Vp: An acquisition too far?

6th July 2018 13:11

by Richard Beddard from interactive investor

Traders have reacted favourably to Vp's biggest ever acquisition, record revenues, and record profits with enthusiasm. Now, companies analyst Richard Beddard tells us whether it's time to celebrate.

It is difficult to tell exactly how well Vp performed in the year to March 2018 because the company made the biggest acquisition in its long history. In November 2017, it acquired Brandon Hire, a UK tool hire firm not dissimilar to Hire Station, one of Vp's businesses.

Nearly five months of revenue from Brandon Hire had a significant impact on Vp. The company increased revenue by 22% compared to the previous year and profit by 20%, but Vp doesn’t disclose the contribution of the new business in its annual report. Generally, Vp's UK firms, which brought in 90% of total revenue and almost all profit, did well. Airpac Bukom, which supplies oil explorers, held Vp’s relatively small International division back. Its fortunes may be improving now the oil price is recovering.

While the performance of Airpac Bukom shows the vulnerability of hire firms, customers can just hand equipment back during recessions, it also demonstrates one of Vp's strengths: diversity. The company is an agglomeration of independent businesses. Each business, Vp says, occupies a strong position in a market niche.

While Vp's hire firms are all tied in some way to cyclical construction, infrastructure and energy markets, the cycles of these industries do not necessarily coincide. The construction cycle responds to property prices and affects businesses like VP's UK Forks, the infrastructure cycle depends on waves of spending on rail (in the case of Torrent Trackside) or water (in the case of Groundforce), and Airpack Bukom is dependent on oil prices.

Specialists versus generalists

If a hire firm has a good reputation in a narrow field, it will often be the first company customers go to when they need equipment. It may also provide services like training and operators, that other firms cannot.

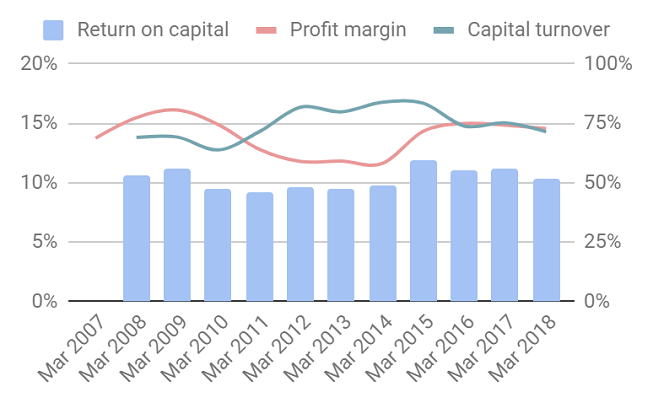

In theory, a broad spread of specialist business should deliver high levels of profitability. Vp’s achieving average adjusted profit margins of 14% after tax, which is very good, but where it really stands out is consistency. Even during the contraction in construction after the financial crisis, adjusted profit margins did not fall below 12%.

Source: interactive investor Past performance is not a guide to future performance

Although after-tax return on capital has decreased from 11% to 10% in 2018, the fall is in part due to a technicality. Vp owned Brandon Hire for less than five months of the financial year, so it earned less than five months profit from it. Profit is the denominator of the return on capital calculation. The numerator, though, capital employed, is calculated using year end balance sheet values, which includes the full value of the depots and equipment acquired.

But Brandon Hire has got me wondering about whether Vp can sustain profitability because it has probably doubled the size of its tool hire business, which supplies everything from gardening tools to carpet cleaners. Tool hire seems to be the least specialised of Vp’s businesses, and it is surely the largest.

Vp ceased publishing the performance of its individual businesses in 2016 but that year, Hire Station earned revenue of £83m and operating profit of £12 million. Brandon earned a very similar amount of revenue (£80 million), but half the operating profit (£6 million). Even if those two businesses haven't grown in the intervening period, and I think they have, they would still account for half of VP’s revenue today. In 2016, both businesses earned lower profit margins than Vp did as a group.

