Top 20 funds in the third quarter of 2021

4th October 2021 14:25

by Douglas Chadwick from ii contributor

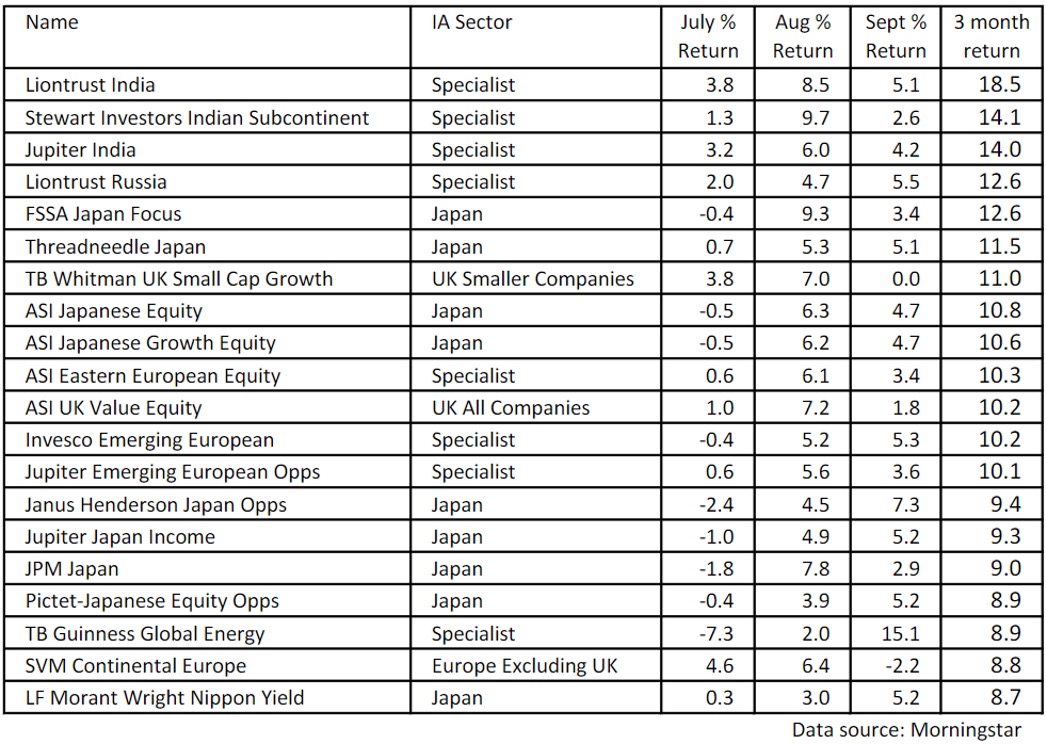

The top four spots over the three-month period were taken by specialist funds, with returns ranging between 13% and 19%.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

