Walker Greenbank: Cheap but fearful

8th June 2018 16:14

by Richard Beddard from interactive investor

These shares are certainly not expensive, and should be a very attractive investment, but what does companies analyst Richard Beddard think?

Record results for the year to January 2018 and a long term track record of profitable growth mean Walker Greenbank should be a very attractive investment, especially since the share price has halved in little more than six months.

Long-term investors wait years for the chance to buy good businesses at cheap prices, but after a frustrating day researching the company I’m not so sure.

Does it make good money without borrowing excessively?

Score: 1/2

Walker Greenbank designs and prints fabric and wallpaper. Its four main brands are Harlequin, Sanderson, which incorporates Morris & Co, Clarke & Clarke, and Zoffany. They pretty much cover the gamut of tastes, from exclusive Zoffany to Clarke & Clarke's mainstream Studio-G range and Sanderson's Scion. Sanderson is the home of Walker Greenbank's more traditional styles, while the other brands are contemporary. Anthology, a sub-brand of Harlequin, is used widely in hotels, but mostly Walker Greenbank's products are for the home.

The company has broadened its product range culminating in the acquisition Clarke and Clarke in 2016. Diverse brands give it more options in a competitive market and more designs to license. Licensing is particularly profitable because the licensee bears the cost of producing and distributing the product and Walker Greenbank collects the royalty.

55% of the output of the company's two factories, one for fabric and one for wallpaper, is for rival designers, but most of the profit comes from its own brands. Investment in manufacturing, the company says, keeps it "at the absolute forefront of what is possible" and the collaboration between design and manufacturing gives it an edge.

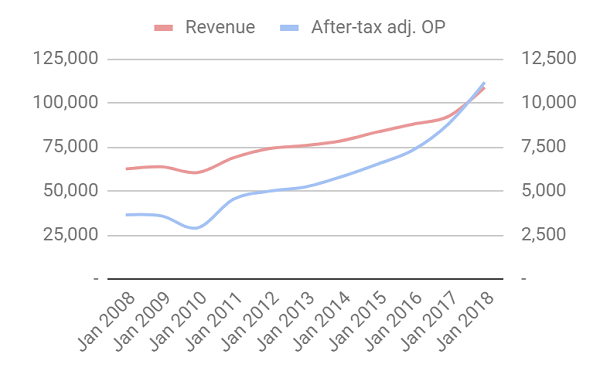

Walker Greenbank has grown pretty steadily, doubling revenue from £54m to £108m in the eleven years since January 2007.

Source: interactive investor Past performance is not a guide to future performance

There are two breaks in the growth trend: in 2010 during the recession, when revenue and profit contracted slightly, and in 2017 and 2018 when it accelerated. The acceleration came from the acquisition of Clarke & Clarke towards the end of the financial year to January 2017.

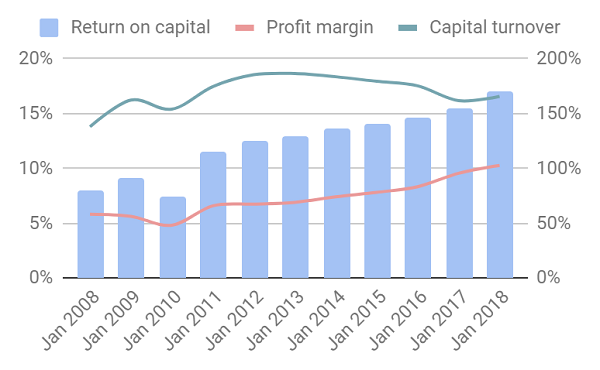

Profit has grown faster than revenue as Walker Greenbank has become more efficient. Return on capital (investment) has increased from a just about adequate 7% to 8% in the earlier years of my chart, to 15% or more over the last three years.

Source: interactive investor Past performance is not a guide to future performance

I ought to love this business, but there is a blemish in the fabric.

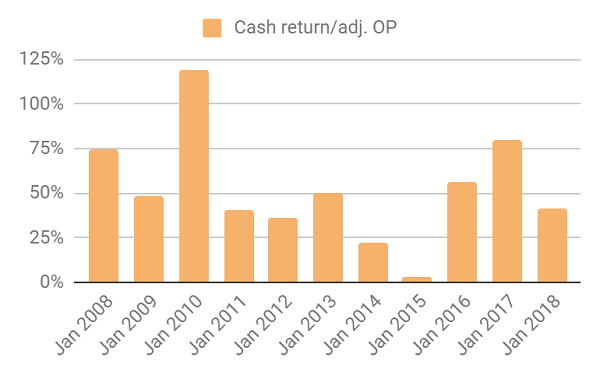

Over the same 11 year period, cash flows after capital expenditure have only amounted to 48% of profit. I'm at a bit of a loss to explain why cash conversion should be this low. The other manufacturers I follow, even those like Walker Greenbank that have been investing heavily, typically convert about 70% to 80% of profit into cash.

Cash is king, but it's unreasonable to expect firms' profits to be entirely earned in cash. One of the points of accounting is to smooth out the effects of large cash flows. Investment penalises cash flow more than profit, because the cost is charged to the cash flow account immediately, and not depreciated gradually like it is in the income statement.

