What a Boris Johnson led Conservative government means for your money

Conservative Party under Johnson has won a sizeable majority - here's what it means for your money.

13th December 2019 10:06

by Edmund Greaves from interactive investor

The Conservative Party under Boris Johnson has won a sizeable majority - the biggest since Labour's in 2005 - here's what it means for your money.

The country has woken up this morning to a strong Conservative party majority. But what will this mean for our finances? We look at the main Conservative policies and how they could play out over the next few years.

Boris Johnson has pledged to hold a budget within the first 100 days of winning power. A date has not yet been set, but it will likely be before March next year. This will lay out all the significant tax and spending priorities of the government. However, the Conservative Party manifesto and pledges made by the party on the election trail already give a strong indication of what the government will mean for our money.

Brexit will happen - and holiday spending gets a boost

A significant Conservative majority now means Brexit will move full-steam ahead. The Prime Minister this morning pledged again to "get Brexit done" by 31 January. The detail of what this means for all aspects of our personal finances will only become clear as the withdrawal arrangement and trade deals with the EU and other parts of the world are established. However, there are already some elements on which we have clarity.

The pound has rallied significantly on the back of the vote. Sterling was up more than 3% against the dollar on the news. A stronger pound is good for holidaymakers spending abroad. However, there are likely to be other changes for holidaymakers over the coming years that are less good news, such as changes to the European Health Insurance Cards (EHICs) which give UK citizens the same access to medical care in the eurozone as other EU citizens.

Source: Graph courtesy of XE.com, 09:30 13 December 2019

Once Brexit takes place EHICs will no longer be valid, but reciprocal agreements between countries could remain in place. This however remains to be seen. Likewise the validity of British driving licences on the continent will become contingent on agreements between the UK and other countries. In practice it is likely that driving abroad will require an additional International Driving Permit, which can be purchased at the Post Office.

- General Election 2019: Results round-up

- What a Boris Johnson led Conservative government means for your money

- ii Super 60 investments: Quality options for your portfolio, rigorously selected by our impartial experts

Further than that, it is difficult to say with certainty how Brexit will affect personal finances. With such a large majority, Boris Johnson now has a free hand to either soften his Brexit stance, or even harden it. The only guarantee is that it will now take place for sure and without a second referendum.

The nature of the trade deals decided in the coming years will have implications for everyone from businesses and their ability to trade, to British expats living in Europe.

Income tax will fall for 31 million workers

The Conservative Party has said it will not raise the rate of income tax, VAT or national insurance if it wins the election. From next year the party says it will increase the national insurance threshold to £9,500 next year from £8,424. This could mean a saving of around £100 a year for 31 million workers.

It says its “ultimate ambition” is to ensure that the first £12,500 people earn is completely tax free.

Boris Johnson has ditched planned income tax cuts of £8 billion for Britain’s highest earners. He had previously pledged during the Conservative leadership campaign to move the point at which someone becomes a higher rate taxpayer from £50,000 to £80,000.

Inheritance Tax will not increase

Inheritance tax breaks are likely here to stay for the foreseeable future. Labour had pledged to reverse the cuts brought in under previous Conservative governments that allow couples to pass on a family home up to the value of £1 million.

High speed broadband for all

The Tories have committed to providing high-speed broadband for all homes and businesses by 2025. This includes a special £5 billion fund for premises to have full fibre broadband where it wouldn't otherwise be economically viable.

The state pension will rise

The Conservative government has pledged to keep the state pension triple lock. This guarantees that the state pension increases every year by the highest of inflation, 2.5% or wage growth.

It has also promised to keep winter fuel payments for pensioners, the older person’s bus pass and other pensioner benefits.

The triple lock was introduced by the Conservative / Liberal Democrat coalition in 2010, and over the years has become increasingly expensive.

It means that from April next year, the state pension will rise by a guaranteed 3.9% or £343 a year.

The Conservatives have also pledged to review the pension tax of low paid workers.

