Tech had a great quarter – these are the top funds

Saltydog Investor assesses the top funds and sectors after the first three months of the year.

9th April 2024 09:20

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

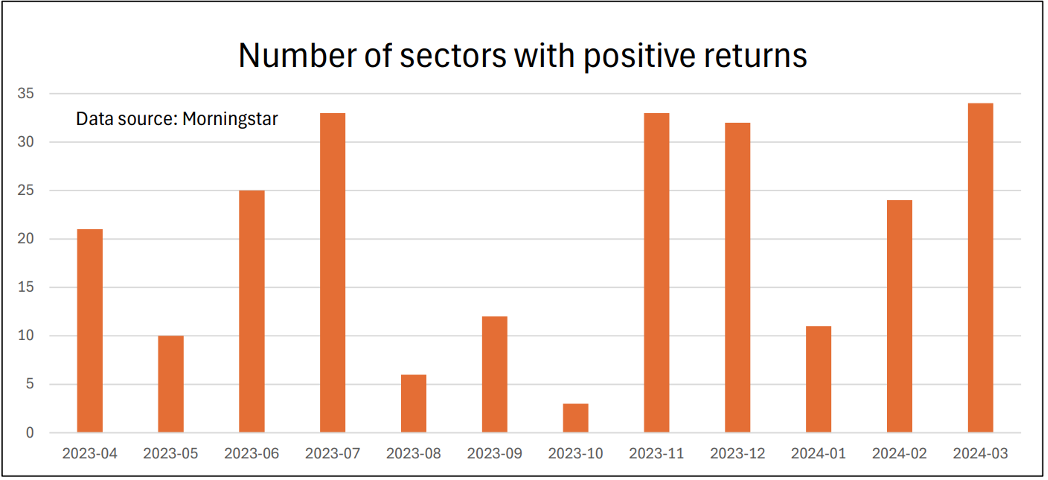

In January, only 11 out of the 34 sectors that we regularly monitor made gains, but since then overall fund performance has improved. In February, that number increased to 24 and last month all the Investment Association (IA) sectors rose in value.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Past performance is not a guide to future performance.

Over the first three months of the year, 28 sectors made gains.

