Three of the biggest finance stocks to buy and one to sell

20th July 2022 09:53

by Rodney Hobson from interactive investor

Rising interest rates are typically good news for banks, but many stock prices have fallen to bargain levels. There are some handsome dividends too. Our overseas investing expert names the ones to own.

Deal or no deal? For much of the second quarter of 2022 it has been a distinct absence of deals for American banks, with an inevitable impact on earnings. Add in fears of bad debts as borrowers struggle with rising interest rates, plus worries over the strength of the US economy, and some caution is clearly merited.

For most banks, profits are down for the second quarter in a row, although the drop was generally less severe than in January-March. Most banks are now making provisions against bad debts, particularly on credit cards, while this time last year they were releasing provisions made in the earlier phase of the pandemic.

However, a lot of bad news is now reflected in the sector’s share prices and this could be a good time for investors to take the plunge. Eventually, banks always bounce back, and at least their balance sheets are much stronger than they were before the 2008 crash.

- Invest with ii: Top US Stocks | Super 60 Investment Ideas | Open a Trading Account

Volatile markets are always blamed in this situation. This means that poor-quality companies pull their flotations, while the more worthwhile offerings will be merely postponed and will bring in better quality investment banking revenue at a later date.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- US results season preview Q2 2022: banks and energy in focus

- ii view: banking giant JP Morgan dives after Q2 results

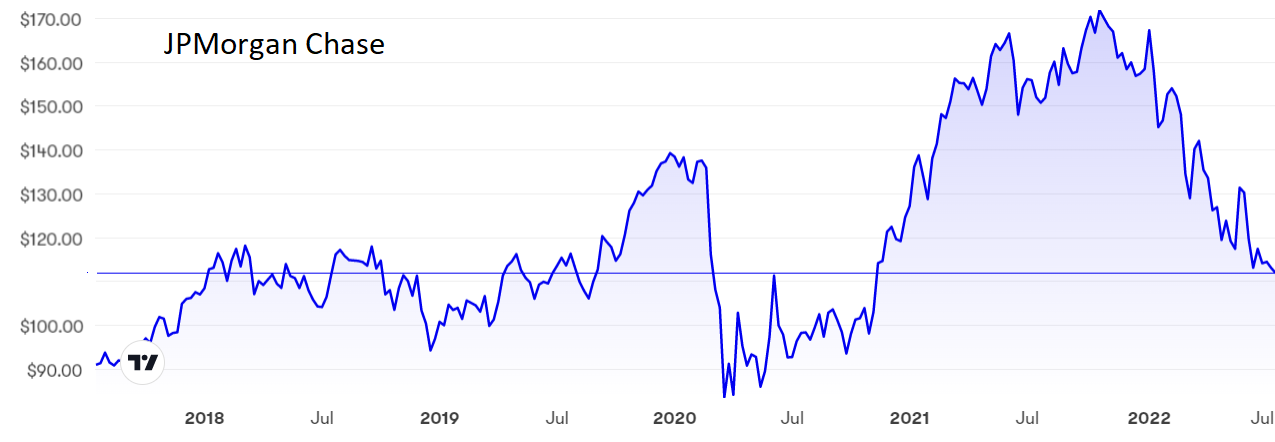

JPMorgan Chase (NYSE:JPM) got the second-quarter results going in poor fashion, although we cannot say we weren’t warned: it was similarly downbeat after the first quarter as well. Net revenue actually edged fractionally higher to $30.7 billion (£25.5 billion) as higher interest rates raked in an extra 19%, but net income, the figure that matters most, fell 28% to $8.65 billion. It was little consolation to note that this was an improvement over the previous three months, when net income slumped 42%.

JPMorgan took a $1.1 billion provision for credit losses, which may be sensible in the current economic crisis, but provisions are starting to look like a regular unwelcome feature again. Last time it was the Russian invasion of Ukraine.

The shares have slipped alarmingly from over $170 last October to $114.50, but may be showing early signs of levelling off, although we cannot feel too confident yet despite a price/earnings (PE) ratio of only 9 and a tempting yield of 3.5%.

Source: interactive investor. Past performance is not a guide to future performance.

Citigroup (NYSE:C) also reported higher revenue but lower earnings, the former up 11% to $19.64 billion and the latter down 27% to $4.55 billion. In Citigroup’s case, the culprits were investment banking and wealth management, while, as at JPMorgan, higher interest rates boosted revenue but at the same time encouraged the setting aside of reserves to cover future defaults.

Citigroup’s figures were better received on the stock market than JPMorgan’s but the shares are still down from $80 to $52 over the past 12 months. With a PE at an astonishingly low 6.3, the shares look undervalued, especially with the yield boosted to a touch over 4%.

Source: interactive investor. Past performance is not a guide to future performance.

Goldman Sachs (NYSE:GS) also took a substantial provision against potential credit losses but, worse still, it even recorded a 23% fall in revenue as its investment bank saw income from underwriting and asset management slide alarmingly. Net earnings were almost halved to $2.93 billion.

Even so, Goldman shares have held up better than most in the sector. The slide from $420 to $318 still leaves them higher than they were at the start of last year. The PE is only 6.8 but the yield is less attractive at 2.66%.

Source: interactive investor. Past performance is not a guide to future performance.

