Two big dividends for adventurous income seekers

27th July 2022 10:28

by Rodney Hobson from interactive investor

With US earnings season in full swing, our overseas investing expert gives his view on this trio of famous multinationals to help diversify your portfolio.

Second-quarter results from American companies have brought the inevitable crop of winners and losers. Time for a few updates.

I don’t often write about tobacco maker Philip Morris International (NYSE:PM), partly because many investors object to tobacco companies on ethical grounds and partly because tobacco is, in theory, being taxed out of existence.

Yet Philip Morris has just raised its outlook for the rest of this year after revenue and earnings both grew in the second quarter. Revenue was up by 3.1%. to $7.83 billion and by 6.1% on an underlying basis. Earnings per share edged up from $1.39 to $1.43.

While this was not a stellar performance, it was a considerable improvement on the first quarter, when income declined by 4.2% and earnings per share by 3.2%. The company now expects revenue to grow 6-8% for the full year and earnings per share to jump 10-12%, both figures assuming stable foreign exchange rates. Given that first-half growth has been pretty anaemic, this implies a very strong performance in the second half.

- Discover more: US Earnings Season | Top US Stocks | Interactive investor Offers

The key is to persuade smokers to switch to the more acceptable face of tobacco, the smoke-free products that now account for 29% of revenue and rising. Philip Morris estimates it has 19 million such customers, up by a fifth on 12 months ago.

Certainly, the company is looking to expand rather than draw in its horns. It has bid $16 billion in cash for Swedish Match (OMX:SWMA), which makes a range of smoke-free products sold mainly in the US and Scandinavia.

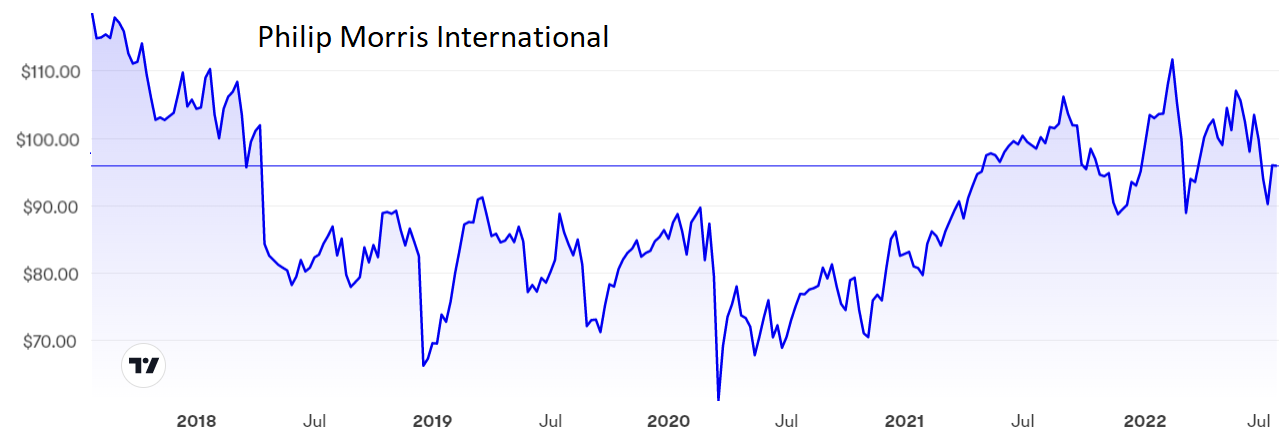

Philip Morris shares have swung between $120 and $60 over the best five years and currently are roughly in the middle at $96, where the price/earnings (PE) ratio is near the market average at 16.45, but the dividend is an attractive 5.21%. It can be seen as a defensive stock in tough times thanks to brand loyalty among customers (critics would rephrase that as addicts) and it is hard to see sales falling much, whatever health-conscious governments may determine.

Source: interactive investor. Past performance is not a guide to future performance.

International Business Machines (NYSE:IBM) rather spooked investors by downgrading its guidance for full-year cash flow but the immediate reaction really looked like overkill. For a start, the downgrade was only from a maximum of $10.5 billion foreseen in April to $10 billion now, disappointing but hardly a catastrophe.

