These oil stocks are rallying right now

Oil prices rose after President Trump stepped in. Here are the shares moving and why.

23rd April 2020 13:17

by Graeme Evans from interactive investor

Oil prices rose after President Trump stepped in. Here are the shares moving and why.

A wild week for Big Oil stocks moved into calmer waters today after the price of Brent crude rebounded to help sustain a recovery for shares in BP (LSE:BP.) and Royal Dutch Shell (LSE:RDSB).

The share price rises mean the London-listed pair are where they were before Monday's shock collapse of the West Texas Intermediate (WTI) price into negative territory.

The Brent crude international benchmark slumped to just 16 US dollars earlier this week, the lowest level since 1999. It was up 7% today at $22 after some covering of short positions in the wake of a Tweet by Donald Trump vowing to take action over Iranian disruption in the Gulf.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Attention will now turn to Q1 results from BP, Shell and the rest of the oil industry next week, when they will provide commentary on the spending and production cuts needed as part of a package of measures to cope with ultra-low oil prices.

| Company | Ticker | Subsector | Share price (p) | Change from last night's close (%) | Change in 2020 so far (%) |

|---|---|---|---|---|---|

| Tullow Oil (LSE:TLW) | TLW | Oil - Crude Producers | 25.13 | 24 | -60.7 |

| Premier Oil (LSE:PMO) | PMO | Oil - Crude Producers | 25.95 | 9.3 | -73.6 |

| Cairn Energy (LSE:CNE) | CNE | Oil - Crude Producers | 110.11 | 11.9 | -46.2 |

| Pharos Energy (LSE:PHAR) | PHAR | Oil - Crude Producers | 17.48 | 8.2 | -66.8 |

| Wood Group (John) (LSE:WG.) | WG. | Oil Equipment and Services | 181.65 | 7.8 | -54.3 |

| Hunting (LSE:HTG) | HTG | Oil Equipment and Services | 193.2 | 6.9 | -53.8 |

| Energean Oil & Gas (LSE:ENOG) | ENOG | Oil - Crude Producers | 673 | 3.5 | -27.7 |

| Petrofac (LSE:PFC) | PFC | Oil Equipment and Services | 156.4 | 2.7 | -59.1 |

| EnQuest (LSE:ENQ) | ENQ | Oil - Crude Producers | 10.82 | 2.2 | -49.8 |

| Lamprell (LSE:LAM) | LAM | Oil Equipment and Services | 11.45 | 1.4 | -71.1 |

| Royal Dutch Shell (LSE:RDSB) | RDSB | Integrated Oil and Gas | 1,361.74 | 0.9 | -39.2 |

| BP (LSE:BP.) | BP. | Integrated Oil and Gas | 312.1 | 0.5 | -33.8 |

| Source: SharePad as at early afternoon 23 April 2020 |

Despite the ongoing supply glut and a 66% year-to-date fall in the Brent price, BP and Shell are expected to state their commitment to maintaining dividends at current levels.

Shell, which hasn't cut its pay-out since the Second World War, has already suspended a $25 billion share buyback programme and said it is cutting operating costs by between $3 billion and $4 billion per annum over the next 12 months.

Shell's recent dividend yield of 15% points to market fears of a pay-out cut later in the year, although analysts also note there's a growing disconnect with the oil price. UBS said this week that it saw limited benefit in “immediate capitulation” by the oil majors.

- Oil for beginners: why oil prices move up and down

- Investing in oil: prices, dividends, shale firms, and stock tips

- Chart of the week: is Shell’s share price rally on borrowed time?

In the meantime, the extent of the current demand shock remains unknown as Covid-19 continues to result in global lockdown measures and the grounding of airlines. The International Energy Agency predicts demand for oil will fall by as much as 29 million barrels per day in April to levels not seen in 25 years, with recent production cuts unable to keep pace.

The oil industry is now running out of places to store unwanted supplies, leading to this week's unprecedented developments in the US. A repeat of the WTI negative price is quite possible next month when the end of the June contract nears, although for today the price was up a further 4% to $14.37 a barrel.

The performance has led to a rollercoaster ride for holders of oil ETFs, which track crude oil futures. Deutsche Bank analysts said today:

“When these were structured no-one could have contemplated a negative price on the contracts they invested in. It’s fair to say it’s caused some chaos.”

Deutsche noted that United States Oil Fund (USO), the world’s largest oil ETF with over $3 billion in assets under management, had altered its fund holdings further away from near-term WTI. It will now roll exposure to August and September in order to shield itself from the price action in near-term contracts.

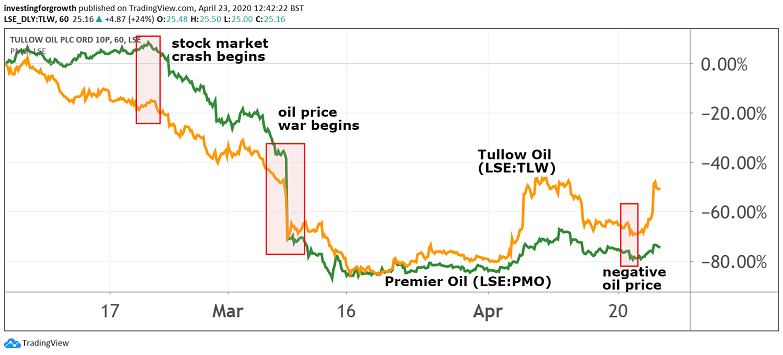

The slide in oil price has also dealt a big blow to indebted explorers such as Premier Oil (LSE:PMO) and Tullow Oil (LSE:TLW). Shares in Africa-focused Tullow have slumped from 140p in December to a low of 7.5p last month, although they jumped as much as 75% to 35p today after the company raised up to $575 million from the proposed sale of its assets in Uganda to Total (EURONEXT:FP).

Source: TradingView Past performance is not a guide to future performance

The deal, which is subject to a number of conditions, is the first step in a portfolio management programme that Tullow hopes will raise more than $1 billion towards debt reduction.

Earlier this week, Tullow said that Rahul Dhir will start as chief executive from July. A trading update accompanying the Uganda announcement reported a first quarter realised oil price of $56 a barrel, with production also in line with expectations.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.