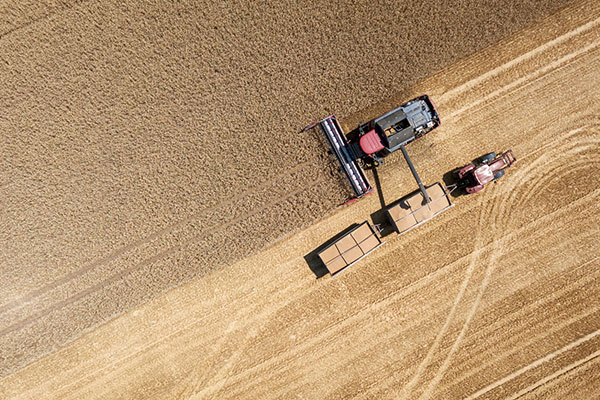

Commodities are the basic stuff of life: raw products that can be bought and sold around the world, often in bulk. They include things like oil, gold, wheat and coffee and even bananas!

There are three main types of commodities: energy, metals and agriculture and food. Energy commodities include everything from oil, gas and diesel to heating oil for rural homes.

- How to play and profit from the commodities boom

- Fund ideas for 2022: technology, healthcare and commodities

Metal commodities are made up of precious metals like gold and silver and, now hugely expensive, palladium and platinum. They also include base metals, used for hundreds of different industrial processes like copper, aluminium, nickel and zinc.

Food and agriculture commodities consist of all sorts of every-day foodstuffs from soya beans and wheat to live cattle. And they also include chemicals used for agriculture and non-food products like cotton and lumber.

How are commodities traded?

Commodities are traded across the world in specialist commodities exchanges like the London Metals Exchange.

Commodities have a set rate on the trading exchange which fluctuates moment by moment and day by day. Traders buy and sell commodity futures: future contracts where traders agree to buy or sell that commodity at an agreed price. At the end of the contract, traders take out an opposite position, selling or buying the commodity, and make a profit or loss on the difference in price.

Why are commodities prices rising?

Prices for many commodities have risen sharply during the early part of 2022. Wheat prices have climbed 45% since the beginning of the year, Brent crude prices are up 51% and gas prices have risen an eye-popping 144%.

But it’s a mixed picture, and some commodities have also seen extreme price volatility. Nickel prices rose a staggering 132% between January and March, only to drop back: in total nickel prices are up a slightly more sensible 42% since the beginning of the year. Likewise, palladium prices skyrocketed, climbing 66% between January and March, only to drop back sharply.

Increasing commodity prices are partly due to the Ukraine conflict, which began at the end of February. Russia is rich in natural resources and is the world’s leading exporter of gas and wheat and the second largest exporter of oil. And Russia also exports vast quantities of precious and base metals, particularly gold, platinum and nickel.

- Watch our video: Russia, Ukraine and the mining sector

- Don’t be shy, ask ii…what’s the difference between Shell A and B shares?

But there are also other factors fuelling commodity prices. The end of the Covid-19 lockdowns led to booming demand for many commodities, particularly in China. And other smaller factors have also contributed to pressure on prices, like increased demand for petrol and electric vehicles and a cold winter in 2020 reducing energy stores.

Like wider consumer inflation, commodity price increases can also have a domino effect. For example, soaring energy costs make it expensive for farmers to harvest, store and transport food, resulting in increased wheat prices.

Will commodities continue to rise?

Some commodity prices look set to continue to rise, or at least maintain their existing inflated costs for the foreseeable future. The Ukraine conflict shows no sign of letting up and demand for wheat, metals and energy is likely to remain strong.

In the case of wheat prices, India’s recent decision to halt wheat exports to guarantee food security could further worsen supply issues.

Are commodities high risk?

Although generally considered lower risk than stocks, some commodities have seen extreme price volatility since the beginning of the year. Anyone who invested £10,000 in nickel in January would now have £14,179. But wait until the March peak to invest, and they would have seen their initial £10,000 investment shrink to £6,091.

In the current market, it’s clear that investing in commodities is an adventurous choice. They could add some spice and excitement to your investing journey, but possibly also some heart-stopping moments.