For the three months to 30 June, revenue at the technology and consulting company rose 9% year-on-year to $15.54 billion, while net income ticked up 4.5% to $1.39 billion. Sales are growing at a similar rate across all countries that IBM serves, with cloud and artificial intelligence products the main driver. This is a great market to be in.

The spin-off of poorly performing Kyndryl into a separate company last November seems to be working out well, as IBM continues to increase sales to its former managed infrastructure services arm.

IBM expects revenue to continue to grow at roughly 7-8%. There is no reason to fear that it will fall short.

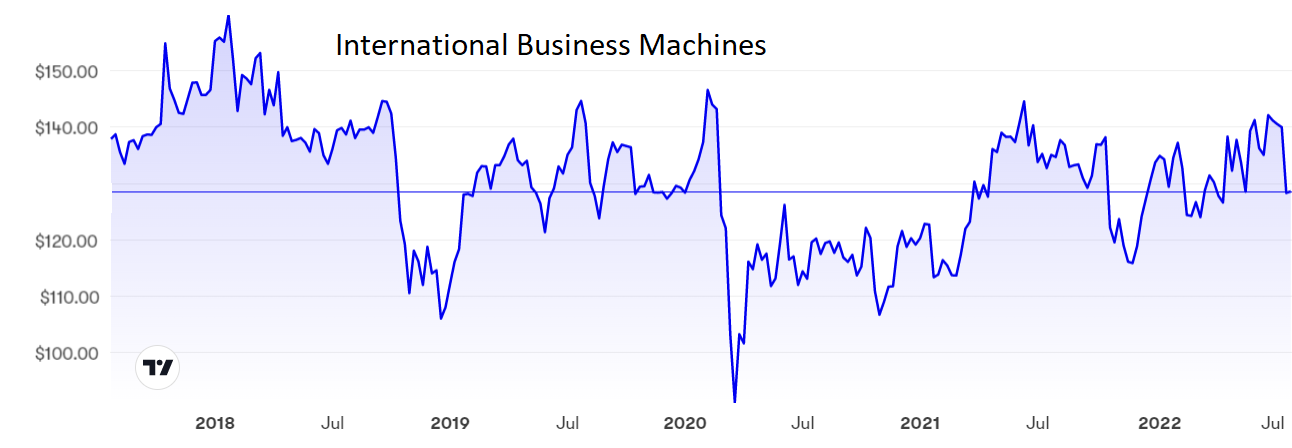

The shares have slumped from a peak of $143 at the end of June to $128 and the downside from here should be limited to $2 at most. The yield of 5.11% is very tempting.

Source: interactive investor. Past performance is not a guide to future performance.

Healthcare group Johnson & Johnson (NYSE:JNJ) also posted sales growth, with the pharmaceutical arm making up for a small decline in consumer health. While the Covid-19 vaccine clearly helped, there was an encouraging performance from multiple myeloma treatment Darzalex, prostate cancer drug Erleada and inflammatory diseases medicine Stelara.

On the negative side, net earnings fell a superficially alarming 23% but that was entirely down to a larger tax provision. The underlying picture showed net income up a respectable if admittedly uninspiring 4.3%.

Guidance for the full year has been maintained for sales growth but trimmed slightly for earnings, so a little caution, though not panic, is called for.

Johnson & Johnson shares have slipped from a recent peak of $182 but at $174 they have quite rightly held up far better than most American shares. They were as low as $110 two years ago at the bottom of the pandemic slump.

Unsurprisingly, the PE is a little demanding at 25 while the yield of 2.5% is not particularly generous but this is after all a quality company.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Philip Morris is not for the ethical investorand the shares are unlikely to take off, but the dividend is attractive so holders should stay in. I think IBM has been oversold to say the least. I have recommended the stock at $120 and $130 and, although the shares are little changed since I did, at least shareholders have benefited from a decent dividend. Buy up to $140.

I rated Johnson & Johnson as a buy at $134, then $144, then $160 and most recently at $170. This is still a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.