What to expect from the US election: four scenarios

Our baseline is conditioned on a Biden victory, but a broad range of alternatives are possible under Trump.

26th June 2024 12:26

by Global Macro Research from Aberdeen

We outline four scenarios for the election – one in which Biden wins and continues the approach of his first term, and three variants of a Trump presidency depending on the policy mix. Our baseline is conditioned on a Biden victory, but a broad range of alternatives are possible under Trump.

Who wins the presidency? What is the composition of Congress? What will Trump prioritise if he wins?

We frame our US election scenarios around the answer to three inter-related questions: who will win the presidency? What will be the split of Congress? And should Trump win, which policies will characterise his second term?

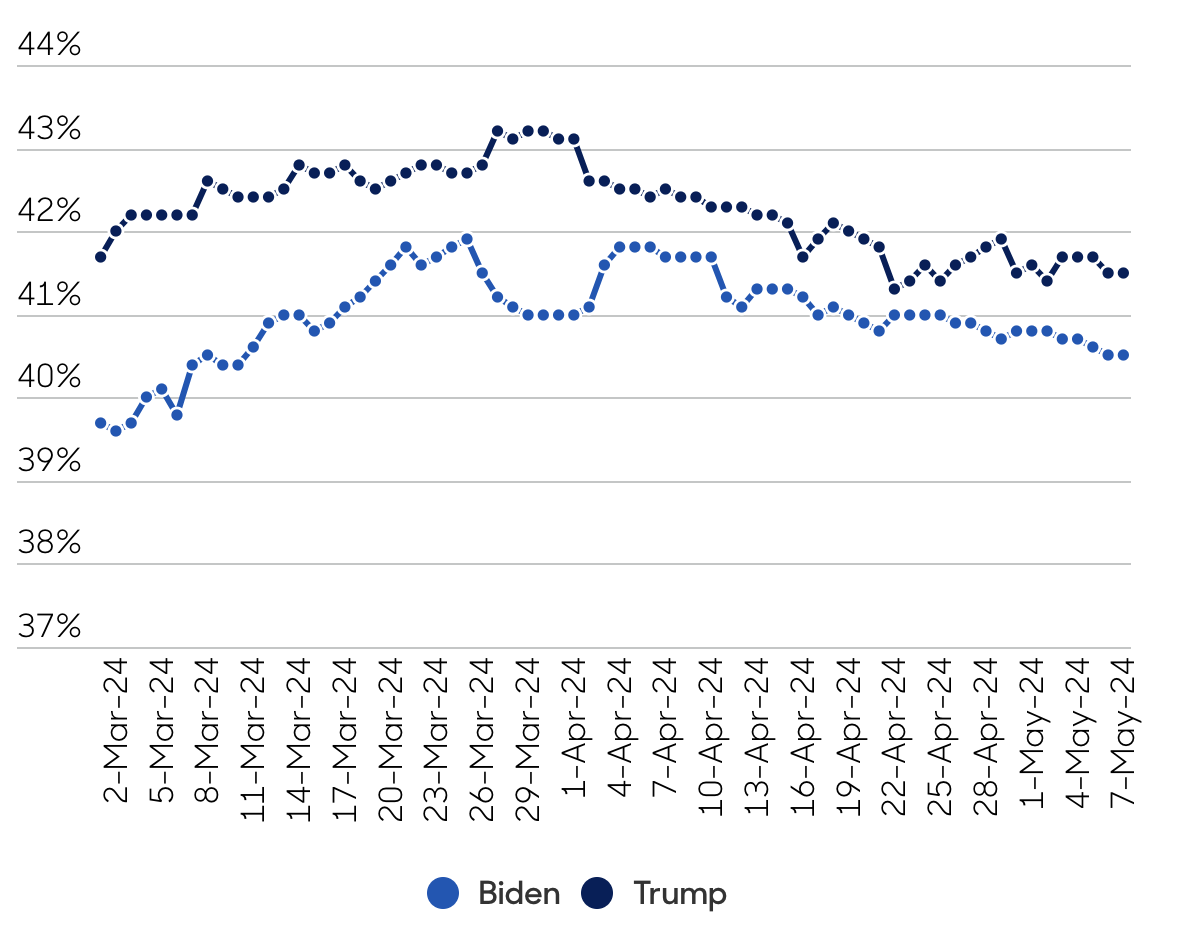

Our current reading of the polls means we think Trump is the marginal favourite (see Figure 1). We peg the probabilities at 55% for Trump and 45% for Biden.