- Watch our video: North Sea oil and gas: the UK shares to own

- Forecasts of a golden future for miners

- Watch our video: Inflation, dividends and a new commodities supercycle

However, depending on your existing portfolio, although not low risk, commodities could reduce the overall volatility of your investment pot. That’s because they will add that crucial element of diversification and often have a different investment cycle to the stock market.

Does investing in commodities hedge against inflation?

Commodities are traditionally thought of as a hedge against inflation. That’s because some commodities, particularly gold, aren’t heavily correlated to inflation in the general economy.

And commodities may also insulate investors from stock market volatility as commodity prices have a different growth cycle to stocks and can often move in opposite directions.

However, this insulating affect is not consistent. Research from Morningstar found that commodities, “may not diversify stock market returns when investors need it most” and that, “in 2008 the S&P GSCI [commodity index] dropped 46% while the S&P 500 dropped 37%.”

Not only that, but some commodity prices, particularly those for energy-related commodities, tend to move in lockstep with general inflation. Morningstar comments that, “since 1991, energy-related commodities and broad commodity indexes, such as the S&P GSCI and Bloomberg Commodity Index, consistently exhibited the highest level of correlation with inflation of all commodities. Notably, gold did not exhibit any correlation with inflation over this period.”

How much should you invest in commodities?

For most investors, it’s a good idea to aim for a well-diversified investment portfolio and commodities can form a small part of this investment mix.

Higher risk and more volatile than traditionally thought, commodities are unlikely to form the bulk of your portfolio. It’s difficult to suggest how much to invest as the decision is dependent on your investment goals and financial situation.

And within the commodities universe, there’s a huge range of risk. Gold is a long-established option for investors and tends to be less volatile than other alternatives.

Some model portfolios contain a small element of commodity investment. For example, the ii Low-Cost Growth Portfolio, a model portfolio that offers ideas for investors, has a 5% exposure to commodities through the WisdomTree Enhanced Commodity ETF (LSE:WCOB).

How can I invest in commodities?

If you’re ready to start investing in commodities, then you have a few different options.

Physical ownership

Physically owning commodities is unrealistic for many ordinary investors as storage of many commodities is difficult.

You may be able to own some precious metals as they are relatively small and easy to store, although security and insurance is often an issue.

Commodities stocks

One of the most straightforward ways to invest in commodities is to buy stocks or shares in companies that specialise in mining, producing energy, producing agricultural products or processing metals, ready for distribution.

You’ll benefit from lower fees than purchasing shares through a fund as there won’t be any annual charges to pay. And you can also pick the companies you prefer and weed out any you want to avoid, for example, companies that operate in Russia.

However, on the flip side, you may not be particularly diversified if you only invest in a few shares. And it can be tricky to consistently pick, track and keep an eye on your share portfolio.

Commodities funds

Investment funds tend to invest in a range of underlying companies that specialise in energy, agriculture or mining.

The advantage of investing through a fund is that you’ll be more diversified than through buying individual stocks. You’ll also save time as you won’t need to pick and track individual shares and make decisions about selling underperforming investments.

- How to invest in a basket of commodities through ETFs

- ETFs for investing in the new commodity supercycle

Commodities ETFs

Exchange-traded funds (ETFs) or exchange traded commodities (ETCs) are a basket of stocks or commodities that track an underlying index.

An ETF invests in the stocks of commodities-producing businesses, whereas an ETC invests directly in commodities through buying futures or physical commodities.

For example, iShares Physical Gold ETC (LSE:IGLN) fund, one of ii’s Super 60 handpicked range of funds, aims to track the daily spot price of gold and physically invests in gold bars: they’re stored in JP Morgan Chase Bank’s vaults.

Are there any sustainable commodities options?

If you’re keen to invest in sustainable energy, there are several specialist funds you could consider.

The ii ACE 40 list includes several sustainable energy funds, where you’ll be able to invest in companies that produce energy from solar, wind, and other renewable sources.

You should bear in mind that some of these companies can be quite small, and stock prices are largely based on future predicted revenues. This means they are potentially a more volatile investment option than established FTSE 100 companies.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.