What the hype cycle can tell you about investing in AI

There’s been a cacophonous buzz around all things AI this year, and at some point, you can expect that to quiet down. Knowing where we are in the cycle can help you make smart investment decisions.

4th August 2023 10:23

by Paul Allison from Finimize

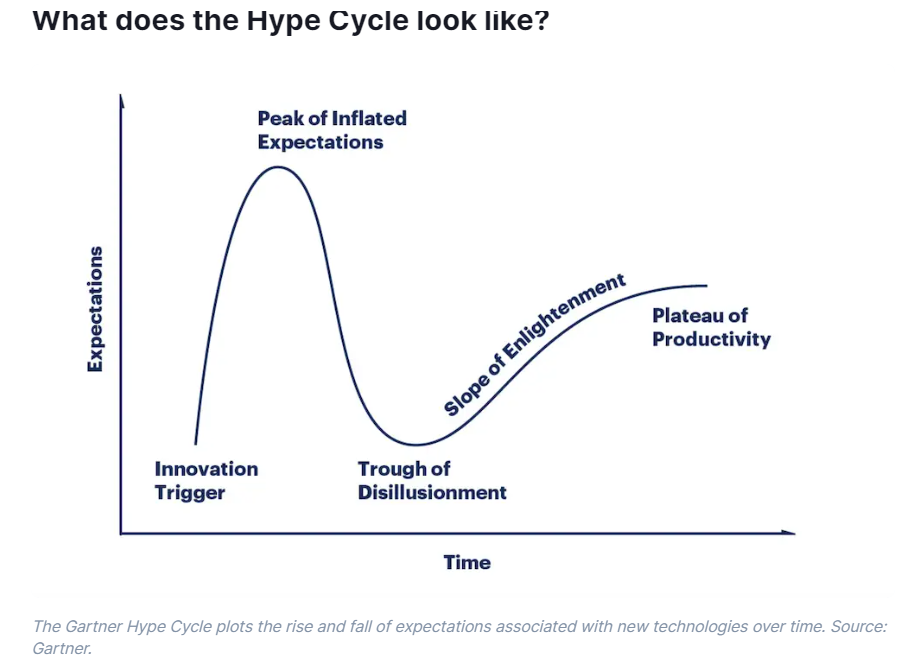

Technology adoption tends to follow a certain five-step pattern, which leading technology research firm Gartner calls “the Hype Cycle”.

AI is probably at, or close to, the second stage, the peak of inflated expectations, and it might stay here for a few years.

Tracing AI’s adoption along the same curve as the internet’s take-up offers some clues as to what might lie ahead.

There’s been a cacophonous buzz around all things AI this year, and at some point, you can expect that to quiet down. See, the excitement about any new, transformative technology comes in waves – it’s what the research firm Gartner has dubbed “the Hype Cycle”. It’s essentially a five-stage pattern – and knowing where we are in the cycle can help you make smart investment decisions.

Stage 1: The innovation trigger

At this early point in the cycle, the tech usually hasn’t been made into any sort of product yet and typically exists only within a few labs or startup firms. There might be some media chatter and a few viewpoints being thrown around, but it’s probably not grabbed the attention of the masses. For AI, this stage was a good number of years ago. The first chess-playing robot was moving pawns way back in the 1950s. But, the start of AI’s journey to becoming a commercial tool was probably the creation in 2010 of DeepMind – the British AI research lab now owned by Alphabet’s Google. By way of comparison, it’s like when Tim Berners-Lee created the world wide web in 1989: it would be years before the internet turned up in universities, and then in offices and homes, around the world.

Stage 2: The peak of inflated expectations

This is what happens after things really start cooking. By now the technology has been used to develop actual usable products, and a whole lot of investment has poured in to fund their development. The advancement has been all over the mainstream media and firms have been racing to be early adopters, in hopes of getting ahead of their competition. Some of those startup outfits will have been acquired by bigger firms and – as the name of this stage suggests – hopes will be sky-high. But, be warned: at this stage, the technology starts to run into a glitch or two.

Now, it seems to me that this is exactly where we are now with AI. I’d compare it to 1999, and the dot-com craze, when hundreds of firms were slapping “.com” at the end of their name and floating their shares on the stock market – sometimes without even having a proper product. It’s not a perfect comparison, because the generative AI technologies in use today – like ChatGPT – are very real, and pretty awesome to boot. But the cycle suggests that at this point, we’re in for a reality check. The question is: what will spark it? Perhaps it’ll be some sobering quarterly earnings from the AI leaders. Microsoft, after all, recently told investors that AI will ramp up only gradually. Not exactly music to the ears of the hyped-up mega bulls.

Stage 3: The trough of disillusionment

When expectations are so inflated, Gartner says, some backlash is inevitable, and that’s important for investors to keep in mind. Until recently, most of the negativity around AI has been confined to the end-of-the-worlders who are convinced that robots are going to destroy humanity. Now, I’m not meaning to be glib here: that’s a real threat. But because most people don’t understand how or why that might happen, the Armageddon scenario tends to be ignored. But, there is a real risk that something bad – short of a global existential calamity, hopefully – might happen. Maybe there’ll be a mini breakout where AI takes over a server or two, or perhaps even manages to close down some airspace or infect some system with a weird bug. Who knows? I’m no AI expert. The point is that investors should expect this period of major disappointment to happen, in whatever form it takes. Just think back to 2001, after the dot-com bubble burst. Believe it or not, investors were saying the internet would never catch on, and that people would always want to try on clothes in a real store and hold an actual, physical newspaper. Lol.

Anyway, this is the disillusionment stage, when investors lean toward thinking that it was all just a flash in the pan and start to bemoan their luck. But there’s no need to despair, says Gartner: this stage is inevitable and what comes after it is where the serious money is made.

Stage 4: The slope of enlightenment

At this point, the version one wrinkles have been ironed out and V2 and V3 are being deployed. The technology has been through enough hits and misses (with the world and humanity still intact, hopefully), and now the new iterations and products can really start to gain widespread adoption.

At this stage, the technology’s real power is unleashed. With AI, it’s practically impossible to know what this will look like, but let’s use our trusty internet comparison for guidance. Just think, the smartphone, streaming, cloud technology, autonomous vehicles, and even AI were all just children of the internet. And AI will have children of its own: that’s an exciting thought.

Stage 5: The plateau of productivity

Simply, this is probably where the internet is now. Cloud adoption is high and a new software startup launches every day. The internet is still an incredible productivity tool and still shaping our world, but at this point, the technology is mostly about doing existing things better, rather than doing brand new stuff. For AI, who knows when this stage will come? With a gun to my head, I’d say it’s a good decade away, maybe more.

What does all of this mean for AI?

If, as Gartner says, all the major tech trends follow this Hype Cycle, there’ll be ups and downs to come for AI. Most pertinently, though, if you agree that we’re at or nearing the peak of inflated expectations, then you can expect some disillusionment ahead. Now, that might not come for some time – people were calling the peak of the internet hoopla years before the bubble popped, after all. And it’s worth remembering that even when we hit that trough of disillusionment, you can still keep your eyes on the long-term prize, and get ready to climb that slope of enlightenment.

Paul Allison is a senior analyst at finimize

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.