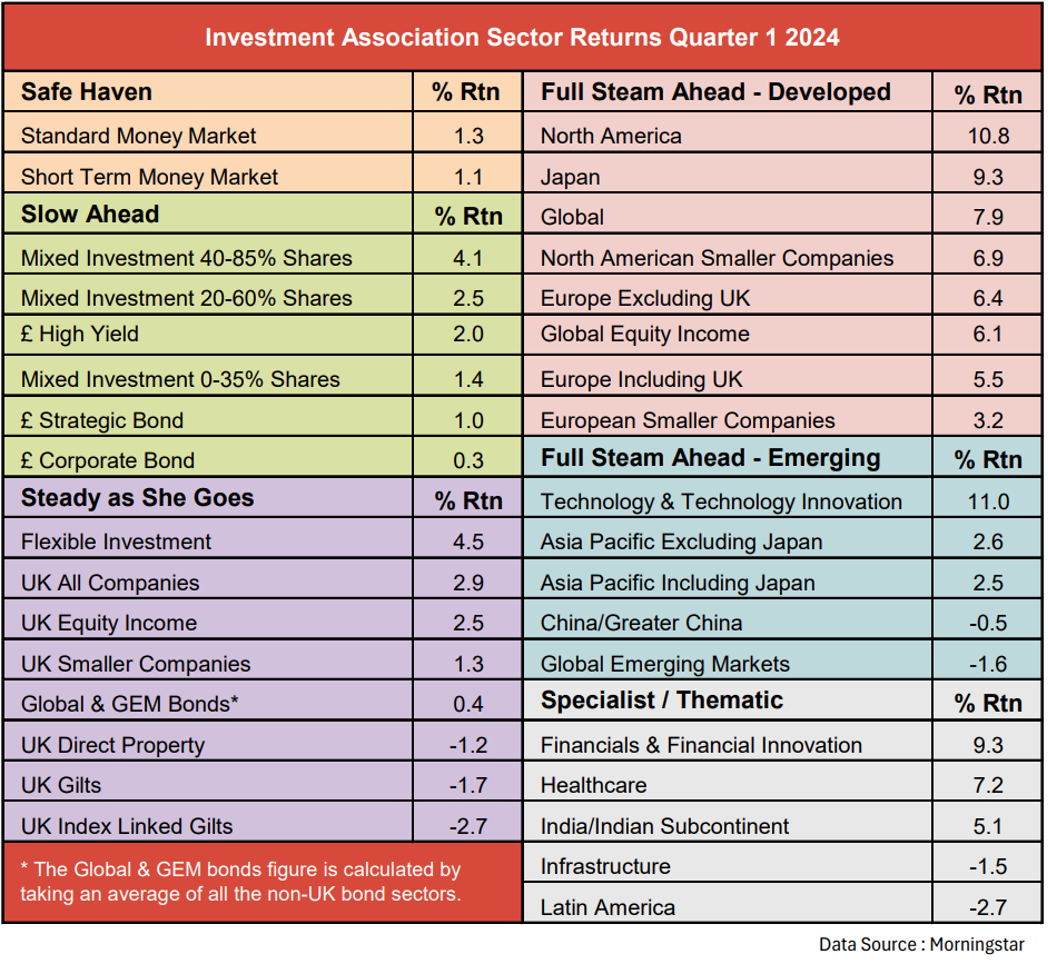

The best-performing sector in January was Technology and Technology Innovation, which rose by 3.2%, followed by Japan, which ended the month up 2.8%. The worst-performing sector was China/Greater China with a 9.7% loss.

A month later and the China/Greater China sector had gained 9.5%, making it the leading sector in February. Next up was the Technology and Technology Innovation sector, up 5.7%, and then North America, up 5%.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- ISA insights: guides, investment ideas and tax tips

Last month the top sector was Financials and Financial Innovations, up 3.7%, followed closely by the three European equity sectors (European Smaller Companies, Europe excluding UK, and Europe including UK).

By the end of the first quarter, the Technology and Technology Innovation sector was showing the largest three-month return, up 11%, followed by North America, which had made 10.8%.

Past performance is not a guide to future performance.

When the Technology and Technology Innovation sector does well, we often find that certain funds from the North America and Global sectors also see an uplift, and that has certainly been the case this year.

If you look at the top 10 funds so far this year, then it is not surprising to see the Janus Henderson Global Technology Leaders fund at the top of the table. The Polar Capital Global Technology, Pictet-Digital and T. Rowe Price Global Technology Equity funds also feature. These funds are all from the Technology and Technology Innovation sector.

Saltydog’s top 10 funds in Q1 2024

| Fund name | Investment Association sector | Monthly return January | Monthly return February | Monthly return March | Quarter One return |

| Janus Henderson Global Technology Leaders | Technology & Technology Innovation | 7.9 | 4.7 | 5.4 | 19.0 |

| WS Blue Whale Growth | Global | 5.5 | 8.1 | 3.8 | 18.3 |

| Polar Capital Global Technology | Technology & Technology Innovation | 5.7 | 10.2 | 0.6 | 17.2 |

| SVS Sanlam North American Equity | North America | 2.8 | 9.0 | 4.5 | 17.1 |

| Invesco Global Focus | Global | 4.4 | 7.9 | 3.7 | 16.8 |

| Artemis Global Income | Global Equity Income | 1.9 | 5.6 | 7.6 | 15.8 |

| Janus Henderson Japan Opps | Japan | 3.6 | 6.8 | 4.4 | 15.6 |

| Pictet-Digital | Technology & Technology Innovation | 5.3 | 6.6 | 2.9 | 15.6 |

| Janus Henderson Global Select | Global | 3.1 | 5.4 | 6.3 | 15.5 |

| T. Rowe Price Global Technology Equity | Technology & Technology Innovation | 5.0 | 6.2 | 3.5 | 15.4 |

Data source: Morningstar. Past performance is not a guide to future performance.

In second place is WS Blue Whale Growth fund from the Global sector. However, if you have a look at its top 10 holdings, then at the top of the list is NVIDIA Corp (NASDAQ:NVDA), followed by Microsoft Corp (NASDAQ:MSFT), then Lam Research Corp (NASDAQ:LRCX) technology – all US technology companies.

The same is true for the SVS Sanlam North American Equity fund in fourth place, which has significant exposure to Microsoft, Nvidia, Amazon.com Inc (NASDAQ:AMZN) and Alphabet Inc Class A (NASDAQ:GOOGL).

The recent growth in interest in artificial intelligence (AI) has driven up the price of a handful of large technology stocks and any funds investing in them, regardless of which sector they are in, will have reaped the rewards. We have seen the benefits in our demonstration portfolios. Not only in funds such as Pictet Digital and UBS US Growth but, to a lesser extent, in the Liontrust Balanced fund, from the Mixed Investment 40-85% shares sector. It has nearly 20% of its assets invested in technology companies including Alphabet, Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM), Nvidea, and Microsoft. We invested in it last June and since then it has gone up by 13%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.