Figure 1: Trump holds a narrow but consistent lead in polling

Source: abrdn, fivethirtyeight (May 2024)

The congressional outcome is likely to be highly conditional on the presidential outcome (see Figure 2).

Should Biden win, Democrats are more likely to flip the House and even stand a chance of holding the Senate. With or without unified congressional control, a second Biden term is likely to be characterised by policy continuity. So, we put the full 45% probability mass of Biden winning into the “Bidenomics” macro scenario, making it our baseline.

Figure 2: Congressional outcomes are highly conditional on the presidential result

Subjective congressional probabilities in event of Trump:

| House | Senate | |

| Republican | 55% | 95% |

| Democrat | 45% | 5% |

Subjective Congressional probabilities in event of Biden:

| House | Senate | |

| Republican | 25% | 75% |

| Democrat | 75% | 25% |

Source: abrdn (May 2024)

A Trump victory would increase the Republicans’ chance of holding the House and would almost certainly see them take the Senate. The macro implications of a second Trump term will depend on the composition of Congress and the policy areas and governing style that Trump emphasises.

These uncertainties are why we have split the 55% probability occupied by Trump winning the presidency into three scenarios, depending on the mix of trade, fiscal and other policies.

1. Bidenomics continued: 45%

Biden would protect key policy achievements, such as the Inflation Reduction Act (IRA), and extend personal tax cuts for those earning less than $400k from the 2017 Tax Cuts and Jobs Act (TCJA) due to sunset in 2025. Democrats would push for the reintroduction of their pandemic-era child tax credits and an increase in corporation tax to 28%, in the unlikely event of a unified Congress.

A split Congress would block corporate tax hikes but could see a deal for a more generous child tax credit in exchange for an extension to tax cuts for higher earners, or a reintroduction of lapsed investment expensing provisions. Real-term discretionary spending would likely remain flat, though increases to defence spending are possible.

On trade, Biden would continue the ‘small yard high fence’ national security and industrial policy, typified by recent tariff increases on Chinese electric vehicle, battery, and semiconductor imports. This could expand to include controls on tech exports, opening investigations into China’s overcapacity and dumping in renewable and electric vehicle technology, cracking down on Asian markets used as a backdoor for Chinese trade, and bringing industries such as health into the “small yard”.

In aggregate, this policy would continue to drive a slow economic decoupling between the US and China, encouraging a rerouting of trade and investment into “friendly” trade partner networks.

Biden would likely tighten immigration controls. In addition to using executive orders to tighten the asylum system, he may back the bipartisan immigration deal proposed earlier in the current session.

Macroeconomically, the scenario would not represent a significant shock to the economy’s current trajectory. Extended tax cuts would mitigate much of the upcoming fiscal cliff and see the large deficit remain broadly stable over coming years. Slower immigration would cool the very strong population growth of Biden’s first term, but it would take time to materialise.

2. Trump trade war 2.0: 30%

In the event of a Trump victory, we think the most probable constellation of economic policies would involve a heavy focus on trade, tariffs, and immigration. This would be especially the case with a split Congress, in which Trump makes heavy use of executive orders.

On the campaign trail, Trump has floated a 10% tariff on all imports and a 60% tariff on Chinese imports. We discussed Trump’s trade policies, and the substantial uncertainty around what he may ultimately do, in a previous note.

