UK trusts: why there’s no place like home

Thomas McMahon of Kepler Trust Intelligence identifies the investment trusts that should retain their appeal as the shift to passive increases.

16th August 2024 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

In journalism school you learn that “dog bites man” is not a strong story, but “man bites dog” is. In that spirit, you might suggest that a story which could be glossed as “man whose livelihood depends on UK-listed shares thinks investors should be forced to buy them” is of questionable interest. But stay with me, because we think we do have something interesting to say.

- Research: Top Investment Trusts |What is a Managed ISA? | Top UK Shares

Reviving the UK stock market is a matter of public debate at the moment, with many industry insiders warning that the LSE is struggling to retain its appeal to companies. There has been a multi-decade trend for professional investors, including UK wealth managers, insurers and pension funds, to sell UK equities and invest overseas. Some of the proposed measures to inject some vigour are intended to incentivise – or even force – UK institutions to buy UK-listed shares again. A light-touch way would be to create preferential tax treatment for UK-listed shares, while a tougher way would be to mandate minimum holdings in UK-listed companies.

The popular press presents this historic selling of UK-listed stock as if it is some judgement on UK plc, on the UK’s economy or people. But I think it is something much more mundane than that. It is the growing “professionalisation” of the investment management industry which has led to the creeping victory of passive index tracking or closet index-tracking strategies.

The basic shape of the financial theory taught to practitioners says that within an equity allocation, investors should use the whole investable market as their baseline. Believers in the efficient markets hypothesis will then invest in it passively, while professional investors are taught to use it as a strategic asset allocation and then tactically adjust positioning around it.

As the industry has consolidated and professionalised, we have been seeing a growing number of large investors take such an approach, meaning that they have been shifting to an allocation that would see a neutral UK weight being just 3.4%, given the current weight of the UK in the MSCI All Country World Index. As previously many of these investors would have had a bias towards the UK, this has caused the huge sucking sound as money disappears out of the window to the larger US or Chinese equity markets.

We think it is a perfectly legitimate aim for a government to seek to moderate this trend. It is of huge economic benefit to the country to have an internationally favoured stock market based here. For multiple reasons, financial services turns out to be one of the sectors the UK leads in, and it brings a huge amount of money into the country which boosts demand in both the private and public sectors. Allowing it to wither is likely to be as successful an economic strategy as Majorcan authorities seeking to rebalance their economy away from tourism. Good luck competing with the Chinese on EVs.

The obvious argument against any restrictions on asset allocations would be that it would potentially lead to worse outcomes for investors. But how serious is this concern? Ultimately, the theoretical justification of the benchmark-focused approach has to be based on some form of the Efficient Markets Hypothesis (EMH), which holds that active management is self-defeating as equity market prices are the best possible estimate of the current value of a security. (It’s certainly irrelevant to complain that UK economic growth is lower than the global average, as UK-listed companies have global revenue streams and the pass-through from local GDP growth to earnings growth is minimal). But there is a pretty major problem with this hypothesis.

The EMH holds that market prices are informed by all public information, because market participants have considered and weighed that information in order to decide whether to buy or sell. But when participants are investing passively, they are only investing in certain companies or countries because of their weights in market cap indices, and so this is false: prices do not reflect information but the influence of flows. (By this logic, the more success the advocates of passive strategies have, the more the intellectual justification for passive approaches is disproved.)

It is also worth considering that the reason for the increased weight of Chinese equities in global indices in recent years has been decisions by the index compilers that the country now has the regulatory and institutional frameworks to be investable. In other words, current benchmarks do not reflect any abstract global investable market, but are artificial and debatable constructs.

It's easy to think that passives are the future. Media coverage creates a picture of growth in passive strategies and the shrinking of the active fund management sector. I think the real picture is a bit more complex. It is instructive to look at the US, as the US is often seen as leading where we will follow. You might have the impression that US investors have switched to overwhelmingly passive strategies, but this isn’t quite true. Morningstar data on the US fund industry tells us that 68% of mutual funds domiciled in the country are active. Adding on the funds invested in ETFs, a combined 48% of pooled funds are still active. There is certainly an ongoing trend to greater ownership of passive funds than active funds.

