UK funds leading the pack, so we are buying

Saltydog has added more UK funds to its portfolios to take advantage of double-digit returns for UK fund.

7th December 2020 14:10

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog has added more UK funds to its portfolios to take advantage of double-digit returns for UK fund sectors in November.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

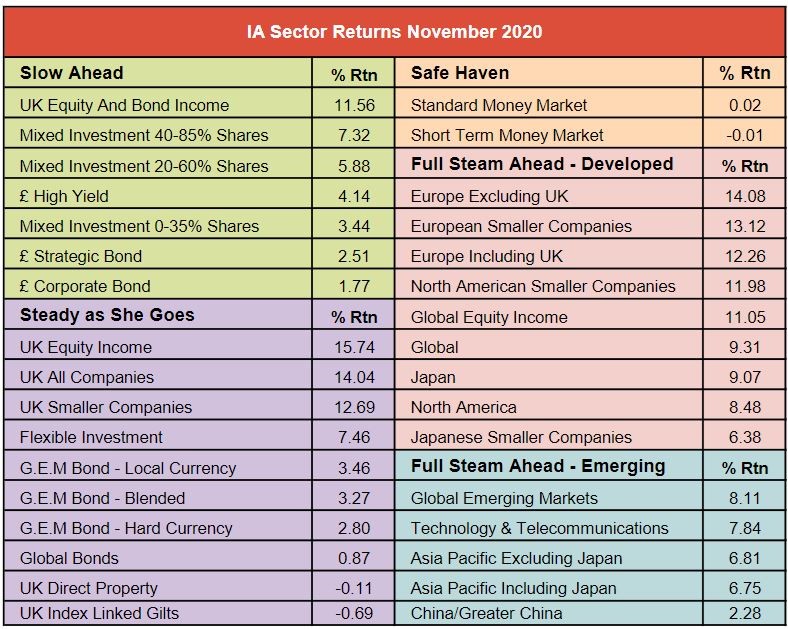

After a difficult October, with most stock markets seeing substantial losses, we saw a complete reversal in November. Equity markets around the world soared. In the UK, the FTSE 100 index had a particularly good month, rising by over 12%. This was its best one month return since 1989.

This has been reflected in our Investment Association sector analysis where all of the sectors investing in UK shares performed well. The sector with the highest return last month was UK Equity Income, gaining 15.7%. The UK Equity and Bond Income, UK All Companies and UK Smaller Companies sectors also saw double-digit growth.

In our demonstration portfolios we have increased our exposure to the UK sectors.

A few weeks ago we invested in the Merian UK Equity Income fund, from the UK Equity Income sector, and the Artemis UK Select fund, from the UK All Companies sector. We have subsequently increased our holdings.

- How Saltydog invests: a guide to its momentum approach

- The two UK funds Saltydog has just bought

- ii Super 60 investments: Quality options for your portfolio, rigorously selected by our impartial experts

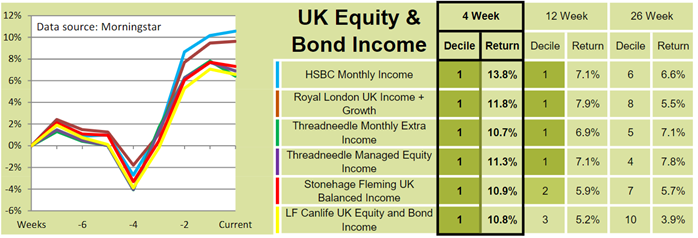

Last week we added the HSBC Monthly Income fund to our Tugboat portfolio and the Threadneedle Managed Equity fund to our Ocean Liner portfolio.

These are both funds from the UK Equity and Bond Income sector, which was the leading sector in our Saltydog ‘Slow Ahead’ Group. The group is made up of sectors investing in bonds, or a combination of bonds and equities, and each week we rank them based on their returns over the previous four weeks. In the past, these sectors have been less volatile than ones just investing in equities.

Past performance is not a guide to future performance

The Threadneedle Managed Equity Income fund has not done as well over the last four weeks, but has done better than the majority of other funds over the last 26 weeks, which swayed our decision to invest in this fund.

- Here’s where investors have been putting their money

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

With one in each portfolio, it will be interesting to see which one does best over the next few weeks.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.