What to expect from share prices in September

5th September 2018 12:07

by Stephen Eckett from interactive investor

They have a poor reputation for returns in September, but how do stocks really perform once the summer holidays are over? Stephen Eckett has the answer.

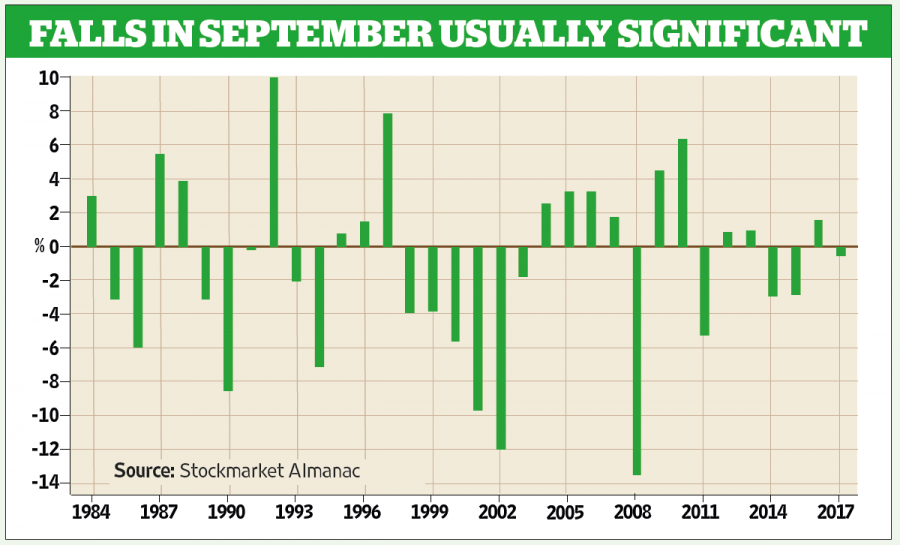

September is a poor month for the stockmarket. Since 1990 the FTSE All-Share index's average return in September has been -1.2%. This record has often made September the worst month of the year for shares. Since 2000 the index's average return in September has been even worse, at -1.6%.

Over the longer term, the returns in half of all Septembers are positive. But when the market declines in the month, the fall can be very large. The FTSE All-Share index has declined by more than 8% three times in September since 2000, for example.

The big problem for investors in September is volatility: share price volatility is often at its highest level of the year this month. The situation is even worse among mid-cap stocks. Since 2000, on average the FTSE 250 index underperforms the FTSE 100 index by 1.4 percentage points in September.

In an average September the market tends to gently drift lower in the first three weeks of the month before rebounding slightly in the final week, although the final trading day of the month has historically been one of the weakest.

Gold tends to be strong in September: since 1968 the average return in the month has been 1.8%, making September the second-strongest month of the year for gold, after February. On the sector front, September tends to be good for tobacco, nonlife insurance and beverages, and relatively poor for industrial transportation, real estate investment trusts, and electronic and electrical equipment.

The NYSE closed on 3 September (Labor Day), FTSE quarterly index reviews will be announced on 5th, and the US non-farm payroll report is on 7th.

Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.