The UK funds leading the way as FTSE 100 hits new record high

Saltydog crunches the numbers to see which UK funds are at the top of the performance charts as the positive run for the FTSE 100 index continues.

30th April 2024 09:04

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

This year, several stock markets around the world have already set new all-time highs. We have seen it in America, continental Europe, and even the Japanese Nikkei 225 beat its previous record, which was set 34 years ago.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Last week, the FTSE 100 joined the club, closing above 8,100 for the first time.

| Stock market indices | Annual returns | 2024 | ||||||

| Index | 2021 | 2022 | 2023 | Jan | Feb | March | 1 to 7 April | Year-to-date |

| FTSE 100 | 14.3% | 0.9% | 3.8% | -1.3% | 0.0% | 4.2% | 2.4% | 5.3% |

| FTSE 250 | 14.6% | -19.7% | 4.4% | -1.7% | -1.6% | 4.4% | -0.3% | 0.7% |

| Dow Jones Ind Ave | 18.7% | -8.8% | 13.7% | 1.2% | 2.2% | 2.1% | -3.9% | 1.5% |

| S&P 500 | 26.9% | -19.4% | 24.2% | 1.6% | 5.2% | 3.1% | -2.9% | 6.9% |

| NASDAQ | 21.4% | -33.1% | 43.4% | 1.0% | 6.1% | 1.8% | -2.8% | 6.1% |

| DAX | 15.8% | -12.3% | 20.3% | 0.9% | 4.6% | 4.6% | -1.8% | 8.4% |

| CAC40 | 28.9% | -9.5% | 16.5% | 1.5% | 3.5% | 3.5% | -1.4% | 7.2% |

| Nikkei 225 | 4.9% | -9.4% | 28.2% | 8.4% | 7.9% | 3.1% | -6.0% | 13.4% |

| Hang Seng | -14.1% | -15.5% | -13.8% | -9.2% | 6.6% | 0.2% | 6.7% | 3.5% |

| Shanghai Composite | 4.8% | -15.1% | -3.7% | -6.3% | 8.1% | 0.9% | 1.6% | 3.8% |

| Sensex | 22.0% | 4.4% | 18.7% | -0.7% | 1.0% | 1.6% | 0.1% | 2.1% |

| Ibovespa | -11.9% | 4.7% | 22.3% | -4.8% | 1.0% | -0.7% | -1.2% | -5.7% |

Data source: Morningstar. Past performance is not a guide to future performance.

The FTSE 100 did not perform as well as most of the other markets that we track in 2023, and struggled in January and February of this year. However, it was one of the leading markets in March, up 4.2%, and it has gained a further 2.4% in April.

- How the pros are preparing portfolios for interest rate cuts

- DIY Investor Diary: how I’m aiming for £10,000 annual income from my ISA

The funds investing in UK companies can fall into three different Investment Association (IA) sectors: UK All Companies, UK Smaller Companies, and UK Equity Income.

Here are the IA definitions for each of these sectors along with the top funds, based on their performance so far this year.

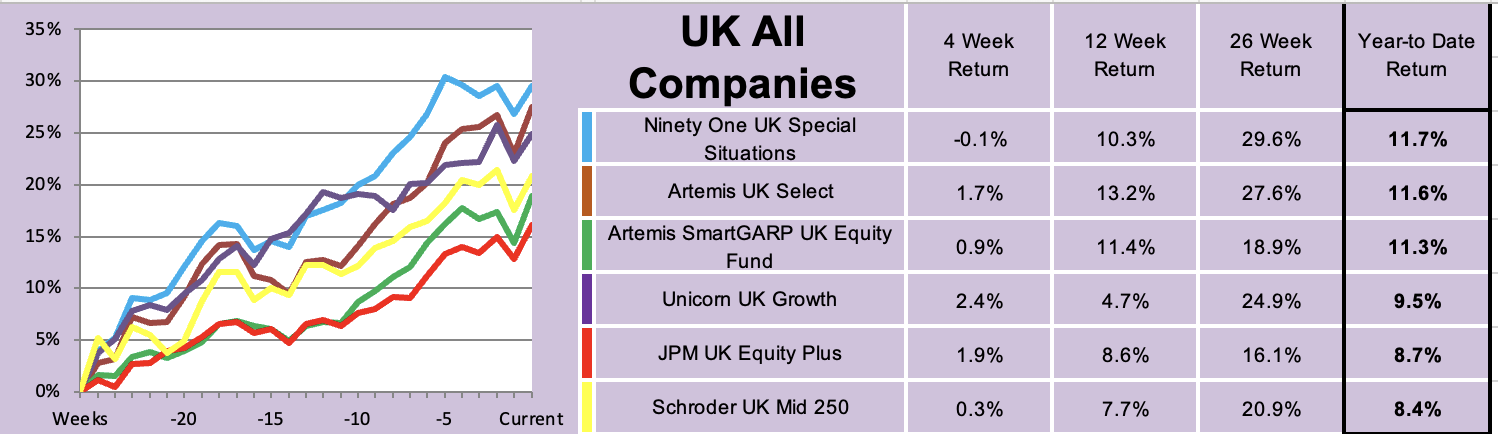

The UK All Companies sector is for “funds which invest at least 80% of their assets in UK equities, which have a primary objective of achieving capital growth”.

Past performance is not a guide to future performance.

