UK Smaller Companies funds up 40% in six months

Saltydog was positioned to profit from a recovery for UK funds and has been adding to its holdings.

4th May 2021 17:10

by Douglas Chadwick from ii contributor

Saltydog was positioned to profit from a recovery for UK funds and has been adding to its holdings.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

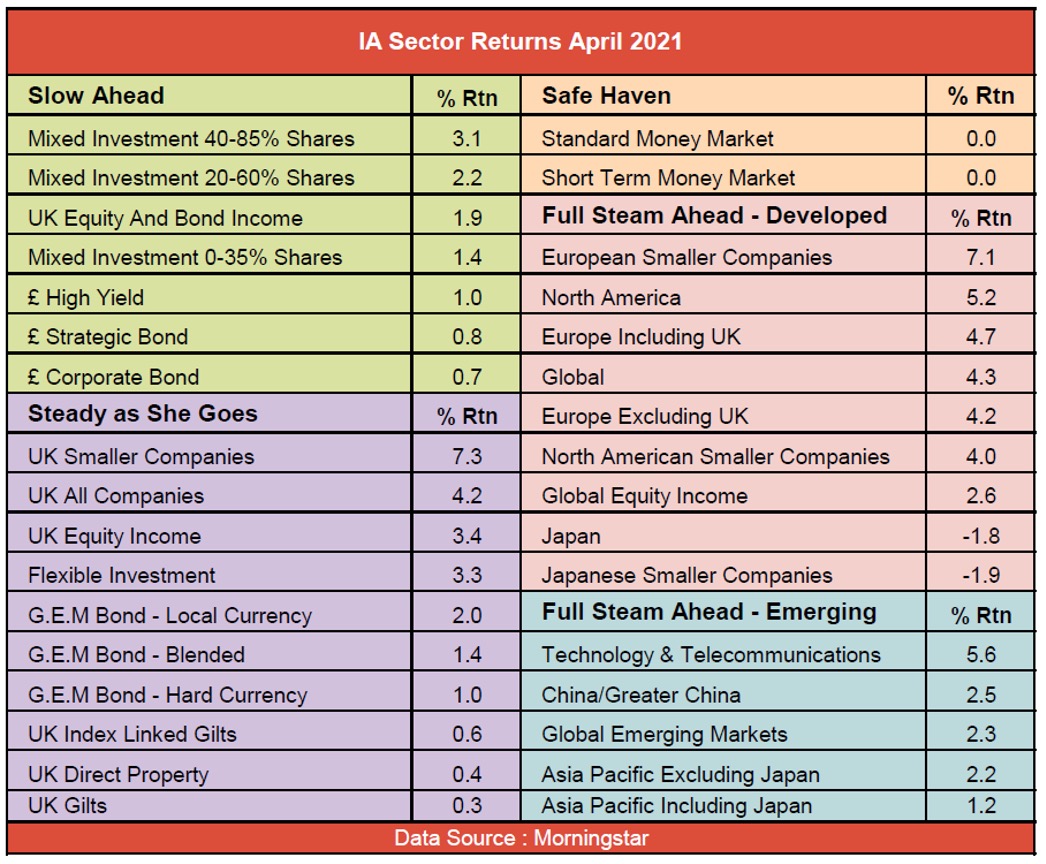

The best-performing sector in the first quarter of the year was UK Smaller Companies, rising by just over 9% between the 1 January and the 31 March. Last month, it extended its winning streak, gaining a further 7.3%.

The UK equity sectors struggled for much of last year. In February 2020, when it became clear that the Covid-19 pandemic was going to have a dramatic effect on the global economy, the UK Smaller Companies sector fell by 10.1% and the following month it lost a further 22.9%. The UK All Companies and UK Equity Income sectors did only marginally better.

Although they then started to recover, the UK equity sectors did not pick up as quickly as those investing overseas. Not only was the UK in lockdown, but it had still not finalised the withdrawal agreement with the European Union.

It was not until November that the tide started to turn. There were several Covid-19 vaccines that had performed well in clinical trials and were being fast-tracked through the approval process. The UK planned to start a national roll-out in December and, finally, there seemed to be some light at the end of the tunnel.

- How Saltydog invests: a guide to its momentum approach

- UK equity funds have a strong first quarter

- This UK fund sector is in fine form

Last November, the FTSE 100 index had its best month since 1989, rising by more than 12%, and this was reflected in the performance of the UK sectors. In November, the UK Smaller Companies sector went up by 12.7% and the UK All Companies and UK Equity Income sectors did even better.

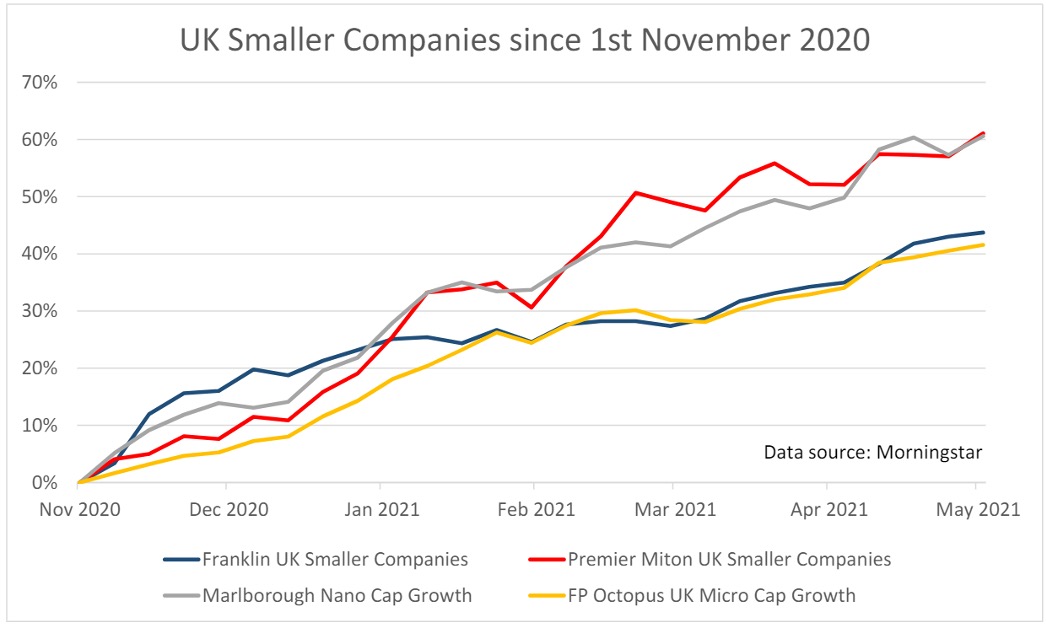

On 19 November, our demonstration portfolios invested in several funds investing in the UK, including the Franklin UK Smaller Companies fund. We are still invested in this fund and have recently added to our holding.

We increased our exposure to the UK Smaller Companies sector in January by investing in the Premier Miton UK Smaller Companies fund. In February, we added the Marlborough Nano Cap Growth and the FP Octopus UK Micro Cap Growth funds. Over the last six months, all these funds have gone up by more than 40%, which is the sector average return over this time frame.

Our holdings in the funds from the UK Smaller Companies sector currently account for around 22% of the overall amount invested in our demonstration portfolios.

With Brexit behind us and the country gradually emerging from lockdown, hopefully the UK economy can strengthen, and the UK Smaller Companies sector will continue to perform well.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.