However, an important point to consider is that Morningstar’s classification system considers specialist sector or factor ETFs as passive. So, for example, a Genomics Healthcare Innovators ETF would be considered passive because it passively tracks a specialist Future Healthcare index. We don’t think this can in any true way be considered a passive investment by the end investor, unless they have worked out the weight of the index constituents in global stock markets and invested the equivalent fraction of a per cent of their portfolio in the ETF. This would be a remarkably time-consuming and wasteful alternative to simply buying the Vanguard Global All Cap tracker fund. As such, figures of passive versus active fund ownership, commonly quoted in the press, need to be taken with a pinch of caution.

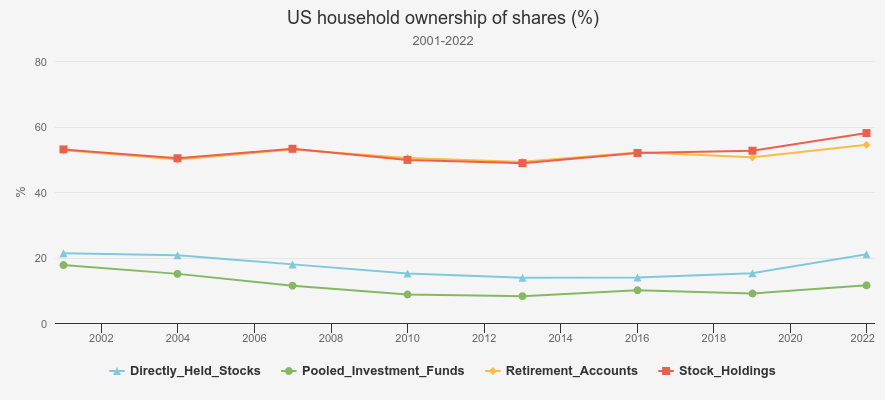

Even more interesting is the US data on individual stock ownership. This seems to suggest that while Americans may be switching into passive funds from active funds, they are increasingly investing actively in stocks themselves on the side. The Federal Reserve has some fantastic survey data on the assets held by US households. This data, recorded every three years, shows that the percentage of households which own stocks directly, i.e. not via active or passive pooled funds or ETFs, fell markedly in the first decade of this century before rebounding post-2016 – and in particular since 2019 – as the blue line below shows.

The chart also includes the percentage of households which own pooled investments (i.e. funds and ETFs) and in retirement accounts. These categories would include any passive and active funds held. We think it implies there is still a pretty vigorous culture of active stock investing. Perhaps US investors have become more and more sceptical about the US active fund industry, rather than more and more sceptical about actively picking stocks?

US OWNERSHIP OF EQUITIES

Source: US Federal Reserve

Why would this be the case? Well, one reason could be the prevalence of closet trackers and expensive funds that differ little from the index. Additionally, investors may be less inclined to pay fees to an active manager when they can much more easily invest in stocks themselves via online stockbrokers with ever more streamlined interfaces and cheaper costs. In any case, it looks like talk of the victory of passive investment could be premature.

We think the growth of passive investment is likely to continue in the UK, but just as in the US, it will not be ideological and investors will be comfortable investing in highly active strategies alongside passive funds, or investing in equities themselves, or indeed bitcoin or other cryptocurrencies.

There should therefore still be a future for truly active funds, and that is where the investment trust space excels. For example, below we show the constituents of the AIC UK All Companies sector versus the FTSE All-Share index. We show some current portfolio characteristics as well as performance characteristics over the past five years, and the data is ordered by five-year returns.

The first column is the r-squared of the NAV versus the FTSE All-Share index. This shows how active the behaviour of the trust’s NAV has been. The scores are generally very low for a set of active funds, in our view. R-squared tells you what percentage of returns can be explained by returns in the market on a simple one-factor model, so a lower number implies a fund is more active.

We then show the market cap breakdown, which is one source of the differentiated return profile. It is interesting that the funds generally have high betas, implying the managers are using gearing and the ability to buy small and mid-caps to boost returns. All this would imply that returns should be expected to be much better in rising markets, which is an interesting thought if you expect a recovery in the markets over the coming years.

In our view, this contributes to a picture of a sector full of highly differentiated, highly active strategies which should retain their appeal as the shift to passives increases.