Those who earn between £10,000 and £12,500 - mainly women - have been missing out on pension tax relief depending how their employer has set up their pension scheme.

No mention was made about pension age changes was made, suggesting the current timetable to raise the state pension age will go ahead as planned.

Waspi women will not receive compensation

The Conservative Party has made no promises to help so-called Waspi women born in the 1950s who have been hit by the changes to the state pension age.

Therefore, nothing is likely to change for them under a Conservative government.

Nearly four million women have been affected by the government’s decision to raise the state pension age from 60 to 66.

Campaign groups such as BackTo60 and Women Against State Pension Inequality (Waspi) argue that many women born in the 1950s were not sufficiently warned of the changes and have suffered financial hardship as a result.

Labour had promised to pay back £58 billion to these women, with individual payouts as high as £31,300.

Capital gains tax remains unchanged

The Conservative government had not made any pledges to change capital gains tax. Had Labour formed a government, it had promised to increased tax paid on both capital gains and dividends payments.

Social care could be back on the agenda

Despite the current crisis in social care, the Conservative manifesto did not provide any concrete proposals. However Johnson pledged to ‘tackle’ the issue, although without any detail how, when he became Prime Minister.

The party says it will provide £1 billion of extra funding a year for social care, as well as a commitment to seek cross-party consensus for long-term reform. It also promised to introduce a system which means no one will have to sell their home to fund long-term care, but details of this were vague.

However, now with a strong majority, a Conservative government will have greater power to push through reforms to create a social care system that is fit for purpose.

The housing market could get moving again

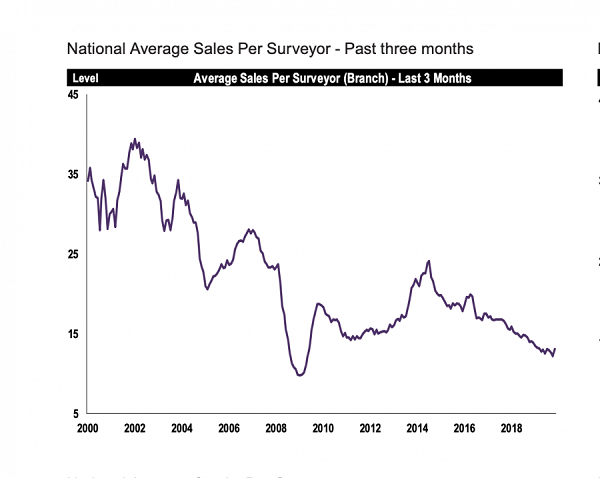

The housing market has been stagnating for some months, with uncertainty around the general election and Brexit likely to have curbed people’s appetite for making big changes in their lives.

However, with a clear outcome to the election – and with it greater certainty around the Brexit process – many housing experts are predicting a boost to momentum in the housing market.

Buyer demand and new sales have been wallowing in negative territory, last month’s figures from the Royal Institution of Chartered Surveyors confirmed. Today’s result may be enough to get the market moving again.

Source: RICs, November 2019

The Conservative Party says it will bring forward a social housing white paper to “set out further measures to empower tenants and support the continued supply of social homes”.

The manifesto also announced a pledge to introduce "lifetime mortgages". These are mortgages that have a fixed rate for the entire duration of the repayment period. The idea behind it is it is a lower risk for providers to offer a whole-life fixed product, allowing them to offer smaller deposit sizes of around 5% to first-time buyers that it would otherwise be difficult to lend to.

The Tories have also committed to a "First Home" program. This is a scheme whereby people buying homes for the first time in their local area will be offered a house at a 30% discount.

For renters, the party has offered a "Lifetime Rental Deposit" scheme. This is an idea that means rental deposits can be transferred from one home to another with the tenant, instead of making a fresh deposit every time someone moves.

It will also commit to renewing the Affordable Homes Programme, in order to support the delivery of hundreds of thousands of affordable homes.

Childcare gets a boost

The Conservative Party says it will establish a new £1 billion fund to help create more high quality, affordable childcare, including before and after school and during the school holidays.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.