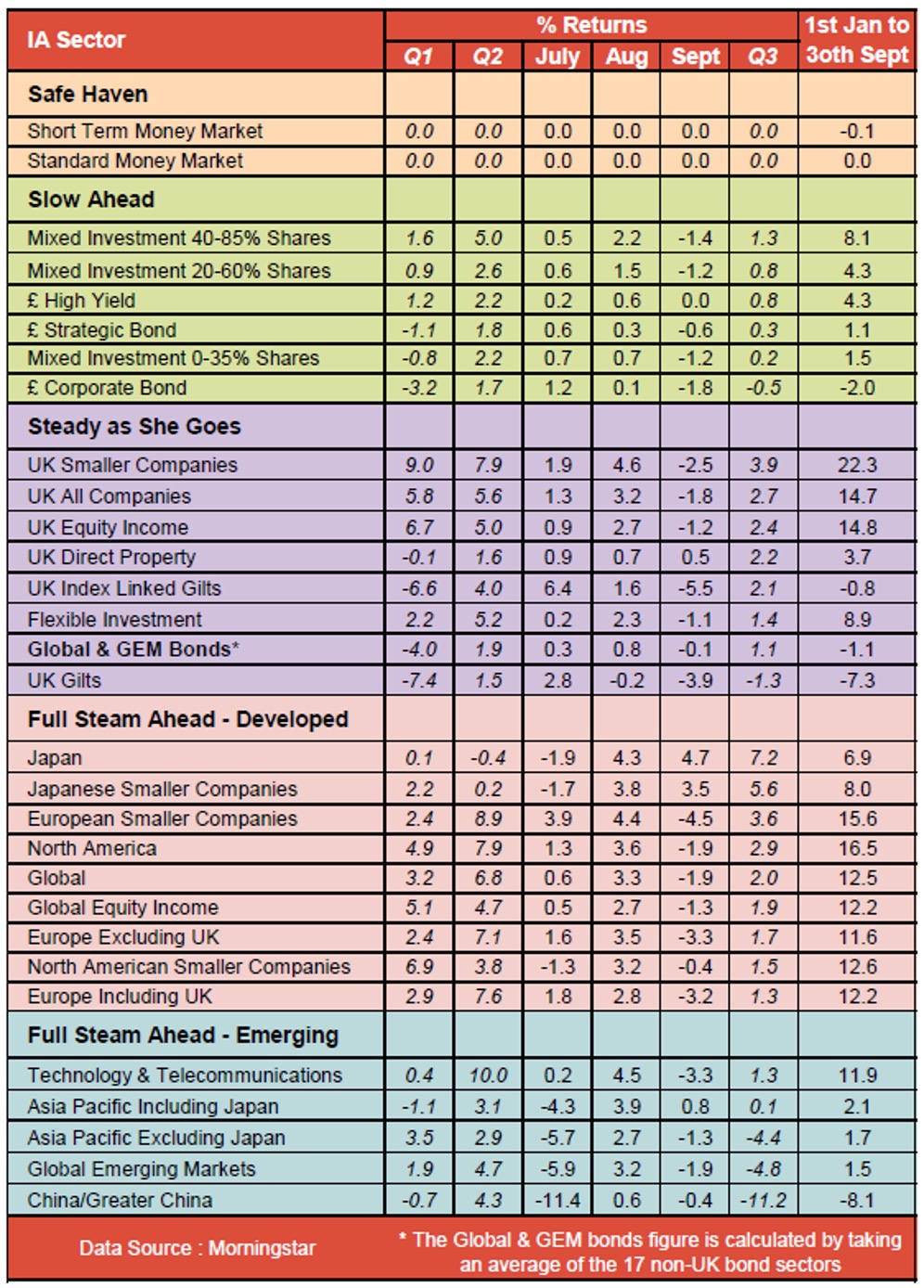

Although September was not great, nearly all the Investment Association (IA) sectors have gone up in the third quarter of this year.

However, there were a few exceptions. The Sterling Corporate Bond sector went down by 0.5% and the UK Gilts sector dropped by 1.3%. The biggest loss was in the China/Greater China sector, which fell by 11.2%, but the Global Emerging Market sector also went down, as did Asia Pacific excluding Japan.

The best-performing sector was Japan. It did not have a very good July, falling by 1.9%, but made 4.3% in August and 4.7% in September. It was up 7.2% over the quarter. The next best sector was Japanese Smaller Companies, up 5.6%.

During the summer, Japan’s now former prime minister Yoshihide Suga and his government received a lot of criticism of the way they handled the Covid-19 pandemic. In particular, the decision to go ahead with the summer Olympics in Tokyo, despite the fact that the area was under a state of emergency at the time.

- How Saltydog invests: a guide to its momentum approach

- Ian Cowie: three trusts to pop in your tank

- The Richard Hunter Interview: investing in ethical UK companies

Even though he was only elected last September, he agreed to step down a couple of months ago and the Japanese stock market reacted favourably. Fumiu Kishida, the former foreign minister, today took office as the country’s new prime minister. It will be interesting to see if the current rally continues now the markets knows who will be the next leader. The Nikkei 225 has already dropped from the highs that we saw in the middle of September.

The UK Smaller Companies sector saw the third highest return, going up by 3.9% over the quarter. It was the best-performing sector in the first quarter of the year, and third in the second quarter. It is still the best-performing sector so far this year.

The table below shows the performance of the IA sectors up until the end of September.

Past performance is no guide to future performance

At the end of each quarter, we look at the leading funds over the previous three months. The best-performimg fund in the second quarter of the year (April, May, June) was Threadneedle Latin America, followed by Baillie Gifford American. There were two other funds from the North America sector in our top 20, along with a couple of funds from the Technology and Telecommunications sector, which were fairly near the top.

- Japan is September’s top market, but who will win in October?

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

This time it is quite different. None of the funds that were in the top 20 last time feature in our latest list. Nine of the funds are from the Japan sector, which is not a surprise because we know that it has been the best-performing sector over the last three months. However, the funds at the very top of the table are from the Specialist sector, or at least they were for most of the period. The Investment Association does not provide a sector average figure for the ‘Specialist’ sector, due to the wide variety of strategies.

Last month, six new sectors were launched. They are Latin America, India/Indian Subcontinent, Financials and Financial Innovation, Healthcare, Infrastructure and Commodity/Natural Resources. Some of the funds that we are still showing in the ‘Specialist’ sector will have moved into these new sectors. Most notably, the three funds at the top of the table that invest in India and the Indian subcontinent.

Past performance is no guide to future performance

In our Saltydog weekly analysis, we have always kept an eye on the funds in the Specialist sector and have our own subzones that we use to classify the funds. These include India, and Russia and Emerging Europe. We have noticed how well these subzones have been doing recently and one of our demonstration portfolios invested in the Jupiter India fund at the beginning of August. It is currently showing a gain of 9%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.