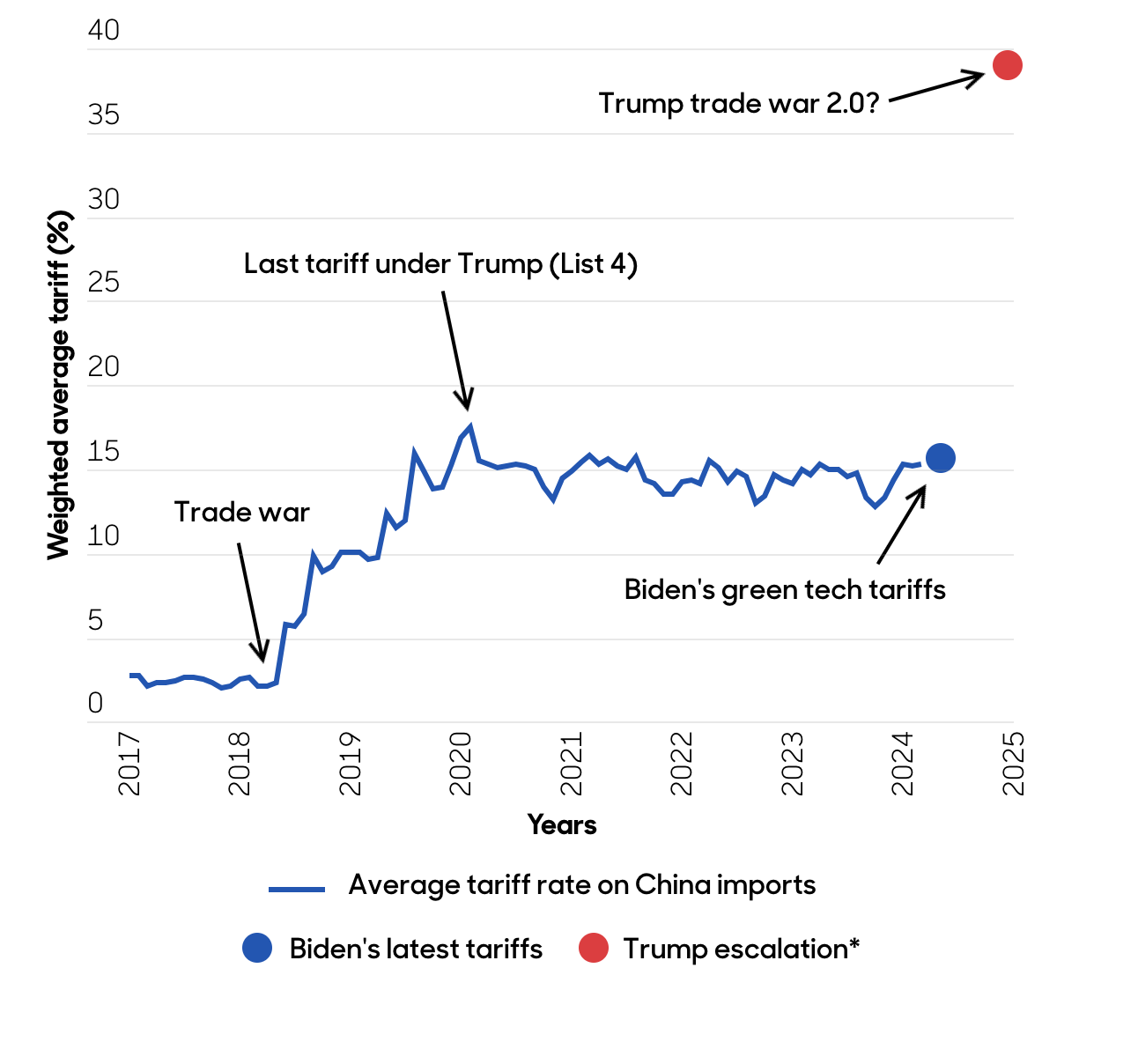

For the purposes of this scenario, we’ve assumed tariffs on Chinese goods targeted during Trump’s first term are increased to at least 60%, taking the average bilateral tariff rate to around 40% (se Figure 3). Other countries with large surplus with the US are also targeted.

Figure 3: Trump’s trade policies could substantially increase the US effective tariff rate with China

*Scenario assumes 60% traffic applied to Lists 1-4

Source: US Census Bureau, USTR, WITS, abrdn (May 2024)

We also assume a large fall in immigration through lower refugee admissions, tighter controls at the southern border, slower processing of applications, and a travel ban from certain countries.

