UK stocks are a bargain after record slump in company revenues

A ‘pariah’ in recent years, the UK stock market now sits at ‘multi-year lows’ relative to peers.

14th July 2021 09:01

by Alex Sebastian from interactive investor

A ‘pariah’ in recent years, the UK stock market now sits at ‘multi-year lows’ relative to peers.

The pandemic caused a record £349 billion decline in UK plc revenues, which has left many stocks attractively valued, new research has found.

According to fund management firm J O Hambro, total sales across all companies were 19% lower in the first 12 months covering the pandemic (April 2020 to March 2021) than during the previous year.

The ‘J O Hambro UK Profit Index’ analyses the latest quarterly and half-yearly results published by all the companies listed on the UK main market, excluding investment trusts and Real Estate Investment Trusts (REITs). It also looks at the last 12 months on a rolling basis to identify trends.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

As one would expect, the impact of the lockdowns was deeper and more widespread than any downturn in recent history. More than half of all listed UK companies saw sales fall during the period.

The lower sales sent profits down 61%, with asset writedowns a key driver of this as well. Free cash flow fell much less than profits, with a 20% fall.

- No trading fees on US shares for new and existing customers from Monday 12 to Friday 16 July 2021. Find out more here

- Discover how to be a better investor here

- Check out our award-winning stocks and shares ISA

J O Hambro found evidence of a strong bounce back between April and June this year, however. Sales across all companies were down just 5.8% year-on-year for the quarter as profits almost tripled with a 181% rise.

The firm now expects the next major round of company results will show a dramatic recovery, and profits could even double to around £110 billion by spring 2022 on an aggregate basis. Profits should even regain their pre-pandemic levels within a further year.

This recovery combined with the steep falls in share prices seen by many companies has left many parts of UK plc looking like a stock market bargain, according to the fund firm.

J O Hambro noted in the report that “political uncertainty” made the UK stock market “a pariah” in recent years even before the pandemic hit, which then compounded this.

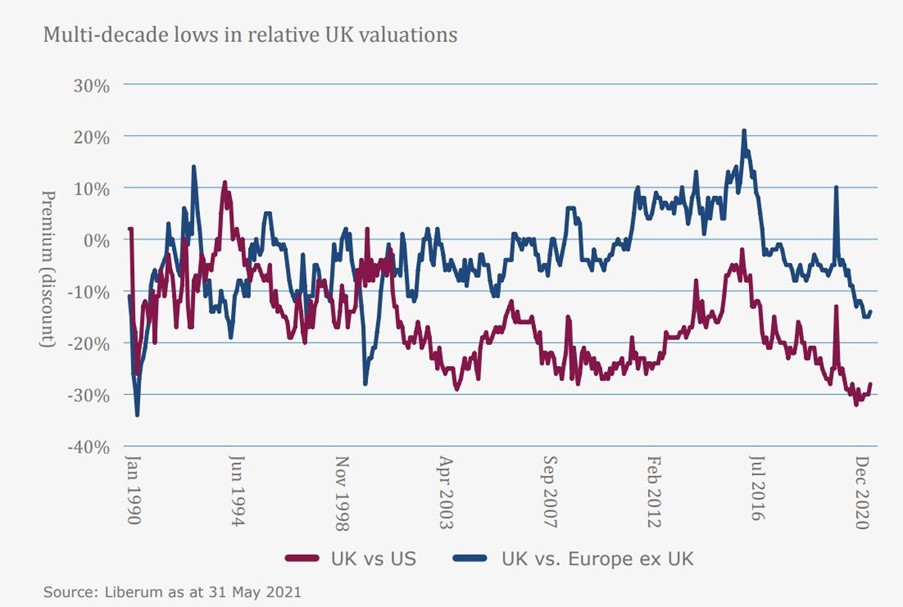

The result, according to the fund manager is the UK market sitting at “multi-year lows” relative to peers, as illustrated here:

The report noted that low portfolio weightings to UK stocks go hand in hand with such low valuations, and mean the UK now looks “very attractive in a global context”.

- A guide on how investors can protect against inflation

- Top 20 most-bought UK shares in Q2 2021

- Stock market recovery 2021: half-term report

Compared to the US and mainland Europe, UK stocks are about a quarter and one-seventh cheaper respectively, based on price/earnings ratios. Similar trends can be seen in other measures such as price-to-book ratio; a company’s share price compared to the total value of its assets.

Alexandra Altinger, CEO for UK, Europe and Asia at J O Hambro, said: “After the shock of the pandemic the change of mood in Britain’s boardrooms is palpable.”

“The recovery is now very strong indeed: high government spending, low interest rates, strong consumer demand, resurgent employment and a buoyant housing market mean that profits are now growing very fast, much faster than market expectations.”

“Surging profits are complemented by enticing valuations. All four J O Hambro UK equities teams agree that UK shares are attractively priced at present, both compared to historic levels and international peers.”

“Valuations across the stock market appear cheap, and in some segments very cheap. Our fund managers are not simply interested in the cyclical upswing, however. They are looking for the companies that are honing themselves an edge for the long term, too. And they are finding them.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.