UK ALL COMPANIES SECTOR

| R2 | Market Cap Giant % | Market Cap Large % | Market Cap Mid % | Market Cap Small % | Market Cap Micro % | Return (Annualized) | Alpha (Annualized) | Beta | Sharpe Ratio (Annualized) | Std Dev (Annualized) | |

| Aurora Ord (LSE:ARR) | 66.8 | 0.0 | 20.8 | 38.9 | 7.9 | 2.0 | 10.9 | 5.7 | 1.0 | 0.5 | 26.5 |

| Fidelity Special Values Ord (LSE:FSV) | 86.6 | 7.5 | 25.4 | 15.4 | 35.9 | 8.4 | 8.6 | 2.9 | 1.1 | 0.4 | 22.8 |

| Schroder UK Mid Cap Ord (LSE:SCP) | 80.9 | 0.0 | 0.0 | 44.8 | 58.5 | 3.8 | 6.2 | 0.8 | 1.2 | 0.3 | 27.4 |

| Artemis Alpha Trust Ord (LSE:ATS) | 75.0 | 13.3 | 30.2 | 37.6 | 7.9 | 6.8 | 6.0 | 0.8 | 1.0 | 0.3 | 25.4 |

| FTSE All Share | 100.0 | 39.0 | 31.7 | 18.4 | 5.2 | 0.9 | 5.8 | 0.0 | 1.0 | 0.3 | 20.6 |

| Mercantile Ord (LSE:MRC) | 78.0 | 0.0 | 0.0 | 55.9 | 49.4 | 4.7 | 5.6 | 0.3 | 1.2 | 0.3 | 28.9 |

| Henderson Opportunities Ord (LSE:HOT) | 84.3 | 7.8 | 22.6 | 9.9 | 27.8 | 40.3 | 3.8 | -1.7 | 1.1 | 0.2 | 23.5 |

| Baillie Gifford UK Growth Trust Ord (LSE:BGUK) | 81.5 | 3.9 | 17.3 | 39.4 | 33.0 | 2.6 | 2.1 | -3.2 | 1.0 | 0.1 | 24.0 |

Source: Morningstar. Past performance is not a reliable indicator of future results

We think the strong performance of Fidelity Special Values Ord (LSE:FSV)is particularly striking. The past five years have seen some dramatic style rotations which have been tough for investors to navigate, and manager Alex Wright’s contrarian, valuation-sensitive approach has had plenty of success. The past five years have seen two distinct periods of market style. The initial phase significantly favoured growth investing as interest rates remained close to zero. Whilst this environment should have been a headwind, Alex only notably underperformed during the initial market falls during the pandemic. However, when inflation and therefore interest rates rose, the value style came back into favour which has contributed to Alex delivering significant outperformance. The contrarian approach, small- and mid-cap bias and strong stock-picking are all ingredients of the trust’s success, and are discussed in our recent note.

Schroder UK Mid Cap Ord (LSE:SCP)has also performed well over five years, despite mid-caps being out of favour for much of the period. While the mid-cap bias is a key explanatory factor for performance versus the FTSE All-Share index, it is worth noting that the trust has outperformed the FTSE 250 index in eight of the past nine calendar years, testament to the value added by the active stock-picking of Jean Roche and Andy Brough. Mercantile Ord (LSE:MRC) has marginally underperformed the benchmark over five years, but has a strong long-term track record and has a similarly active approach focused on the mid-caps. Both trusts have significant levels of gearing, which increases the return potential and could boost returns if the low valuations of the UK mid-caps lead to a period of strong returns.

Conclusion

We think there’s a strong case to be made for creating incentives for institutional capital to be invested in UK markets in order to benefit the British economy. We don’t think there is anything sacred about a benchmark-aware, semi-passive approach, which is what opponents of these measures seem to value. This is particularly the case when you consider how artificial the benchmark-construction process is. We already accept restrictions and incentives in other scenarios, with institutional investors not always able to invest in all asset classes, and so this would not be breaking new ground, and the arguments that a passive approach is the only proper approach to investment hold no water.

Meanwhile, evidence from the US seems to imply that there is still plenty of appetite for genuinely active investment opportunities, and less and less interest in semi-active approaches. Keeping UK capital in UK markets would boost liquidity and improve the opportunity set for managers in the UK All Companies sector as well as retail investors managing their own money. In our view this would be a welcome next step in the de-globalisation trend.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.