UK small caps help Saltydog portfolios to a record high

UK investments we backed in November are now bearing fruit, especially one small-cap fund.

11th January 2021 12:45

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

UK investments we backed in November are now bearing fruit, especially one small-cap fund.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

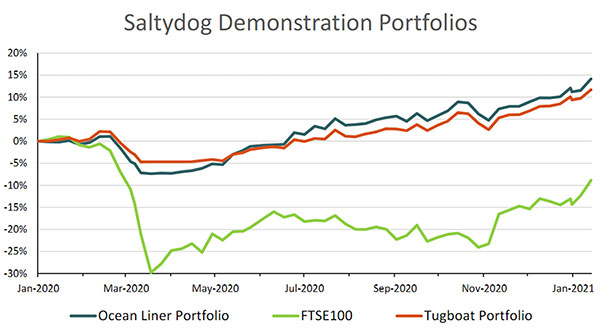

As is often the case, stock markets around the world had a final flourish in the run up to Christmas. The FTSE 100 index gained 3.1% in December to add to the 12.4% that it made in November. Unfortunately, it was still not enough to make up for losses earlier in the year. Overall, it went down by 14.3% in 2020.

The FTSE 250 did better, gaining 6% in December, but it still ended the year down 6.4%.

- How Saltydog invests: a guide to its momentum approach

- Four funds that helped power our portfolios to all-time highs

The recent return to form for the sectors investing in UK equities is now beginning to show in our sector analysis.

In November, UK Equity Income was the best-performing sector, and the UK All Companies and UK Smaller Companies sectors were not that far behind.

Last month, the UK Smaller Companies sector saw the greatest return, up 7.5%, with the UK All Companies and UK Equity Income sectors also making reasonable gains.

Past performance is not a guide to future performance.

This year, the FTSE 100 has got off to a flying start and has already gone up by 6%.

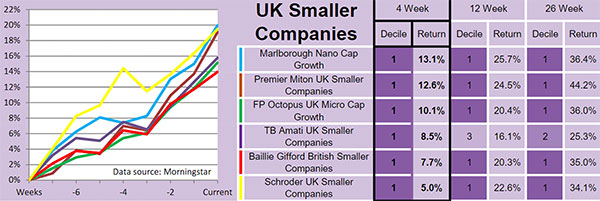

When we looked at the sector reports last week, the UK Smaller Companies sector had the best returns over four, 12 and 26 weeks. A few of the leading funds were showing gains of more than 10% in four weeks, 20% in 12 weeks and 35% in 26 weeks.

Past performance is not a guide to future performance.

In our demonstration portfolios, we picked up on the improving performance of the UK sectors during November and invested in funds from the UK Equity Income, UK All Companies and UK Smaller Companies sectors. In December, we added a couple of funds from the UK Equity & Bond Income sector.

Both portfolios went up during December and are now at all-time highs.

Past performance is not a guide to future performance.

The Franklin UK Smaller Companies fund was one of the funds that we recently selected, and it has gone up by 8.2% since we went into it in November. It is currently in decile two, based on its return over the last four weeks, which means it does not feature in our current shortlist of leading funds. However, we are happy with its progress.

It is obviously early days, but hopefully the Brexit deal and a successful vaccination programme will help the UK stock market make up some of the ground that it lost last year. If the UK Smaller Companies sector continues to trend up, we will consider investing in more funds from this sector.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.