What does 25 years of being an ISA early bird amount to?

Someone who invested on 6 April since 1999 in an average global fund would have almost three times the total invested amount, new interactive investor calculations find.

5th April 2024 11:10

by Myron Jobson from interactive investor

- Someone who invested the full ISA allowance every 6 April since 1999 in the average global fund (£306,560 invested) would have a portfolio worth £807,455 over 25 years of ISA

- A smaller contribution of £5,000 (£125,000 invested in total) would have resulted in a portfolio worth £402,020 over the period

- The returns are even higher if the same contributions were invested in the average global investment trust

- 25 years of ISA, 25 free trades: to commemorate 25 years of ISA, interactive investor is offering £100 worth of free trades to new customers opening an ISA or a Trading Account between 6 April and 30 April 2024.

To commemorate 25 years of ISAs, interactive investor, the UK’s second-largest investment platform for private clients, explores the performance of early bird investing into global funds and investment trusts over the period.

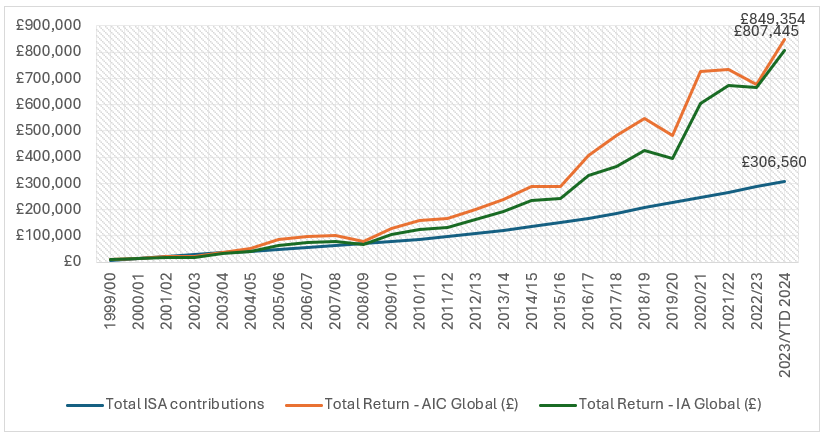

Calculations* by interactive investor show that someone who invested the full ISA allowance (£306,560 invested in total) into the average global fund within the Investment Association (IA) universe on 6 April each tax year since 1999 would now have a portfolio worth £807,455 (to 31 March 2024).

The same contributions into the average global investment trust would have resulted in a larger portfolio value of £849,354 over the period.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

This mirrors the experiences of ISA millionaires on interactive investor. They tend to be early bird investors and have invested over the long term (with an average age of 74), giving their money more time in the market to work hard for them and reap the rewards from compounding returns.

In reality, the vast majority of investors haven’t been able to max out the annual ISA allowance, but the growth and potential tax savings are still significant over the long term on smaller contributions.

Someone investing £5,000 over the same period (£125,000 invested in total) in the average global fund would have a portfolio worth £402,020 rising to £446,860 if the money was invested in the average investment trust over the same period.

Global funds and investment trusts serve as a proxy to a geographically diversified portfolio. The average fund and investment trust performance is based on the aggregated performance of funds in the IA Global and AIC Global sectors, respectively, with a 25-year track record.

Total returns achieved by investing full ISA allowance in average IA and AIC Global Funds/Trusts from 6 April 1999 to 31 March 2024

Source: interactive investor/Morningstar. Past performance is not a guide to future performance.

- NOTE: there are a limited number of funds and investment trusts with a 25-year track record.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “ISAs are one of the UK’s biggest success stories, with around 22 million adults in the UK holding savings and investments in an ISA, valued at approximately £741.6 billion. While few have been in the fortunate position to make full use of the annual allowance every tax year, many have benefited from the simple, transparent and easy-to-understand tax wrapper.

“Our calculations shows that you didn’t need to be an expert stock picker to achieve significant tax-free returns over the 25 years since the introduction of ISAs. A middle-of-the-pack global fund or investment trust would have yielded over 2.5 times the total invested amount over the period.

“It is clear that time, patience and the magic of compounding returns have worked wonders on globally diversified portfolios over the long term. While few have been in the fortunate position to make full use of the annual allowance every tax year, the principal of patience and diligence has also been enriching for those investing more modest amounts.”

interactive investor commemorates 25 years of ISA with £100 of free trades deal

To commemorate 25 years of ISA, interactive investor is offering £100 worth of free trades to new customers opening an ISA or a Trading Account between 6 April and 30 April 2024. The trading credit is equivalent to 25 free trades (at £3.99 for UK Shares, Funds, Gilts and Bonds and US shares).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.