All this constitutes a negative supply shock, which would lower growth and push inflation higher. Based on a range of empirical estimates, we think tariff increases consistent with this scenario would take between 0.5% and 2% off the level of GDP as they hit real incomes, raise domestic production costs, lower investment and dampen sentiment. Tariffs would raise core PCE inflation by around 0.2% and 0.6% in the year after implementation. Immigration restrictions would take an additional 0.2ppts off growth and add another 0.1ppts to inflation.

The combination of upward pressure on inflation and downward pressure on growth would create a policy dilemma for the Federal Reserve (Fed). The cutting cycle through 2025 would be much slower, or even stall entirely.

3. Full-fat Trump: 15%

Alternatively, if Trump enters office with a unified Congress, he may seek to enact the entire policy agenda articulated on the campaign trail. In this scenario, he would pursue the trade and immigration policies of the previous scenario, but also significant additional tax cuts and spending increases, a deeper deregulatory agenda, and greater political interference in the Fed.

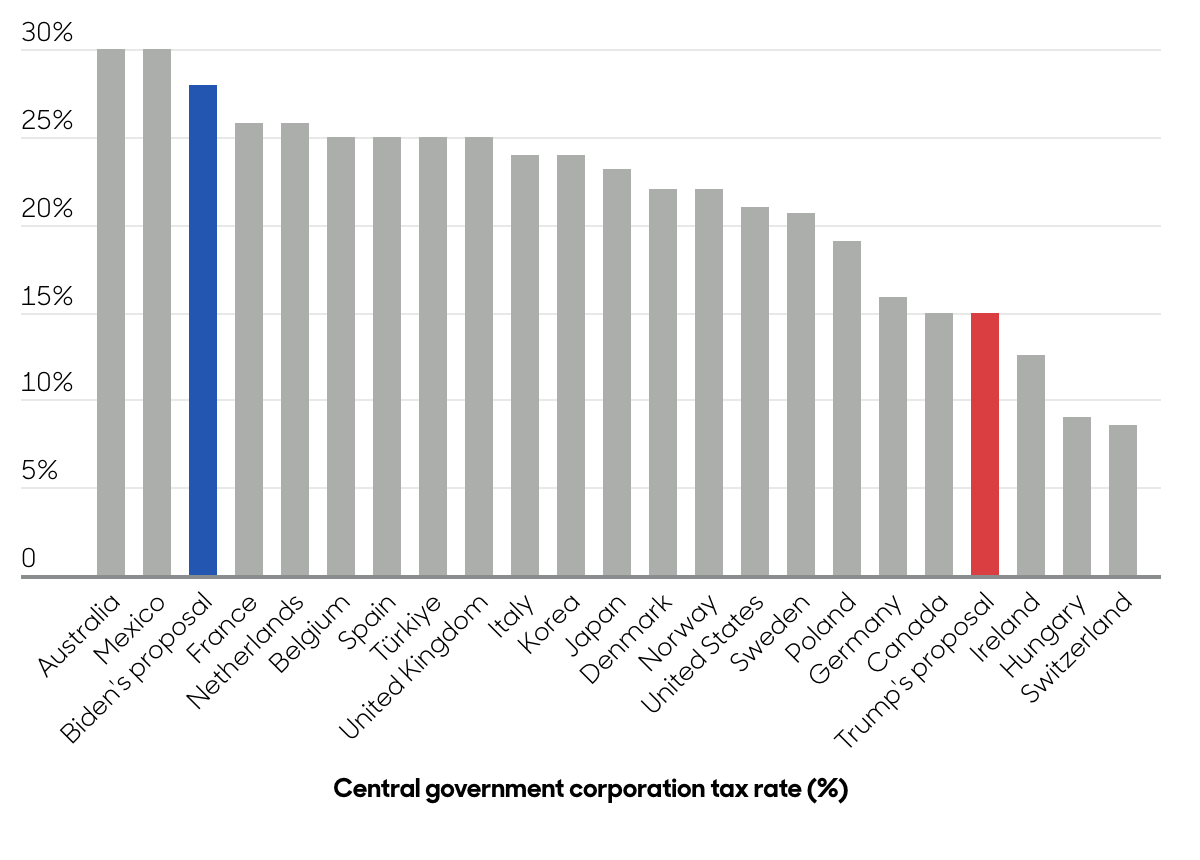

On fiscal policy, expiring personal tax cuts are extended along with additional tax cuts for higher earners, and a reduction in the corporate tax rate to 15% (see Figure 4). Congressional Republicans may advocate for the restoration of full investment expensing and research and development (R&D) tax credits introduced under the TCJA that have since expired.

Figure 4: Trump and Biden have significantly differing views on corporation tax

Source: OECD, abrdn (May 2024)

A full repeal of the IRA is unlikely, but funding will probably be scaled back for certain provisions, especially renewable energy and electric vehicles.

