The top tech funds as AI boosts returns

Saltydog Investor takes the pulse of the tech sector, and reveals the top funds over the past six months.

26th November 2024 09:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The Technology and Technology Innovation sector was the best-performing sector in 2023, delivering an annual return of 38.7%. It then dropped by 2.5% in the first week of this year but quickly recovered and went on to make a 3.2% gain in January.

The sector also went up in February and March, and ended up being the top sector in the first quarter of the year, with a three-month return of 11%.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

In April, it fell by 3.7% but rallied in May and June. Overall, it gained a further 5.1% in quarter two, and was the leading sector in the first half of the year, with a six-month return of 16.7%.

Much of the growth was attributed to companies involved with developing artificial intelligence (AI) or businesses that might benefit from its widespread adoption. This year, we have seen a semiconductor manufacturer, NVIDIA Corp (NASDAQ:NVDA), overtake Apple Inc (NASDAQ:AAPL) as the world’s largest company. At one point, its share price was showing a year-to-date gain of over 200%.

High-growth technology stocks also tend to thrive when interest rates are falling and so will have benefited from the cuts that we have already seen from the Federal Reserve. Further rate cuts are expected.

However, it has not all been plain sailing. After such a strong performance, it is not unusual for investors to question whether stock valuations have become unrealistic. Any slightly disappointing news can spark a sell-off. In July, the sector suffered its largest drop of the year, falling by 4.4%, and it dropped by a further 0.5% in August. It was the worst-performing sector in the third quarter of this year, losing 4.8%.

- Stockwatch: should you own Nvidia at an all-time high?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

More recently, we have seen this sector rally. On the day that it was announced that Donald Trump had won the US presidential election, the Nasdaq rose by 3% and closed at an all-time high. Investors are expecting his policies to be pro-business, especially for the US, and the prominence of Elon Musk in his campaign would suggest that he will also be pro-technology.

Trump has already said that the US needs to be ‘at the forefront’ of AI development, and has pledged to repeal President Biden's executive order on AI, which he criticised for imposing regulations that he believes stifle innovation.

In October, the Technology and Technology Innovation rose 3.3%, and so far this month it is up a further 6.7%. The leading funds are now back to the highs that we saw earlier in the year.

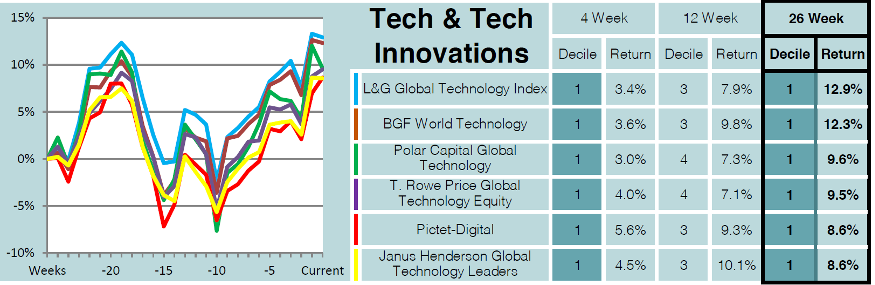

Each week, we highlight the leading funds in each sector based on various different timescales. Here is an excerpt from last week’s reports, showing the top funds from the Technology and Technology Innovation sector, ranked by their performance over the past six months.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.