Morgan Stanley (NYSE:MS) blamed volatile markets for its 29% fall in net income to $2.5 billion, although on a positive note the 11.6% slippage in revenue to $13.13 billion was better than most in the sector. Investment banking was the main culprit, down 55% as fewer mergers and acquisitions were completed. Wealth management held up surprisingly well, recording a revenue fall of only 5.9%. The $101 million provision for credit losses was comparatively low.

The shares have slipped from $104 to $81 but remain well above pre-pandemic levels. The PE rating of 10.66, although modest by stock market standards, is one of the highest among banks, reflecting a general view that Morgan Stanley will come through current difficult times better than most. The yield of 3.55% is mid-range.

Source: interactive investor. Past performance is not a guide to future performance.

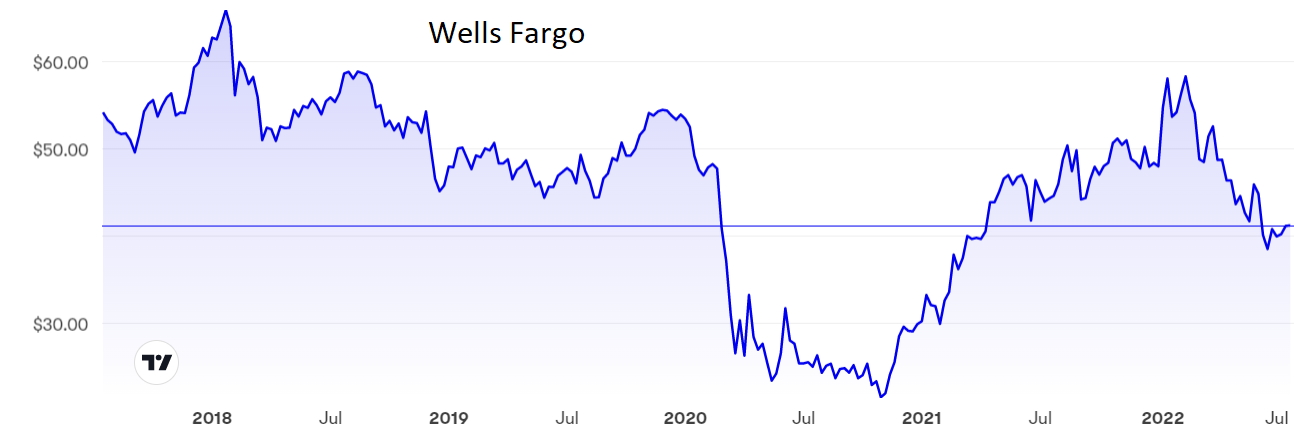

Normally, banks welcome rising interest rates as a means of widening the spread between borrowing and lending, but Wells Fargo (NYSE:WFC) blamed this factor in part for a very disappointing second quarter. Revenue was down 16% to $17.03 billion, against the general trend in the banking sector, and net income almost halved to $3.12 billion.

Higher interest rates did bring in higher revenue from lending, but they held back venture capital, mortgages, investment banking and brokerage advisory outcomes.

Wells Fargo shares have slipped from $58 to $43 so far this year and while that decline is not particularly severe it is worth noting that they are very firmly below pre-pandemic levels. They were worth twice as much at the start of 2018.

The PE is 9.88 and the yield is 2.18%. Neither figure is particularly attractive.

Source: interactive investor. Past performance is not a guide to future performance.

Bank of America (NYSE:BAC) joined the queue to report that credit provisions had affected second-quarter profits, down 32% to $6.25 billion. Total revenue rose 5.7% to $22.7 billion, thanks largely to a 22% rise in net interest income.

The PE of 10 is top end for the sector and the yield is still unattractive at 2.6%.

Source: interactive investor. Past performance is not a guide to future performance.

It is sensible for investors to beware a possible deterioration in the world economy. Interest rates in developed countries are still well below traditional levels and will surely continue to rise sharply; oil and gas prices have slipped from their peak but will inevitably remain high; and the war in Ukraine looks set to drag on for many more months, even years.

There must also be worries over the European Union, especially as regards to Germany and other nations heavily dependent on Russian supplies of oil and gas. However, the US economy continues to defy the doomsters with jobs and consumer spending continuing to edge upwards.

- Ask ii...what are the pros and cons of investing in a US company?

- Top 10 things you need to know about investing in the US

Hobson’s choice: I warned six months that caution was required at JPMorgan but in April felt that the slide in the shares, then around $130, ought to level out soon. It didn’t, so caution was indeed justified. At the risk of proving to be overoptimistic, I rate the shares a buy now.

Citigroup still looks the best of the bunch, as I said in April, and is a clear buy. The shares have already started to tick up again.

I have lost enthusiasm for Goldman over the past three months and now rate them as just a hold. On the other hand, I recommended selling Morgan Stanley last October when the shares were above $100 and now feel that they should be considered as a buy after the correction since then.

I rated Wells Fargo as the least attractive of the major US banks after first-quarter results fell short of expectations and I still do. Sell.

Last October, I warned that Bank of America shares looked fully valued around $46.50. They are now at a much more sensible $32.50 where they are likely to find support. If you stayed in through the share price slide you may as well hold on now. The worst is probably over.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.