The week ahead: Tesco, Ted Baker

28th September 2018 15:40

by Lee Wild from interactive investor

Whether it be food, clothing or affordable sofas, retailers will hog the spotlight next week, led by high-flying Tesco, writes Lee Wild.

Monday 1 October

AGM/EGM

Vedanta Resources

Tuesday 2 October

Trading Statements

Inspiration Healthcare Group, Revolution Bars, Ferguson, Avacta Group

Wednesday 3 October

Tesco

The supermarket sector has been one of the best performers over the past few years. Morrison (Wm) Supermarkets and Tesco have stood out, joined in 2018 by a resurgent Sainsbury's. For Tesco, all the chat in recent weeks has been around Jacks, its new budget concept designed to compete directly with aggressive discounters like Aldi and Lidl. It’s early days, so any data we do see in these second-quarter results indicates nothing more than initial curiosity among budget conscious shoppers.

Indications are that business has slowed in recent months, and that cost savings rather than volume growth will drive an improvement in retail profit margin to around 2.5%. The tie-up with Carrefour also becomes operational in October, which should bring costs down further. And the Booker acquisition continues to pay off, with like-for-like sales tipped to have grown 14% at a margin of 3.75%.

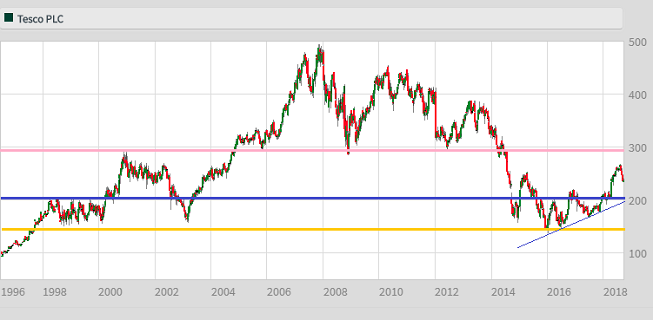

Tesco shares have almost doubled since their early 2016 nadir, and despite pulling back from a four-year peak over the past month, the overall trend remains positive. Based on expectations of further rapid growth in profit over the next few years, Tesco shares trade at a discount to rivals Sainsbury's and Morrisons.

Source: interactive investor (*) Past performance is not a guide to future performance

Trading Statements

Topps Tiles, Tesco

AGM/EGM

RM2 International

Thursday 4 October

Ted Baker

Ted Baker was on track to hit full-year targets when it last updated the market in June, having seemingly overcome problems flagged in a warning just three months earlier. Watch half-year wholesale sales closely. After a 14% increase at the start of the year, we've already been told that high single-digit growth is still possible for the full-year.

Ted Baker aims at the upper end of the high street market, and its shares were once as pricey as its clothes. Suffering from a wider slowdown across the sector, the valuation is now much more reasonable and well below the historic average. Forecasts for double-digit profit growth over the next few years, plus a 3% dividend yield make Ted Baker shares attractive at current prices. Any positive surprise at these results will be well-rewarded.

Source: interactive investor (*) Past performance is not a guide to future performance

Trading statements

Electrocomponents, ICG Enterprise Trust, Ted Baker, DFS Furniture, e-Therapeutics, Morses Club

AGM/EGM

Ilika

*Horizontal lines on charts represent previous technical support and resistance. Blue diagonal line on Tesco chart represents uptrend since 2016.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.