Tech’s back – and we’ve bought this fund

Saltydog Investor is looking to capitalise on rising technology valuations once again.

18th December 2023 14:27

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

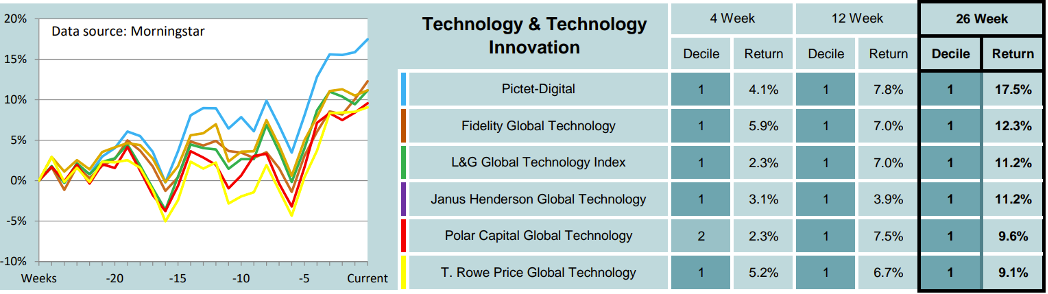

Last week, our Ocean Liner portfolio invested in the Pictet-Digital fund. At the time, it was at the top of our table listing the leading funds over the past 26 weeks in the Technology & Technology Innovation sector.

Past performance is not a guide to future performance.

Our latest sector analysis was showing that, on average, the funds in this sector had risen 4.7% in the previous four weeks, the same as the European Smaller Companies sector and more than all other sectors. It was also the leading sector over 12 weeks and one of the few sectors where the 26-week return was greater than the 12-week return, which in turn was greater than the four-week return. A good sign of upward momentum.

The Technology & Technology Innovation sector is for funds that “invest at least 80% of their assets in equities of technology and related sectors, including industries such as telecommunications, robotics and online retailers”.

The sector has had a pretty good run over the last 10 years and was the best-performing sector in 2019, up 31%, and again in 2020, gaining a further 45%. It fell dramatically at the beginning of the Covid pandemic, but quickly recovered and did well during the lockdowns when people were forced to spend more time at home. There was a surge in demand for technology services and products including remote collaboration tools, cloud services, e-commerce platforms, and streaming services. Companies such as Peloton Interactive Inc (NASDAQ:PTON) and Zoom Video Communications Inc (NASDAQ:ZM) were suddenly household names.

At the same time, interest rates were being held at all-time lows which made equities, including technology stocks, look attractive when compared with government bonds and other fixed-interest investments.

This trend continued for most of 2021, when the sector gained a further 16%. The Nasdaq Composite Index, which is generally considered to be a good indicator of the performance of technology stocks, peaked on 19 November 2021, closing at 16,057.

The following year was not so good. The economic recovery from the pandemic led to a demand in goods and services which could not be met. Supply chains had been disrupted during the lockdowns, that would take time to be re-established, causing a shortage of materials that led to increased prices. The situation was exacerbated when Russia invaded Ukraine and energy costs soared. Inflation, which had started to go up in 2020, was spiralling out of control, peaking in 2022 at a 40-year high.

To combat rising inflation, central banks pushed up interest rates. This made it more expensive for companies to borrow money. This was particularly difficult for many of the technology companies which were using debt to finance growth and development. At the same time, it looked as though many countries, especially in the developed world, would go into recession, which lowered consumer confidence.

By the end of the year, the Nasdaq had fallen below 10,500, a drop of almost 35% from its all-time high. The Technology & Technology Innovation sector ended the year down 27%.

- The winners and losers from AI and weight-loss drugs

- Investing in themes: the opportunities and pitfalls

This year, we have seen a marked recovery, but it has not all been plain sailing.

It started well with the sector gaining 9.3% in January. It also went up in February and March and was showing a gain of 15.8% by the end of quarter one. It then went down by 2.8% in April, but recovered in May and June, ending quarter two up a further 7.7%. In July, it rose by 2.6%, but in August it fell by 1.6% and it went down by a similar amount in September. October was even worse with a 3.1% loss. (That is when we sold the remains of the Liontrust Global Technology fund which we had bought earlier in the year).

Last month, we saw the sector recover, gaining 9.6%, and so it now looks like it is back on an upward trajectory. The leading funds have still not got back to where they were when they peaked in 2021, but they are heading in the right direction. Inflation is coming down and interest rates have stopped going up, at least in the US and the UK.

The Pictet Digital fund, that we have recently invested in, has broadly followed the overall trend of the sector. Up from 2019 to 2021, down in 2022, but up this year. It dropped in the first half of August, recovered in September, but then fell in October. It has done particularly well since the beginning of November. I hope this bodes well for 2024.

Past performance is not a guide to future performance.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.