Source: interactive investor Past performance is not a guide to future performance

After investment, the prime candidates for cash leakage are the pension fund, and growing inventories. These are more troubling discrepancies. Walker Greenbank's defined benefit pension scheme is in deficit, which, despite the company's best efforts to plug it, just has not closed. The company’s pouring about £1.9m a year into the pension black hole, most of which is not reflected in the accounting charge to profit, hence profits are higher than cash flow.

As Walker Greenbank grows, it must fund more inventory (stock, and unfinished goods). Since all of the increase in inventory is a cash cost, but only the cost of inventory sold during the year is charged to profit, increases in inventory as the company grows will penalise cash flow more than profit. Since Walker Greenbank's inventory has grown faster than revenue the effect is exaggerated.

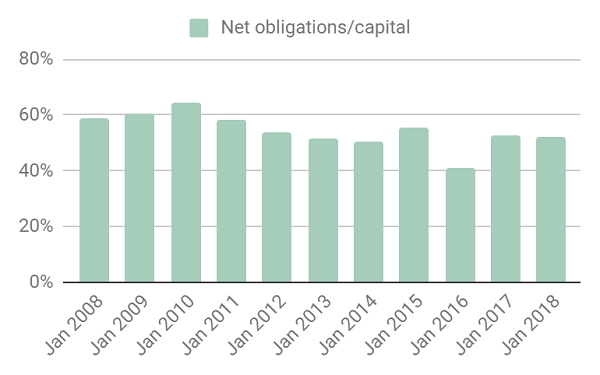

Cash flows have been sufficient to keep debt under control but add in other financial obligations, the pension deficit and more significantly the capitalised value of lease obligations and Walker Greenbank is 50% funded by outside capital:

Source: interactive investor Past performance is not a guide to future performance

That won’t be a problem as long as it can sustain profit and cash flows. The company says it expects to increase profit this year, and its targeting average double digit growth over the next three years.

How will it make more money?

Score: [1/2]

Even though Walker Greenbank's brands grew (very modestly) in the year to January 2018, the company has delivered bad news about trading in the new financial year. In the first February, March and April, brand sales fell 8% in the UK where Walker Greenbank earns 55% of its revenue, and 4% overseas, compared to the same period in 2017.

The reversal has prompted the company to focus its efforts overseas, although brand sales are under pressure there too, and in licensing designs to more licensees and a wider range of products: clothing for example, as well as homewares like bed linen.

The strategy extends Walker Greenbank's designs into new territories and products, but there are uncertainties associated with it. Worldwide, I think, the market for wallpaper and fabric is becoming more competitive as it moves online. Unlike competitor Colefax, which wants to maintain the exclusivity of its products and sells almost exclusively to designers, You can buy Walker Greenbank’s products online through the company's own 'Style Gallery', retailers like John Lewis and through partnerships with online only retailers like blinds2go. Frankly, I don’t know which is the better strategy, to dive into the fray or hide from it.

The company doesn't divulge how profitable licensing is, but once the terms of the license are agreed it's hard to imagine what other costs Walker Greenbank would incur. While licensing only earns 3% of revenue, it may still be highly significant. The value of royalty income was 28% of profit in the year to January 2018.

In it's annual report, Walker Greenbank reported eye-catching licensing deals including the launch of rage of womenswear by Japanese fashion retailer Uniqlo, using designs from Morris & Co. Licensing, however, depends on the popularity of the brands, which may be on the wane.

What could go wrong?

[1/2]

Possibly the company's poor performance in the first nine weeks of the year is a harbinger of a permanently more competitive environment. The Internet enables more companies to reach individuals, and has resulted in something of a backlash against brands as customers seek novelty and authenticity, often from a long tail of smaller companies. If in the future, brand power is weaker, a major plank in Walker Greenbank's strategy is also weakened.

It's tempting to believe the pension deficit problem will disappear. Walker Greenbank has lived with a large pension obligation for a long time, and a combination of relentless payments into the scheme and the potential for a reversal of decades-long-trends in falling interest rates and rising longevity may do the job. But it could remain a millstone, sucking cash out of the business and crimping its ability to invest, acquire, or pay higher dividends.

I am also slightly concerned that inventory is growing faster than revenue, even though Walker Greenbank lost a substantial amount of stock after a flood in 2016. This too consumes funds, and limits growth and the potential for dividends.

Will we all benefit?

[1/2]

The board’s pay and bonuses are typical, by which I mean I don’t see evidence of restraint. Neither does the company tell us much about relations with staff, suppliers, customers or shareholders to base a judgement on. I’m hedging my bets.

Are the shares inexpensive?

2/2

The valuation is modest. The current share price is just shy of 120p, valuing the enterprise at just 11 times adjusted profit. The earnings yield is 9% - a reasonable, albeit theoretical, return even if Walker Greenbank's profits stagnate.

But a score of 6/10 means I don’t have enough confidence in the business to buy the shares for the long-term.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.