What future holds for high yielder Phoenix

A prospective dividend yield of over 11% looks attractive on paper, but it's been flattered by a tumbling share price. Independent analyst Alistair Strang gives his view of the share's potential.

31st October 2023 07:41

by Alistair Strang from Trends and Targets

We’ve had a few emails asking about Phoenix Group Holdings (LSE:PHNX) (known as Pearl since the 1800s) because they are apparently cheap.

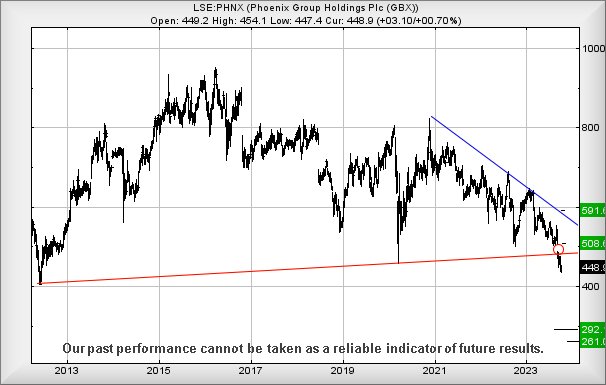

However, the savings and retirement giant's share price is looking a little problematic. Since 2014, the share has been achieving a series of “lower lows” and, visually, this is worrying.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Making matters worse, in September the market opted to gap the share price below a long-term Red uptrend, a decision which calls into question any excuse for immediate optimism.

And there is a solid excuse for optimism as the recent drop to 436p represented a Big Picture bottom, an important price level from which we’d normally hope to see some sort of bounce. It is certainly the case that anything capable of propelling the price above Red at 485p currently should be significant, capable of triggering recovery to an initial 508p with secondary, if exceeded, at a longer term 591p.

In fact, to be honest, we’d love to see the market discover a reason to gap this upward above Red as visually this will provide an almost confident picture for long-term recovery.

Unfortunately, it would be unusual for the market to gap a price below such an obvious long-term trend without strong reason and, as a result, we fear for its future.

Source: Trends and Targets. Past performance is not a guide to future performance.

Now, below 436p threatens to continue a cycle of misery, giving an immediate drop target down at 292p with our secondary, if broken, an eventual 261p.

As we’re fond of Big Picture arguments, our suspicion is to watch for this reaching the 300p level as it’s be an ideal price from which to start serious recovery, because that’s where we suspect this Phoenix will find its little pile of ashes!

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.