The week ahead: Royal Mail, easyJet

13th July 2018 13:42

by Lee Wild from interactive investor

Two of the most easily recognisable corporate names are about to publish quarterly updates. Lee Wild runs through what to look for on results day.

Monday 16 July

Trading Statements

Rio Tinto, WH Ireland Group

AGM/EGM

DPA Group

Tuesday 17 July

Royal Mail

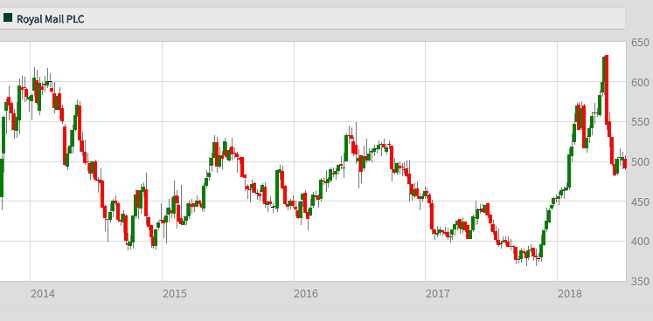

Resolving a potentially devastating industrial dispute put a firework underneath Royal Mail shares late last year. The excitement finally died down in May following mediocre full-year results, but not until the shares had made a record high above 630p.

Down a fifth since their peak, the shares are more modestly rated and now offer a prospective dividend yield of over 5%. It looks attractive on paper, but Royal Mail is still bugged by the ongoing and inevitable decline in letter writing, fierce competition in parcel delivery and pressure to keep slashing costs, so don’t expect any major surprises from these first-quarter results.

Letter volumes are expected to keep falling at 4-6% a year, but it could be greater this time if, as expected, new GDPR legislation shrinks the quantity of marketing mail. However, given GDPR came into effect with only one month of the first quarter remaining, the bigger impact is likely to be felt in Q2. Royal Mail’s European logistics business GLS will remain the star of the show, offsetting difficult trading across the rest of the business, although watch out for any impact of higher staff costs on margins.

It will be Moya Greene’s last set of numbers as chief executive. She’ll hand over to Rico Back, currently running GLS, in September.

Source: interactive investor Past performance is not a guide to future performance

Trading Statements

Royal Mail, TalkTalk Telecom, SSP Group, Hydrogen Group, Galliford Try, Dairy Crest, BHP Billiton, Etalon Group, Synectics, NCC Group, Polar Capital Technology Trust

AGM/EGM

Brown (N) Group, HICL Infrastructure

Wednesday 18 July

easyJet

Shares in easyJet have almost doubled in the past couple of years, but it’s not plain sailing for the budget airline. Industrial action by French and Italian air traffic controllers has caused easyJet to cancel thousands of flights, and we’re warned to expect more of this throughout the summer.

Share price weakness has been a buying opportunity in recent years, but Ryanair has suffered as much as easyJet during a three-week sell-off, and its historic valuation premium to easyJet has disappeared.

It was already a tough gig convincing analysts to upgrade profit expectations for easyJet before the strikes. Watch third-quarter results closely for any deviation from latest company forecasts for profit of £530-£580 million in the year to September.

Source: interactive investor Past performance is not a guide to future performance

Trading Statements

Severn Trent, Hochschild Mining, RPC Group, easyJet

AGM/EGM

Ashmore Global Opportunities, Biffa, BP Marsh & Partners

Thursday 19 July

Trading statements

AO World, SSE, Euromoney Institutional Investor, Unilever, Moneysupermarket.com, Nichols, Sports Direct, Versarien

AGM/EGM

Royal Mail, Babcock International, Harbourvest Global Private Equity, Golden Rock Global, SSE

Friday 20 July

Trading statements

Acacia Mining

AGM/EGM

Homeserve, KCOM

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.