Perhaps Vp can improve Brandon. Hopefully the pair will perform more consistently than listed rivals Speedy and HSS, both of which are tool suppliers, and both of which have experienced financial difficulties in recent times: Speedy after the financial crisis and HSS after it floated in 2015.

Demon Debt

The temptation with consistent but not spectacularly profitable businesses like Vp is to load them up with debt. Borrowing allows them to grow faster and earn higher returns for shareholders. As long as the profit and cash flow rolls in, they can afford the interest.

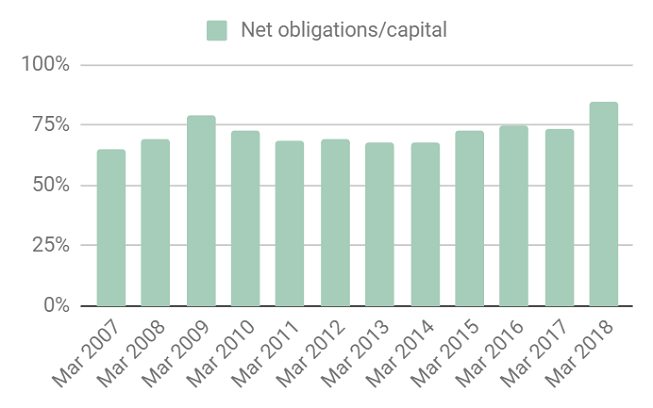

Source: interactive investor Past performance is not a guide to future performance

Funding the acquisition of Brandon Hire has lifted Vp's dependence on outside financing (bank borrowings and operating lease commitments) from just under 75% of the capital it requires to operate, to 85%. These levels are high, and perhaps risky - especially if Vp has become less specialist, and therefore, potentially less profitable.

Scoring Vp

As usual I'm scoring Vp to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

The remarkable think about Vp is its stability, but I would describe profitability as healthy rather than high. Cash flow is inconsistent and averages about 64% of adjusted operating profit, probably due to spending on more equipment as Vp grows.

Adaptable: How will it make more money?

Score: 1

Vp has invested in more equipment to grow its specialist hire brands, and acquired new businesses. Now tool hire probably earns Vp over half its revenue, I wonder if it can justifiably call itself a specialist. I’m coming to think of it as a tool hire firm with some interesting specialist business attached.

Resilient: What could go wrong?

Score: 1

In difficult times Vp says it can flex its fleet, which means sell off equipment it no longer needs to raise cash. But the higher its dependence on external finance, the more likely it is to get into difficulty should the construction industry experience a severe downturn.

Equitable: Will we all benefit?

Score: 2

The executive team of three are being richly rewarded, which makes me wonder if the rest of us will be. Their single figures of total remuneration (including benefits, pensions, bonuses and share schemes) added up to £3.6 million in 2018.

Executive chairman Jeremy Pilkington, who was chairman and chief executive between 1981 and 2004, is the firm’s majority shareholder. Neil Stothard, who succeeded him as chief executive, also owns a substantial shareholding. Vp’s consistent record suggests they are concerned with the long-term health of the company.

This stewardship may be evident in Vp’s relations with its staff. It says employee turnover is 24%, but 25% of employees have been with the firm over ten years, and 47% percent are members of its Save As You Earn share scheme. All employees are eligible to join.

Cheap: Is the firm’s valuation modest?

Score: 0

Not really. At £11.25 the shares cost about 19 times adjusted profit (adjusting for debt).

Verdict: Cheap at three quarters of the price

A score of 5/10 means Vp is good-ish business and the shares are a reasonable-ish price.

Management knows a lot more than I do though. Vp may be confident enough in the economic prospects of the next few years that it will be able to reduce debt back down to historic levels.

Contact Richard Beddard by email: richard@beddard.net or on Twitter:@RichardBeddard

Richard owns shares in Vp.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.