Overall spending would likely rise due to higher expenditure on defence and homeland security, while social security and Medicaid would be protected from significant cuts. The deficit would likely widen, as tariff revenues wouldn’t fully offset tax cuts and spending increases.

On regulatory policy, a rollback of environmental regulation, as well as a focus on budget cuts for regulatory agencies, would be likely.

These policies would represent a highly inflationary mix, pushing down on aggregate supply and up on demand. Inflation could be at least 0.6ppts higher in 2025 than in the baseline. The net growth impacts of tariffs, immigration restrictions, and fiscal easing are ambiguous, and would depend on the monetary policy response.

Ordinarily, the Fed would tighten monetary policy in response to such a shock, leading to higher interest rates, a stronger dollar and tighter financial conditions.

However, Trump may find this policy response intolerable. He may try to put political pressure on the Fed to loosen policy and appoint more malleable policymakers when positions become open. There has even been speculation of deeper changes to the Fed’s independence, to give the president a greater say in policy making.

These changes may be restrained by Congress. However, overt politicisation could undermine the Fed’s inflation credibility.

This scenario is likely to involve significant market volatility as investors struggle to price often-times contradictory aspects of the policy agenda. The risk premium across asset classes is likely to spike higher, with inflation-linked assets particularly affected and a steepening yield curve.

4. Trump delivers for markets: 10%

As Trump’s first term demonstrated, his pledges on the campaign trail can be a poor indicator of his focus when in office.

