Two food chains that will thrive despite the pandemic

An inevitable surge in demand very soon makes this pair attractive to our overseas investing expert.

20th May 2020 09:38

by Rodney Hobson from interactive investor

An inevitable surge in demand very soon makes this pair attractive to our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Financial health and physical well-being are two quite separate issues. You may never visit a fast food outlet; you may detest the food. But shares in companies such as McDonald’s (NYSE:MCD) could still be to your taste.

It is true that fast food will come under heavy criticism because people suffering from obesity and Type 2 diabetes, which are linked to unhealthy lifestyles, have been more prone to fall seriously ill or die from Covid-19. You might think that this wake-up call will have an immediately and long-term effect. Do not count on it.

Western governments have spent decades trying to stamp out smoking, yet even after the word death was put on heavily taxed cigarette packets, smokers have continued to put cash into the pockets of tobacco company shareholders.

Wherever there are social distancing rules, as in the UK, food chain outlets will be severely limited in numbers of meals that can be eaten on the premises.

However, chains such as McDonald’s should have little difficultly organising queues for takeaways, while drive-through sales will be unaffected.

McDonald’s generates revenue through nearly 40,000 company-owned and franchised restaurants in 120 countries and via licensing.

It has managed to keep 99% of its US outlets open, though mostly as takeaways, but restaurants in other leading countries such as France, Italy, Spain and the UK have been closed temporarily.

These are now being reopened and all UK restaurants will be up and running in June. The company says demand at reopened sites has been “huge”.

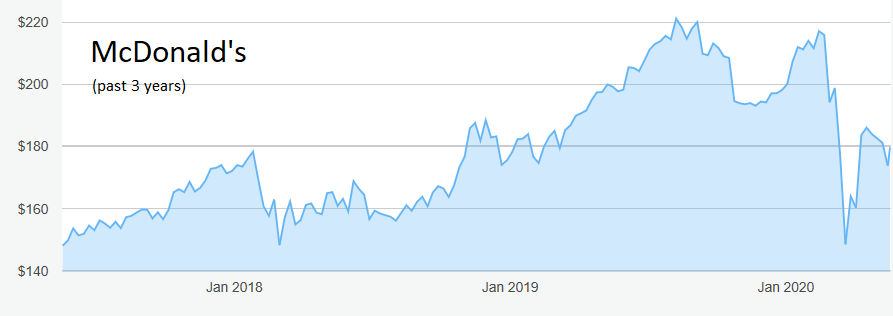

Source: interactive investor. Past performance is not a guide to future performance.

It needs to be, as global sales slumped 22% in March and the trend will have continued throughout April and for much of May.

Net income fell from $1.33 billion in the first quarter of 2019 to $1.11 billion this time. The second-quarter comparison will inevitably be worse, probably substantially so.

The outlook for the rest of the year, issued as recently as February, has been withdrawn. However, McDonald’s will surely get back to the kind of growth it boasted in the final quarter of 2019.

Like-for-like growth was 5.9%, the best for more than a decade, while revenue rose 4% to $5.35 billion. Net income of $1.57 billion was up 11%.

The quarterly dividend stood at $1.25.

There is no danger that the group will run into cash-flow difficulties in the meantime. At the end of March, it took the precaution of raising $1 billion in borrowings for one year to add to the $3.5 billion in a revolving credit agreement entered into in 2018, which remains unborrowed.

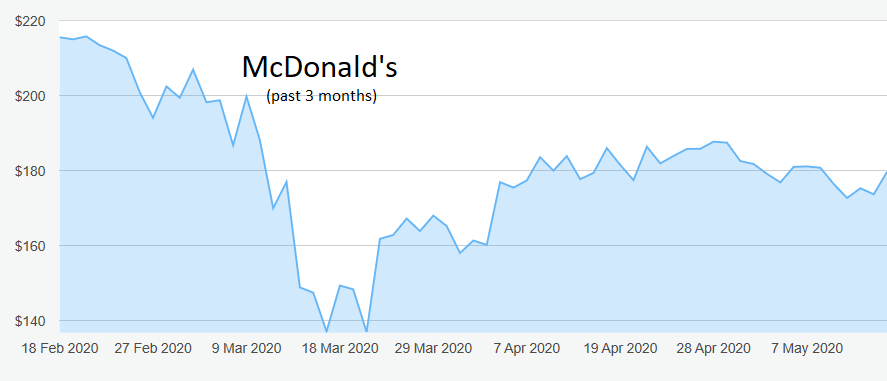

McDonald’s shares pushed above $220 last summer and were not far off that level when the crisis broke, but they plunged below $140 in mid-March.

Well done anyone brave enough to pick them up at that stage. They are currently back around $180 and will surely recover further as life returns to normal later in the year.

Source: interactive investor. Past performance is not a guide to future performance.

An alternative is Restaurant Brands (NYSE:QSR), owner of Burger King and Tim Hortons.

It is smaller than McDonald’s with 27,000 outlets, but is expanding through mergers and acquisitions.

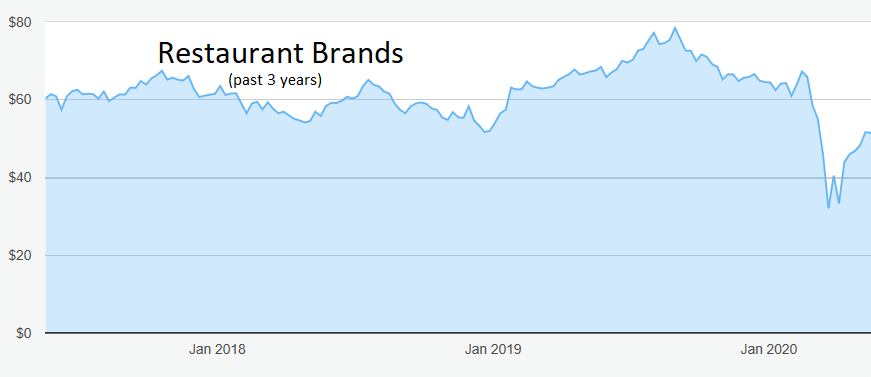

I suggested buying at $75 last August but the share price performance since has been far more disappointing, even before the coronavirus shutdown sent them tumbling to a low of $28.

They have returned to $52 and should continue a slow but steady recovery.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I last looked at McDonald’s in December, well before the company was knocked out of line by the Covid-19 epidemic, and suggested buying below $200. Things have not gone as planned but the advice still stands. Restaurant Brands is worth considering up to $60 at this stage.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.