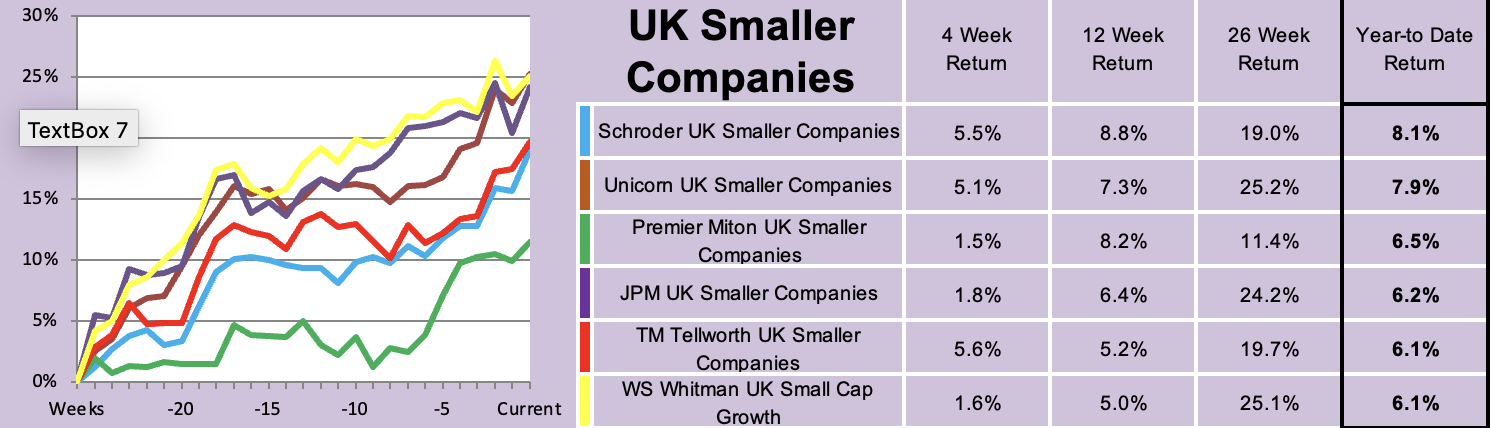

The UK Smaller Companies sector is for “funds which invest at least 80% of their assets in UK equities of companies which form the bottom 10% by market capitalisation”.

Past performance is not a guide to future performance.

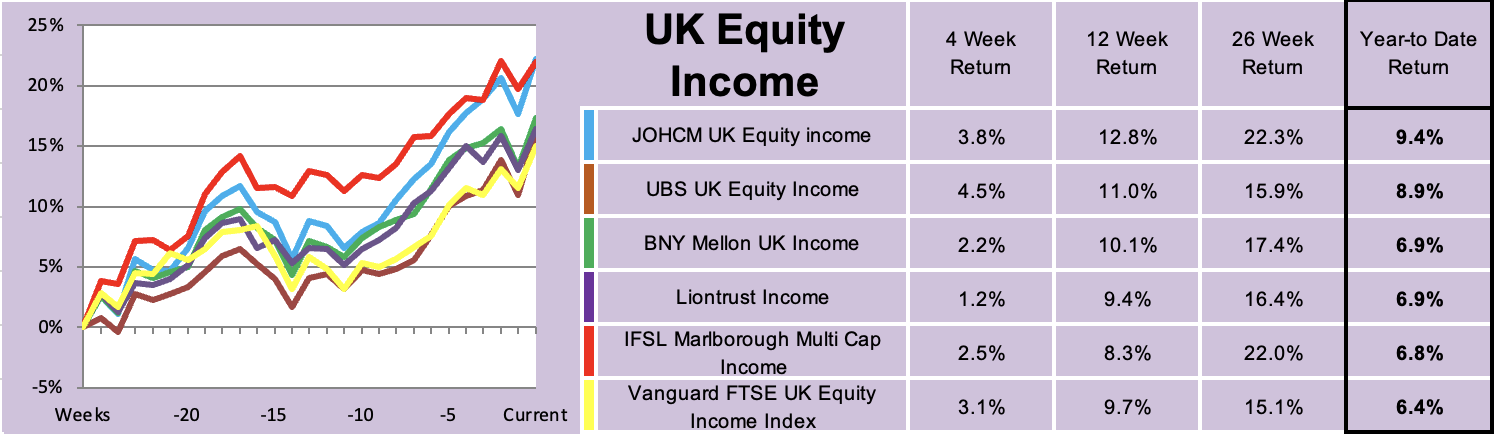

And finally, the UK Equity Income sector which is for “funds which invest at least 80% in UK equities and which intend to achieve a historic yield on the distributable income in excess of 100% of the FTSE All-Share yield at the fund's year end on a three-year rolling basis and 90% on an annual basis”.

Past performance is not a guide to future performance.

There are various advantages in investing relatively close to home. You probably have a better understanding of the local economic and political environment. It also reduces the currency exchange risk that comes with investing abroad. However, it is worth noting that the FTSE 100 is slightly unusual in that a lot of the listed companies generate most of their income overseas.

- Where to invest in Q2 2024? Four experts have their say

- A glaring opportunity to snap up these cheap investment trusts

Another advantage is that there is a wide range of funds available, with the UK All Companies sector the largest in our analysis. However, as you can see, the performance can vary significantly from fund to fund. We are just looking at the top six funds in each sector and their year-to-date returns already go from 11.7% down to 6.1%. (The worst-performing fund, looking at all funds in these sectors, has gone down by over 3% in the same period).

The best-performing fund has been Ninety One UK Special Situations.

Our Ocean Liner portfolio invested in this fund last year, in early December, and we added to our position in February. Last month, we increased our holding again, and at the same time introduced this fund into our Tugboat portfolio.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.