This UK fund sector is in fine form

Saltydog analyst has found a trend among UK funds, and names the five he is backing to play it.

29th March 2021 17:19

by Douglas Chadwick from ii contributor

Saltydog analyst has found a trend among UK funds, and names the five he is backing to play it.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

If you had told me 18 months ago that it would be illegal for half a dozen friends in England to get together for a few drinks, I would never have believed you. We are rightly proud of our democratic history and fiercely protect the freedom of our people. In principle, we oppose undue legislation and restrictive practices.

This is the first time since the world wars that the government has had to impose such direct controls on the day-to-day lives of its electorate; determining who we are/are not allowed to see, and even who can and cannot work. By any standards, it has been a challenging 12 months.

- How Saltydog invests: a guide to its momentum approach

- Your chance to win £1,000: take part in the Great British Retirement Survey

I do not envy the politicians who have had to make some very difficult decisions over the last year, and with hindsight it is easy to find fault. However, the support for the development, testing, approval and roll-out of the vaccines has meant that the UK has now started to lift restrictions. For the first time since early November, we can now meet in groups of six, or two families, in an outside space.

The UK stock market crashed just over a year ago, along with markets all around the world. When it started to recover, it struggled compared with other nations, especially the US. We had the additional complication of Brexit to deal with, and a lot of our largest listed companies are the massive multinational businesses, which rely on shipping goods and materials all around the world; they are not suited to a lockdown environment.

On the other hand, the businesses that thrive on providing online solutions prospered.

- The UK shares the pros are backing to play the post-pandemic recovery

- Cutting back on some old fund favourites

Since November, when the first vaccines were approved, we have seen the tide beginning to turn and UK sectors starting to pick up.

Each week, we provide our members with performance data on a wide range of funds, investment trusts and exchange-traded funds (ETFs). We have designed the reports to help private investors, such as ourselves, spot trends in the markets and then establish which funds are riding the current wave of momentum.

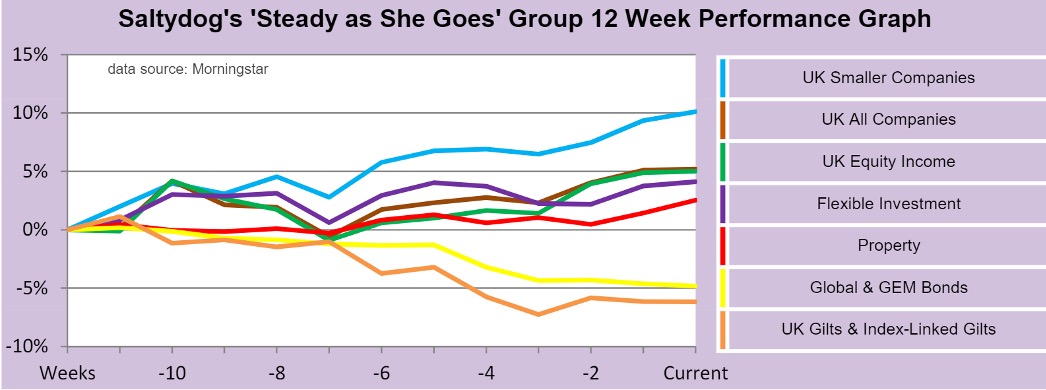

We start by looking at how the different Investment Association (IA) sectors are performing. We combine them into our Saltydog groups, based on their historic volatility. The least volatile sectors are in the ‘Safe Haven’ group, then ‘Slow Ahead’, followed by ‘Steady As She Goes’ and the ‘Full Steam Ahead’ group for the most volatile sectors. We split the ‘Full Steam Ahead’ Group into developed and emerging markets.

The three UK equity sectors, UK All Companies, UK Smaller Companies, and UK Equity Income are all in our ‘Steady as She Goes’ group. Although they have the risk associated with being fully invested in stocks and shares, they are not as exposed to currency fluctuations as funds in the ‘Full Steam Ahead’ groups.

Here’s a graph from the reports that we released last week showing their 12-week performance up until the 20 March.

Past performance is not a guide to future performance.

Over this period, the UK Equity Income and UK All Companies sectors have gained around 5%, while the UK Smaller Companies sector is up by more than 10%. Their progress has also been relatively stable.

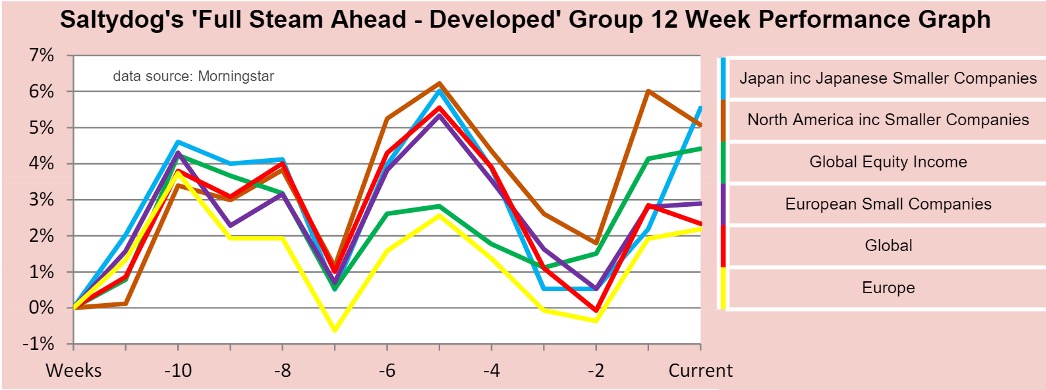

In contrast, look at the volatility of the sectors in our ‘Full Steam Ahead – Developed’ group.

Past performance is not a guide to future performance.

In recent months, our demonstration portfolios have sold all the funds they were holding from the 'Full Steam Ahead' groups and have prioritised funds investing closer to home.

We currently hold the Artemis UK Select, Franklin UK Smaller Companies, Premier Miton UK Smaller Companies, Marlborough Nano Cap Growth and FP Octopus UK Micro Cap Growth funds.

In two weeks, we will hopefully be allowed a drink in a beer garden with five friends, and in 48 days we might be able to actually go into the pub. This timetable reflects the more general return to normal for thousands of UK businesses – hopefully there will be plenty to celebrate in the coming weeks and months.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.