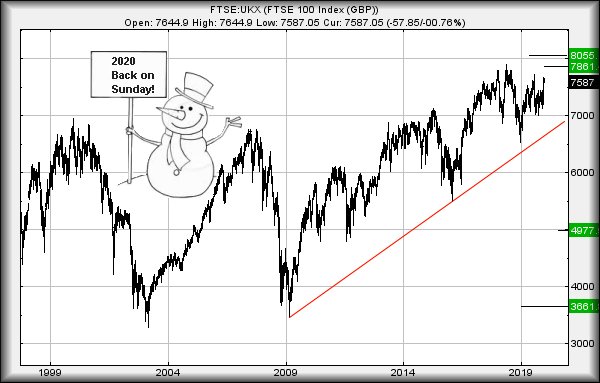

These indices can rally in 2020, but will FTSE 100 top 8,000?

In his last report of 2019, our analyst provides 'cut out and keep' forecasts for the new year.

31st December 2019 08:53

by Alistair Strang from Trends and Targets

In his last report of 2019, our analyst provides 'cut out and keep' forecasts for the new year.

A "Print This Out" section

To signal potential danger levels against indices, on the S&P 500 we think 3,280 may prove troubling.

If exceeded, 3,500 almost must provide "issues". The index requires below 2,930 to spoil this calculation.

For the Dow Jones, travel to 29,900 shall not surprise us. And, if bettered, 31,900 looks like a great level to try out a parachute. It will need below 27,000 to justify changing underwear.

Germany and the DAX is interesting as 14,100 calculates as possible. If bettered, it could even climb 1,000 points higher before it "must" reverse. Below 12,470 and we'd start be concerned things are going wrong.

France with the CAC40 should run out of steam around 6,500 points. Needs below 5,380 for panic.

Finally, the FTSE 100. It feels like 7,860 should provoke some sort of ceiling but, if exceeded, the index could clamber up to 8,050, a point where oxygen masks risk failing. The UK market requires below 6,750 to give serious concern for its future.

Our best wishes for a profitable 2020. And thanks for tolerating this headline section, where we try and use words to glue the numbers together!

One of the civilised things in Scotland is the 2nd January being a holiday, so we shall return on Sunday evening.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.