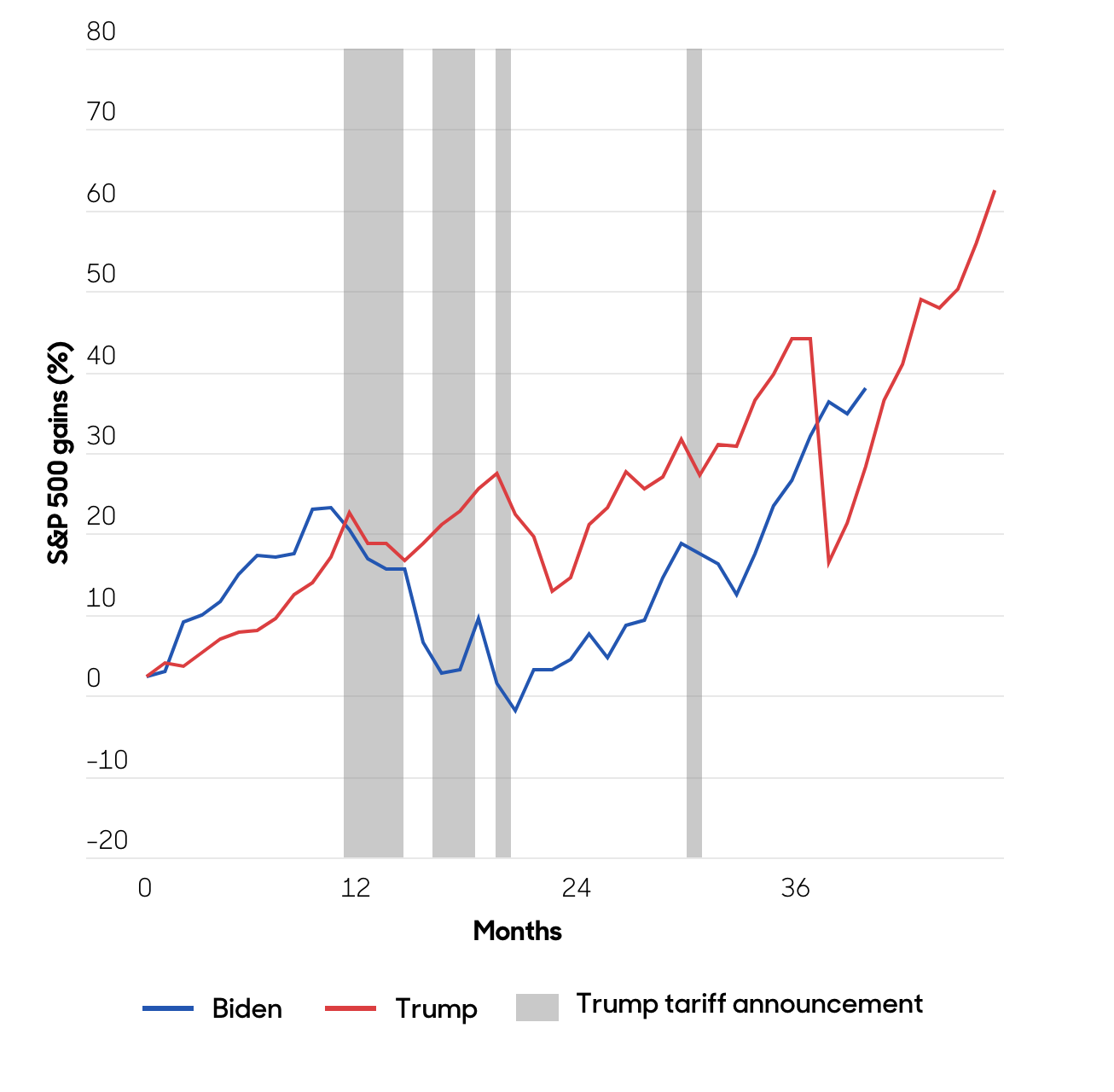

His first term saw the appointment of broadly institutional figures in key roles including at the Fed and Treasury, while a focus on tax cuts, especially in the earlier part of his presidency, was more important in driving risk market performance than trade measures (see Figure 5).

Figure 5: Equities performed positively over Trump’s first term, but sold off around tariff announcements

Source: Haver, abrdn (May 2024)

In this scenario, Trump takes advantage of a unified Republican Congress to focus on tax cuts and deregulation, including renewing the TCJA and cutting corporate tax to 15%. Defence spending would increase in real terms, while social security and Medicaid would be protected from substantial cuts.

A full or even partial repeal of the IRA may not occur, in part due to its impact on key voting constituencies.

Trade policy moves closer to Biden’s ‘small yard high fence’ ethos, with tariffs remaining targeted towards national security products. Threats of higher tariffs are largely used as leverage to begin trade negotiations, meaning that blanket tariffs are avoided.

On regulation, various agencies face a hard cap on their budget, limiting their capacity to intervene in markets. The anti-trust framework takes a much more permissive attitude to tech firms and large mergers.

This overall policy mix should support aggregate demand, and business and consumer sentiment is likely to pick up.

Monetary policy would likely be tighter than the baseline. If tax and regulatory reforms are successful in boosting productivity growth, then the equilibrium level of interest rates could move higher.

Trump may make some rhetorical noise about the impact of higher rates and the dollar but continues to allow the Fed to operate independently and his nominations to the board are all technocratically competent. As such, inflation expectations would stay well anchored.

Higher corporate profitability more than offsets higher discount rates, and US equity markets tend to perform well, attracting overseas capital.

Stylised scenarios versus reality

These scenarios are necessarily simplifications. The reality could be much messier, especially in the event of a Trump victory. Different aspects of his agenda could be on display at different times. Markets may price different outcomes over time, as the precise policy mix is revealed.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.